A Bermuda LLC or Limited Liability Company is a new legal entity for investors around the globe to consider forming. While Bermuda is a popular offshore company jurisdiction with The Companies Act of 1981 (amended in 2006), a new law offers Limited Liability Companies to its offshore entities structure.

In 2016, Bermuda enacted a new law specifically allowing the formation of Limited Liability Companies (LLC) called “The Limited Liability Company Act” which is modeled after a similar law in the State of Delaware in the U.S. The LLC Act came into effect on October 1, 2016.

A Bermuda LLC is a hybrid of an offshore corporation (Bermuda Exempted Company) with a partnership into a unique corporate entity. A LLC is an offshore corporation offering limited liability to its members (shareholders). However, instead of corporate shares, a Bermuda LLC has members where each one has an interest in a capital account just like partners in a partnership. The Bermuda LLC Act allows the freedom to establish flexible operational terms and management, as well as, the timing and amount of profits distribution amongst its members.

When the LLC is sued, the members can be protected from personal liability. When a member is sued, there are provisions in the law such that the company and items that the company owns are shielded from being seized by the creditors of a member. This makes the Bermuda LLC an ideal asset protection tool.

Bermuda Background

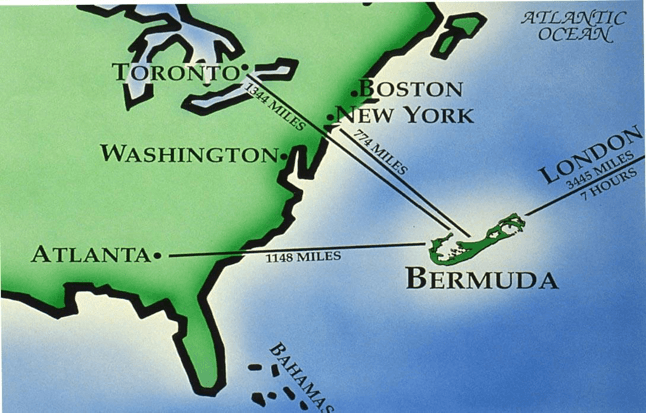

Bermuda contains over 150 islands which are located in the North Atlantic Ocean. Its total size is approximately 40 square miles (50 square kilometers) with an estimated population of 68,000 mostly of African and European descent.

As a dependent British Territory, Bermuda’s Chief of State is England’s Queen Elizabeth II who appoints a Governor. Its political system consists of an appointed upper house (Senate) and an elected House of Assembly. Its laws are based on the British Common Law system.

Economically, Bermuda has one of the world’s highest per capital incomes as a result of its financial services industry and tourism with its luxury resorts.

Bermuda LLC Benefits

A Bermuda LLC enjoys many benefits including:

- No Taxes: Bermuda does not have corporate or income taxes or capital gains tax. However, U.S. citizens and those residing in countries taxing worldwide income are required to declare all income to their tax authority.

- Privacy: The only document filed with the government does not contain names if its members.

- Separate Legal Entity: Unlike a partnership, the LLC is a separate legal entity like a corporation.

- Fiduciary Duties: An individual’s duties (including fiduciary duties) to the LLC, its managers, members, or to other 3rd parties can be restricted, expanded, or eliminated by the LLC Agreement. The only exception is that no provisions will allow dishonesty or fraud.

- Flexibility: As mentioned above, a Bermuda LLC’s Operating Agreement (LLC Agreement) provides flexibility regarding how profits and losses are allocated to its members, along with their distribution. LLC membership interests can be denominated in any foreign currency. Membership consent and voting rights can be designated according to different groups or classes of its members. The LLC Agreement can declare it has the same rights, capacity, power and privileges of a natural person.

- One Member: Only one member is required to form a LLC.

- Easy Formation: The only document required to form a Bermuda LLC is filing a Certificate of Formation with the Registrar of Companies.

- Low Fees: The Belize government only charges $305 USD for initial registration and annual renewals.

- Management: A LLC can be managed by its members or can appoint a manager.

- Mergers: The LLC Act allows LLC’s to merger with a foreign entity and can choose to proceed either as a foreign entity or a Bermuda LLC.

- Conversion: The LLC Act allows for a LLC to convert into a Bermuda offshore exempted company or vice versa. The same rights exist for conversion into a limited partnership.

- No Minimum Authorized Capital: Since LLC’s are not typical legal entities, there is no minimum authorized capital.

- English: Bermuda’s official language is English.

Bermuda LLC Name

A LLC cannot choose a company name which resembles or is similar to another Bermuda company, corporation, or legal entity name.

Office Address and Local Agent

The LLC will need to have a local office address. However, since it is technically not a legal entity, it will not have to appoint a registered agent.

Members

A LLC is not a corporation with shareholders. It has members and according to its LLC Agreement the rights and privileges of its members can be limited, restricted, or expanded depending on the member’s group or classification. This pertains to voting, control, and distribution of profits and other privileges.

Directors and Officers

LLC’s do not have a board of directors or officers. According to its LLC Agreement, members can manage the LLC by majority vote or appoint a manager to run its daily operations.

Authorized Capital

There is no minimum authorized capital for a LLC.

Taxes

Bermuda has no taxes on income, profits, or dividends, nor is there any estate tax or inheritance tax, or capital gains tax. Profits can be accumulated and it is not obligatory to pay dividends.

Annual Fees

A LLC will pay the same initial registration and renewal fees as a Bermuda IBC which is $305 USD plus registered agent fees.

Public Records

The only document filed with the government is the Certificate of Formation with the Registrar of Companies. The Certificate of Formation does not contain members’ names.

Accounting and Audit Requirements

Bermuda does not have any requirements regarding the maintenance of financial records nor is there a mandatory audit.

Annual General Meeting

There is no requirement for any type of meetings for LLC’s.

Time Required for Registration

With the filing of the Certificate of Formation, registration can be completed in one day.

Shelf Companies

There are no shelf LLC companies due to their uniqueness.

Conclusion

A Bermuda LLC enjoys many benefits including: no taxes, privacy, separate legal entity, control over fiduciary duties, flexibility over managing its affairs and manner of merging or conversion, only one member required for formation, easy and low cost registration, no minimum authorized capital, and English is the official language.