An Aruba Limited Liability Company (LLC) offers flexibility by choosing to keep it simple or more complex. Setting up a LLC is similar to a corporation. The Dutch name for a LLC is “Vennootschap met Beperkte Aansprakelijkheid” (VBA).

Foreigners can form LLC’s and own all of their shares.

Background

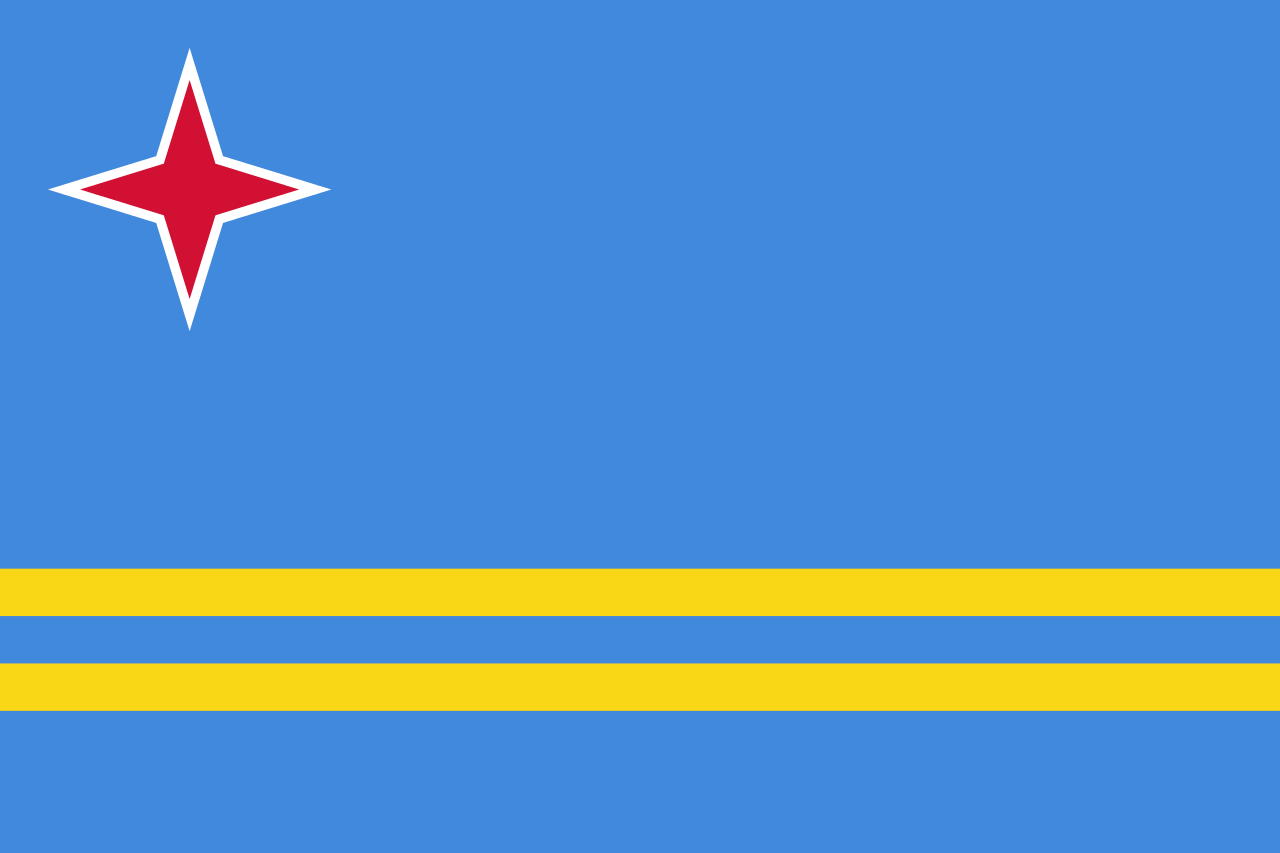

Aruba is an island country situated in the Southern Caribbean Sea near the Venezuela coast. It is part of the Kingdom of the Netherlands comprised of the Netherlands, Aruba, Curacao, and Sint Maarten.

Its political system is described as a “unitary parliamentary representative democracy under constitutional monarchy”.

Aruba has three official languages: English, Dutch, and their local Papiamento.

Benefits

An Aruba Limited Liability Company (LLC) can use these types of benefits:

• Total Foreign Ownership: Foreigners can own all of the shares in the LLC.

• One Shareholder: Only one shareholder is required to form the LLC.

• Tax Exemption: Tax exemption or lower taxes are available for certain types of business activities or location in the Free Zone. However, U.S. residents must disclose all income to their tax agency as do everyone subject to global income taxes.

• Privacy: The names of the shareholders are not included in any public records.

• No Minimum Capita: There is no requirement for a minimum share capital

• Limited Liability: Shareholder liability is limited to the contribution to the share capital.

• English: English is one of the three official languages.

Aruba Limited Liability Company (LLC) Name

A LLC must select a company name different from any other legal entity’s name in Aruba.

Since the legal documents can be in English, the company name can be in English but must end with either the word “Limited” or its abbreviation “Ltd.” or the words “Limited Liability Company” or abbreviation “LLC”. The Dutch abbreviation “VBA” may also be used.

Limited Liability

LLC’s limit the liability for their shareholders to their contribution to the share capital.

Registration

A civil notary first files a draft of the Deed of Incorporation with the Minister of Justice with an application for a Ministerial Declaration of No Objection. Once that is obtained, the civil notary registers an executed and notarized Deed of Incorporation with the Trade Registry at the Aruba Chamber of Commerce. Then the LLC (VBA) legally exists.

If the LLC engages in local business, the civil notary applies for a business license with the Department of Economic Affairs. This is required even if the LLC only engages in international business outside of Aruba. The reason for this is that a LLC may engage in local business enterprises in the future with the licensing already in place.

Deed of Incorporation

Deeds of Incorporation may be written in one of the three official languages: Dutch, English, or Papiamento (local language).

A Deed of Incorporation must include the following information:

• The Articles of Incorporation;

• The incorporator’s name, residence address, date and place of birth;

• Initial director’s name and address; and

• The shares types and amount issued including the names, addresses, and personal information regarding the legal entities and/or natural person holding shares with the amounts paid up for the shares.

These are only the minimum required information. A Deed of Incorporation may contain additional information.

Articles of Incorporation

Similar to other countries’ Articles of Incorporation, this legal document establishes the purpose, objectives, procedures of operation, and methods of termination. Like the deed, the articles can be written in one of three languages: English, Dutch, or the local Papiamento which are the three official languages.

Bylaws

Line any other corporate bylaws, the rules and regulations of the LLC are contained in the bylaws. Often referred to as the “operating agreement”, the bylaws also include items purposely excluded in the Deed of Incorporation and Articles of Incorporation.

Bylaws are established by the shareholders who may amend them at any time. They must be filed with the Trade Registry, but are not public documents unless the LLC authorizes them to be open for public inspection.

Directors

A minimum of one managing director must be appointed by the LLC. At least one director or the legal representative (explained below) must be an Aruba resident. Directors not born in Aruba but holding Dutch citizenship must apply for a director’s license with the Department of Economic Affairs.

If every manager is a non-resident of Aruba, a local corporation specializing in representing local VBA’s (LLC’s) must be appointed as a non-management director which is licensed as a legal representative.

LLC’s have the option to create a one-tier or a two-tiered management structure.

Managing directors must comply with the deed of incorporation, the bylaws, and the law.

Legal Representative

The required legal representative is not a managing director and is appointed with limited responsibilities when the other directors do not reside in Aruba. These limited responsibilities include:

• Keeping a shareholders registry;

• filing required documents with the Trade Registry;

• Filing tax returns;

• Issuing share certificates;

• Filing applications for required licenses; and

• Keeping contact with local authorities.

Shareholders

Only one shareholder is required to form a LLC.

Shareholders can be citizens of any country and reside outside of Aruba. Shareholders can also be foreign legal entities from any country.

The LLC has the option to issue shares or not which must be stated in the Articles of Incorporation. By law, shares can be transferred to third parties, but the Articles of Incorporation may restrict or prohibit their transference.

Shares may be issued with or with or without profit rights, with or without voting powers, and with or without nominal value. Shares can be issued in any foreign currency. However, at least one share must be issued with voting and profit rights.

Minimum Capital

There is no requirement for an authorized minimum share capital.

Taxes

LLC’s have the option of applying to be eligible for different tax regimes including:

• Tax exempt regime where no taxes are imposed. Qualifying companies are passive investments, financing, holding companies, and licensing intellectual property rights.

• Transparency regime where the ownership and shareholders’ identities are public so the LLC is taxed as a partnership with no corporate tax, but shareholders pay income taxes;

• Free Zone location regime with corporate tax rate of 2%.

• Imputation payment regime for hotels, shipping, aviation, insurance, financing, investments companies paying a corporate tax rate of 10%; and

• Normal tax regime with corporate tax rate of 25%.

Accounting

LCC’s must file annual financial statements with the Aruba Chamber of Commerce.

The following information must be included in the filed financial statements:

• Summary balance sheet;

• Summary profits and loss statement;

• Minutes approving the financial statements;

• Notes; and

• Shareholder’s register.

Registered Office

LLC’s must maintain a local office address which is normally their legal representative’s office address.

Public Records

While the shareholders’ names are included in a register filed with the Aruba Chamber of Commerce, it is not part of the public records.

Conclusion

An Aruba Limited Liability Company (LLC) enjoys these types of benefits: 100% foreign ownership of the shares, privacy, tax exemption or low tax options, no minimum share capital, one shareholder, English is one of the three official languages.