A Bahamas Foundation is a viable alternative to Bahama trusts and corporations. The foundation is a hybrid between a company and a trust. A lot of flexibility exists with a foundation which may or may not have beneficiaries and/or a protector. Foundations can be created by a will or filing documents with the Bahamas Registry. Bahamas laws prevent forced heirs rules found in other countries. The founder may revoke the foundation if allowed for in its charter.

The Bahamas considers a foundation to be a legal entity with the capacity to own assets in its own name and to be able to sue or be sued in a court of law. As a legal entity, once assets are transferred to a foundation they become exclusively owned by the foundation and not by the settlor (founder). The foundation’s documents identifies the beneficiaries who may be natural persons, a charitable organization, or even the public at large. Assets owned by the foundation cannot be transferred to the beneficiaries until the provisions in the foundation’s charter states when and how they are to be distributed.

The law governing foundations in the Bahamas is called “The Foundations Act of 2004 (the “ACT”). This law was amended in 2007 which included the appointment of a local agent, the required Foundation Council, and established the rights of the beneficiaries. The Act defines a foundation as a legal entity established by its “Charter” which is registered with the government. Then it becomes a legal resident entity domiciled in the Bahamas and able to sue or be sued in a court of law.

Background

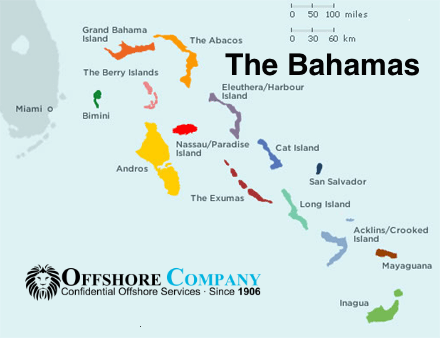

The Bahamas are a group of islands in the Atlantic Ocean near Haiti, Cuba, and the Florida Keys. Its official name is the “Commonwealth of the Bahamas” they are members of the British Commonwealth where English is its official language. The political system includes a written constitution along with an elected two house parliament who appoints the prime minister. British common law is also followed in its legal system.

Bahamas Foundation Benefits

A Bahamas Foundation has the following benefits:

• No Taxes: There are no taxes of any kind. Note, U.S. taxpayers and those from countries taxing worldwide income must reveal all income to their tax authorities.

• Asset Protection: A Bahamas Foundation provides total global asset protection. The foundation acts as legal owner of all assets which includes bank accounts, bonds, brokerage accounts, corporation shares, commodities, real estate, securities, etc.

• Estate Planning: Expensive and time consuming Probate proceedings are avoided because the settlor (founder) no longer owns the assets. The foundation owns all assets and passes them onto the beneficiaries according to the settlor’s wishes.

• Privacy: The names of the settlor, beneficiaries, council members, and protector are not included in the public records.

• Confidential: The laws prohibit anyone not authorized to disclose any information about a foundation to third parties. Violation of this law leads to criminal prosecution including large fines and jail time.

• Low Minimum Capital: There minimum capital requirement for foundations is $10,000 USD. .

• Fast Formation: The foundation can be formed and registered in one day.

• English: As a British Commonwealth member, the Bahamas official language is English.

Bahamas Foundation Name

The Foundation’s name must include the word “Foundation” in English or in a foreign language translation (if approved by the Registrar). The name cannot be the same, similar, or resemble the name of another legal entity in the Bahamas.

Asset Protection

A Bahamas Foundation owns all assets transferred to it from the settlor (founder) as it is a legal entity in itself. This insulates all assets from the previous owner(s).

Foundation Formation

A foundation is established by filing its “Charter” with the government. A duly executed will can also be filed with the government instead of a Charter. The government then issues a Certificate of Registration. Then the foundation is legally formed.

Foundation Charter

The Act requires every Charter to include the following information:

1. The Foundation’s name;

2. The Founder’s name and address. If the Founder is a legal entity, the place of registration and legal number and its address in the Bahamas for service of process;

3. The Foundation’s purposes and objects;

4. The initial endowment of assets and a description of them;

5. Designation of the beneficiaries;

6. Designation of the duration of existence (indefinite or fixed period of time);

7. The Secretary’s name and address in the Bahamas (if one is appointed), or the Foundation’s Agent and registered office address in the Bahamas;

8. Declaration that the total assets are at least $10,000 USD or its equivalency in another currency;

9. Founder’s signature in front of a notary public, or the authorized representative’s signature if the Founder is a legal entity.

Articles

The Foundation’s Articles are also known as Bylaws or Regulations are optional. If this option is chosen, they can provide for:

1. How assets will be distributed by the Foundation’s governing body;

2. Identity of the initial beneficiaries; and

3. Regulations for the governing bodies.

Then it becomes a legal resident entity domiciled in the Bahamas and able to sue or be sued in a court of law.

Registration

A Foundation is registered with the government by submitting the following documents:

1. The Agent’s (if appointed) or Secretary’s (if appointed) statement specifying:

• Name of the Foundation;

• Date of the Charter;

• Foundations purpose or objects;

• Date of the Articles for the Foundation (if any);

• Agent’s (if appointed) or the Secretary’s (if appointed) name and address;

• Registered office address;

• Duration of the Foundation (set period or indefinite);

• Initial assets total value which are at least $10,000 USD or equivalency in another currency;

• Any other important information the Agent or Secretary or the attorney wishes to include.

2. A list of the first officers including their names and addresses; and

3. Declaration by the Agent or Secretary that the Foundation complies with the Act.

Note: the Charter and Articles do not have to be filed with the Registrar. They can remain without public access at the registered office.

Foundation Council

The Act provides that the Founder only has the option to appoint a Council unless when no officers have been appointed, then it becomes a requirement. The Council must have a minimum of two natural persons, a legal entity and at least one natural person, or a legal entity on its own. The Council ensures the Foundation’s compliance with the Charter’s terms, the Articles’ provisions, and the Act. All Officers must abide by the Council’s wishes and instructions, The Council has full access to all records, books, and accounting. In addition, the Council has the power to:

1. Appoint an auditor;

2. Be informed of all meetings;

3. The right to attend all meetings to be heard but not to vote;

4. Receive all circulations of the Foundation’s business documents when circulated to the Officers;

5. Receive information when powers are delegated to Officers.

If no Officers have been appointed, the Council will assume all functions and powers of the Officers.

Council members do not have to be residents of or located in the Bahamas.

Foundation Officers

Officers can be natural persons or legal entities. A minimum of one Officer must be appointed before the Foundation registers. Undischarged bankrupts, convicted criminals, and mentally incapacitated persons cannot serve as Officers.

In the absence of a Council, the Officers will be the governing body of the Foundation. Their duties are administrative and not as fiduciaries. Officers must use reasonable skill and care while conducting Foundation affairs while managing and investing. They must follow the Charter, Articles, and the Act. Officers will be held personally liable for willful default, gross negligence, dishonesty, fraud, or acts of misconduct.

Secretary

The Act makes the appointment of a Secretary optional. If appointed, the Secretary is a Foundation Officer. If an Agent is not appointed, the Secretary will assume the duties of the Agent. If the Foundation appoints an Agent, the Secretary will perform typical secretary duties.

Foundation Agent

Foundations have the option to appoint an Agent and/or a Secretary. Agents must be licensed corporate and financial services providers. Licensed banks and trust companies can be appointed as an Agent. This appointment cannot be assigned.

The Agent’s duties include following counterterrorism and anti-money laundering regulations and making sure the Foundation complies with the Act. Agents can be excluded from all personal liabilities except for fraud.

Minimum Capital

The total value of the foundation’s assets must be $10,000 B ($10,000 USD) or the equivalency in another currency.

Purpose

Every foundation must have a declared purpose or object which can be any lawful purpose including charitable, family estate planning, or asset management (including the purchase and sale of assets).

Registered Office

Before registering, a Foundation must maintain a registered office address in the Bahamas which can be the address of an appointed Agent or Secretary.

Annual Meeting

Annual meetings by the Officers are required. The Founder and Council members must be notified of the annual meetings.

Accounting

The Act requires Foundations to maintain accounts, records, and financial statements as deemed necessary by the Council or the Officers reflecting the actual financial status of the Foundation. All records must be kept at the registered office.

Beneficiaries have the right to request access to all accounting records.

There are no filings of accounting records or financial statements with the government.

Confidentiality

The Act provides all beneficiaries with the right of confidentiality. The identity and interests of beneficiaries cannot be disclosed to third parties. An exception exists if such disclosure is required by Bahamas laws or if a Bahamas court issues an order requiring information. This applies to all Officers, the Protector, Council members, other governing body members, the Foundation’s attorney and auditor, and Foundation employees. Violation of confidentiality will result in a criminal prosecution with a maximum fine of $50,000 USD and a maximum prison term of three years.

Taxes

The Bahamas has no income taxes, no capital gains taxes, no corporate taxes, no inheritance tax, no gift tax, and no estate taxes for its foundations.

Public Records

The names of the Founder and Beneficiaries are not included in any public records. Only the Agent and Officers names are in the public records.

Shelf Foundations

Shelf foundations are not available for purchase as they are unique.

Conclusion

A Bahamas Foundation has the following benefits: no taxes, asset protection, estate planning, confidentiality, privacy, low minimum capital, fast formation, and English is the official language.