Form a Corporation in Finland Introduction

Finnish corporations are regulated by Finnish Corporate Governance Code 2015 which adopted recent European Commission recommendations.

Finland Corporation Background

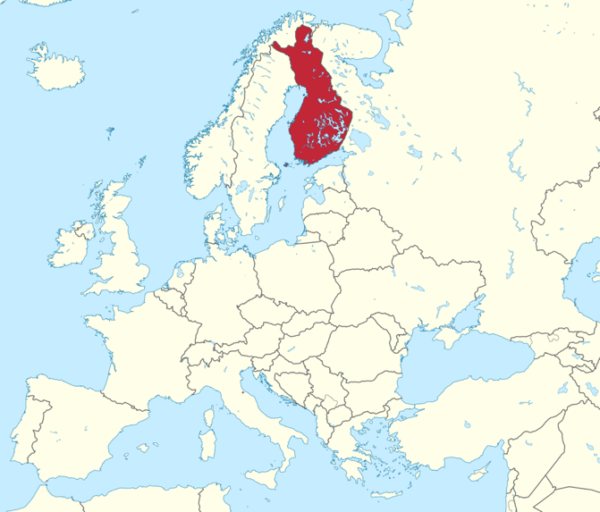

Finland is a sovereign country in Northern Europe. Its official name is the “Republic of Finland”. Finland borders Norway to the north, Sweden to the northwest, and Russia to the east. Finland’s population is estimated to be 5.6 million where 88% of the population is Finnish. It has the eighth largest land area in Europe, but is the most thinly populated country in the European Union (EU). Finland is a parliamentary republic with a central government based in the capital Helsinki.

Finland Corporation Benefits

There are several benefits for a Finnish corporation including:

- Only One Shareholder: The minimum requirement to incorporate in Finland is one shareholder.

- Low Minimum Share Capital: The minimum paid up share capital is 2,500 Euro.

- No need to Visit Finland: Foreigners do not have to visit Finland in order to form a new Finnish corporation.

- English widely Spoken: Many Finnish speak good English especially in the business sector.

- Euro: Finland is the only Nordic country using the Euro as its currency.

- EU Membership: Finland is a member of the European Union (EU) which opens doors for doing business with other EU members.

- Low Corporate Tax: The corporate tax rate is a flat 20% which is at the low end for EU and global countries.

- Political and Economic Stability: Finland has maintained a stable political system for many years along with a stable economy.

- Northern Europe Opportunities: Historically, Finland’s trade connections in Northern Europe as well as its friendly ties to countries surrounding it opens up ample opportunities for foreign investors to also benefit from these relationships.

- Skilled Workforce: Finland has a well educated population offering a skilled workforce.

- Ideal Country for a Tech Company: Tech companies in Finland can obtain low interest loans up to 1 million Euro from the Finnish Funding Agency for Technology and Innovation (Tekes). Research & Development (R&D) employees paid between 15,000 to 400,000 Euros annually can get the employer a 200% tax deduction of their salaries.

- Dividends Tax Exemption: Dividends paid to EU holding companies from their Finnish subsidiaries are tax exempt.

Legal and Tax Information

Time to Incorporate

It is estimated to take up to three weeks to complete the incorporation process. In addition, it will take another three weeks to open a corporate bank account.

Minimum Authorized Capital

The minimum authorized capital for Finnish corporations is 2,500 Euros.

Registered Agent and Office Address

A Finnish corporation is required to have a registered agent and an office address to accept service of process and official notices. However, a physical office in Finland is not required.

Shareholders

Only one shareholder is required.

Directors and Officers

Two directors are required as a minimum where at least one must be a resident. Nominee directors are available. A corporate secretary is not required.

Taxes

The Finnish corporate tax rate is 20%.

Shelf Corporations

There are no shelf corporations in Finland.

Form a Corporation in Finland Conclusion

There are several benefits for a Finnish corporation including: only one shareholder is required, there is a low minimum share capital, no need to visit Finland to incorporate, English is widely spoken, Finland is a member of the EU and is the only Nordic country using the Euro as its official currency, a low corporate tax rate at 20%, dividends tax exemption, opportunities to do business in Northern Europe; political and economic stability with a skilled workforce; and tax and financial benefits for tech companies operating in Finland.