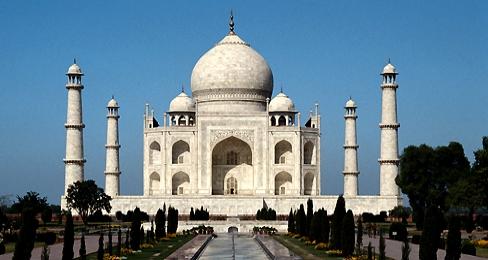

India is considered part of Asia and is located between the Arabian Sea on its southwest and the Indian Ocean on the south with the Bay of Bengal on its southeast. It is officially called the “Republic of India”. Its population estimated at over 1.2 billion is the 2nd most populous country in the world. It shares borders with China on the northeast, Pakistan on the west; and Bangladesh and Myanmar (Burma) on the east.

As a former British colony from 1858 to 1947 when it became an independent country but its land was divided with part of it become the nation of Pakistan. As a result of the long British rule, English is its second language.

Indian corporations are governed by the India Companies Act of 2013. Another law affecting foreign investments in India is The Foreign Exchange Management Act of 1999, as it regulates both offshore investments and transactions.

Benefits

There are several benefits available to Indian corporations including:

• Two Shareholders: India requires corporations to have a minimum of two shareholders.

• Low Authorized Minimum Capital: Low and affordable authorized capital requirement of INR 100,000, which is about $2,250 USD.

• Reasonable Corporate Tax Rate: Indian corporations pay a flat tax rate of 25%.

• Special Economic Zone: Indian corporations located in the Special Economic Zone receive particular tax exemptions. However, U.S. citizens and those residing in countries which tax worldwide income must declare all income to their tax authorities.

• IT Industry: India offers several tax incentives to corporations in the IT sector.

• Double Taxation Treaties: India offers its corporations the benefit of many double taxation treaties with other countries to avoid paying taxes twice on the same income.

• Skilled English Speaking Workforce: India has many skilled English speaking persons in its available workforce.

• Low Wages: Indian employees extremely affordable to hire.

Corporate Name

Indian corporations must pick a corporate name which cannot be similar to any other registered corporation. Also, The Companies Registration Office in India does have the power to revise the status of names. Particular words can only be utilized in a business name with certain permissions (for instance, “Institute” and “National”). In addition, the name of the corporation needs to be easily seen at the corporation’s offices, or other places the corporation conducts business.

Office Address and Local Agent

In India, corporations are allowed to have a main address that does not have to be located in India. However, both a registered office located in India and a local registered agent, are required. Some corporations use the office address of their accountant or attorney as their registered office location. The registered office will be the place where official correspondence from India go to including process service.

Shareholders

India corporations must have at least two shareholders and can have as many as two hundred shareholders.

Directors and Officers

To incorporate in India, the corporation must have at least two directors and can list as many as fifteen directors.

Directors must individuals at least eighteen years old. In India, there are no restrictions on citizenship or residency so that directors can live anywhere in the world.

Authorized Capital

The authorized share capital requirement in India in Indian Rupees is 100,000 (approximately $2,250 USD). In addition, the corporation needs to have a declared, nominal share capital divided into shares of fixed amounts.

Taxes

The tax rate in India for corporations is 25%.

Annual Fees

The annual renewal fee for a corporation in India is 1,050 Euros.

Public Records

Some information about corporate records is made available to the public in India. In addition, directors of companies can be personally liable if a company engages in business activity outside of its Article of Incorporation.

Accounting and Audit Requirements

Corporations in India need to hire a qualified auditor. The auditor must work with the treasurer of the corporation. The main reason for this required cooperation is to ensure that the corporation follows the rules of the Companies Act. By law, corporations have to keep accurate financial records that reflect the company’s true position at any given time. These accounts need to demonstrate both a profit and loss account, as well as a balance sheet including the directors’ and auditors’ reports.

Companies must also keep other records besides account books. These other records include a register of members and share ledger, a register of directors and secretaries, a register of share transfers, a register of charges, and a register of debenture holders. During the corporation’s annual meetings, auditors will either be appointed or re-appointed and at the same time, the corporation reviews its annual accounts.

Annual General Meeting

Corporations are required to hold an annual general meeting in India.

Time Required for Incorporation

The general time period for a incorporating in India is two to six weeks. The timing of the process depends on how long the submission of documents takes, as well as, the timing of the necessary Government Approvals.

Shelf Corporations

Shelf corporations are available In India for those seeking to incorporate faster.

Conclusion

India corporations are afforded several benefits including: only two shareholders are required, the minimum authorized share capital is around $2,250 USD, the corporate tax rate is 25%, there are Special Economic Zones to locate in to obtain tax exemptions, IT industry corporations receive tax incentives, there are several double taxation treaties to avoid being taxed twice for the same income, India offers an English speaking skilled workforce at low wages.