An Antigua International Business Corporation (IBC) is a tax exempt company requiring only one shareholder and one director who can be the same natural person or legal entity from any country. Thus, foreigners may own all of the corporate shares in an IBC.

The Antigua International Business Corporation Act of 1982 governs an IBC. This law allows for fast registration, 100% exemption from all taxation, and complete control by foreigners.

Background

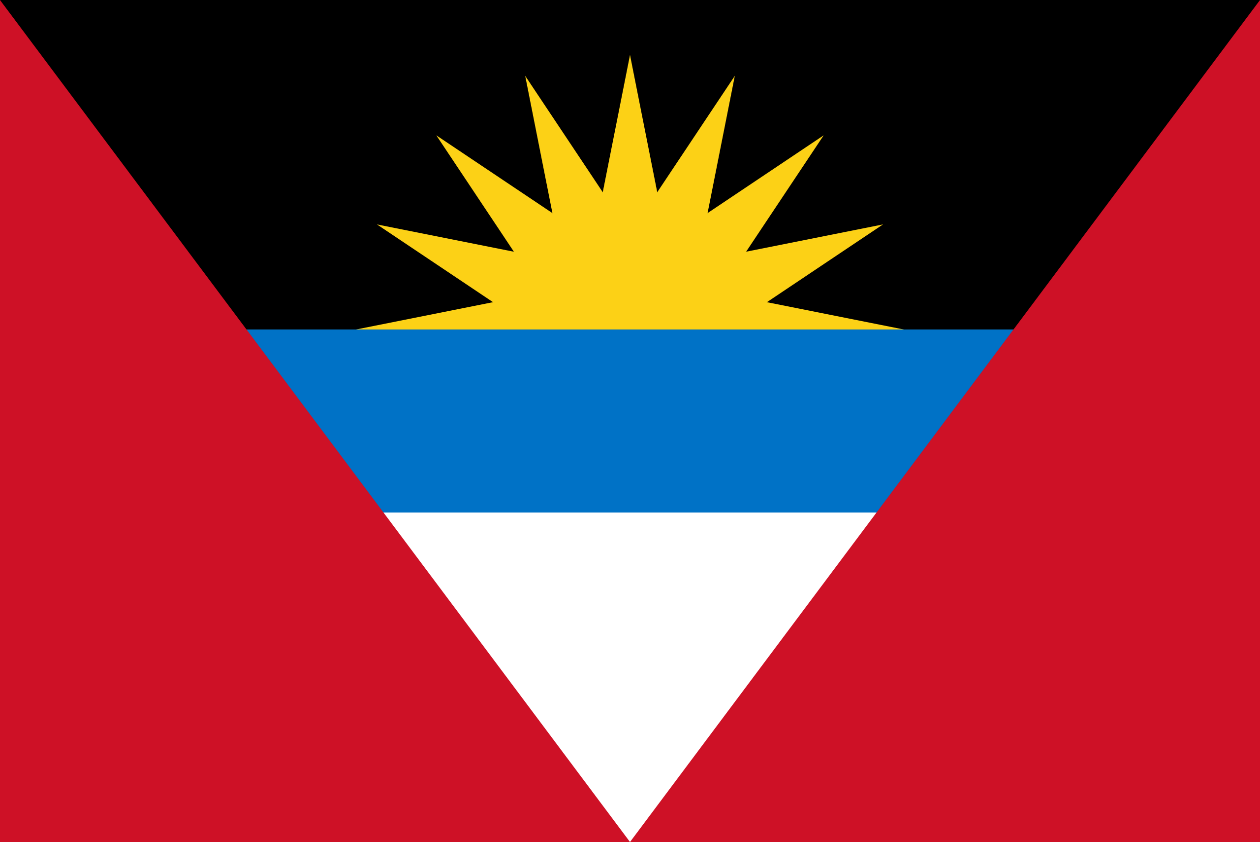

Antigua and Barbuda (hereinafter Antigua) is a small islands chain located in the Eastern Caribbean. Its main industry is tourism with financial services as one of its secondary industries.

Antigua was a British Colony from 1632 until 1981 when it was granted independence.

Its political system is a unitary parliamentary representative democratic monarchy. It has a democratically elected two house parliament and a prime minister. Its monarch is Queen Elizabeth II of England.

The judicial system is based on English Common Law. English is its official language.

IBC Benefits

An Antigua International Business Corporation (IBC) enjoys these benefits:

• Entirely Foreign Shareholders: All of the shareholders can be foreigners.

• Tax Free: IBC’s pay no taxes of any kind. However, U.S. taxpayers and everyone subject to global income taxation must report all income to their governments.

• Confidentiality: It is a crime for anyone to disclose any information regarding an IBC or banking details to unauthorized persons.

• Privacy: The names of beneficial owners and shareholders are never included in any public records.

• Asset Protection: The IBC’s assets are never disclosed in public records and are owned by the IBC as a separate legal body from the shareholders.

• Fast Formation: An IBC can be formed and registered within one day.

• One Shareholder/One Director: Only one shareholder is required who may be the sole director for total control of the IBC.

• No Minimum Capital: There is no minimum authorized capital requirement.

• English: After nearly 350 years as a British Colony, Antigua’s official language is English.

Antigua International Business Corporation (IBC) Name

Every IBC must choose a name unique from the names of all other legal entities in Antigua.

In addition, misleading company names or those inferring these types of businesses without appropriate licenses are prohibited: asset manager, banks, depositories, fiduciary services, financial funds, insurance, lenders, pensions, savings, securities, stocks, and a trust.

Trading Restrictions

The only restrictions regarding trading and commercial activities are they cannot occur within Antigua’s borders.

Uses

An IBC can be created to conduct many types of business or investment activities including:

• Asset protection of a family’s wealth;

• International investments;

• Global commercial trading;

• Holding company of corporate shares in international companies;

• Leasing worldwide assets;

• Antiguan flag registration of ships and yachts and other vessels; and

• International Trust activities.

Confidentiality

The IBC Act of 1982 makes it a crime for anyone associated with an IBC to disclose any information about an IBC without authorization. Penalties for violations include imprisonment and/or fines.

Banking Confidentiality

Antigua also has very strict banking confidentiality laws making it a criminal offense for any bank employee or IBC employee or associate to disclose any banking information to unauthorized persons. The criminal penalties include imprisonment and large fines.

Registration

Two Antigua citizens including one attorney or an authorized resident legal entity may form an IBC by signing and filing the Articles of Incorporation with the Registrar. In addition, an Application for an International Business Charter must also be filed.

Shareholders

Only one shareholder is required in order to form an IBC. Shareholders may be natural persons or legal entities. In addition, shareholders can be citizens of any country (natural persons) or registered in other countries (legal entities) and residing in any country.

Shares may be issued as Bearer for greater privacy, or Nominative.

Nominee shareholders are permitted for privacy.

Director

A minimum of one director is required to create an IBC. The director may be the sole shareholder for greater control.

Directors can be natural persons or legal entities, citizens of or registered in any country and residing anywhere.

Registered Agent and Office

Every IBC needs to appoint a local registered agent and have a registered office address which may be the registered agent’s office.

Minimum Capital

There are no requirements for a minimum authorized capital.

Taxes

IBC’s pay no corporate tax, no income taxes, no capital gains tax, no withholding taxes, no stamp duties, and no estate taxes. In addition, the shareholders can receive dividends paid from the IBC’s income free of income taxes.

Note: U.S. residents and others subject to taxation of worldwide income must report all income to their country’s tax authorities.

Accounting

No audits are required. No annual corporate filings are required. No annual financial statements are filed.

Annual General Meetings

While annual general meetings are required, they may be held anywhere in the world.

Public Records

Information regarding and IBC’s beneficial owners and shareholders are not included in any public records.

Time for Formation

An IBC can be formed within 24 hours including preparing the Articles of Incorporation, Application for an International Business Charter and government registration.

Shelf Companies

Shelf companies are available to purchase.

Conclusion

An Antigua International Business Corporation (IBC) has the following benefits: total foreign ownership, confidentiality, privacy, no taxes, fast formation, no minimum capital, one shareholder with one director who can be the same person or legal entity, asset protection, and English as the official language.