A Bahamas Limited Liability Company (LLC) can be incorporated as a local limited liability company under the Companies Act of 1992 or as an international business company under the International Business Companies Act of 2001 with limited liability protection.

Unless foreigners are interested in doing local business within the Bahamas, the limited liability international business company is the most popular LLC in the Bahamas.

Background

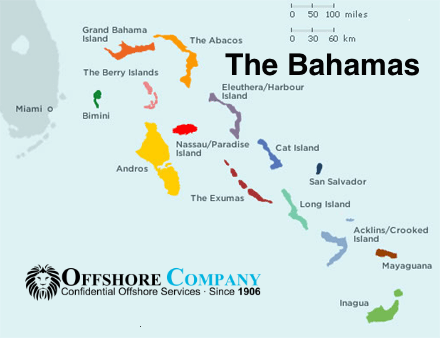

The “Commonwealth of the Bahamas” is located in the Atlantic Ocean near the state of Florida and Cuba. More than 700 islands, cays, and islets, form the Bahamas Islands.

In 1718, the Bahamas became a British colony. Independence was gained in 1973. Its political system is a unitary parliamentary constitutional monarchy with a democratically elected parliament which appoints its prime minister. Allegiance is still owed to the English monarch. Its capital is Nassau on New Providence Island.

Benefits

A Bahamas Limited Liability Company (LLC) has the following benefits:

• No Taxes: Every Bahamas LLC company enjoys totally tax free profits. However, U.S. taxpayers and anyone subject to global taxation must report all income to their tax authorities.

• Asset Protection: The law contains asset protection clauses against actions originating outside the Bahamas.

• Privacy: Shareholders’ names are not in any public records.

• Limited Liability: Shareholders’ liabilities are limited to their shares in the company’s capital.

• 100% Foreign Ownership: The LLC can be totally owned by foreigners.

• Two Shareholders: The minimum number of shareholders is two to form a LLC.

• One Director: A minimum of one director is required to manage a LLC.

• Fast Registration: A LLC can be registered in one business day.

• Low Cost Registration: It only costs $330 USD to register and $350 USD for annual renewals. Keep in mind this is only one of the government filing fees and does not include the legally required agent address that we provide or legal fees to form the company.

• No Minimum Capital: There is no required minimum capital.

• English: The official language of the Bahamas is English.

LLC Company Name

The LLC must choose a trade name which will not resemble any other Bahamas company name.

LLC’s must end their company name with either “Limited Liability Company” or its abbreviation “LLC”.

Business Activities

LLC’s formed under the International Business Companies Act of 2001 cannot conduct business activities with local residents. Ownership of real property in the Bahamas is prohibited. Properties may only be leased by a LLC for office usage. LLC’s cannot engage in banking, insurance, or re-insurance activities. Providing registered facilities for companies incorporated in the Bahamas and/or providing company management services are prohibited. However, any of these activities may be allowed with special permission granted by the Central Bank of The Bahamas.

LLC’s can own shares in Bahamian corporations, open local bank accounts, and hire local professionals for their services.

Registration

Since 2001, LLC’s must provide the names and addresses of the officers and directors to the Registrar General’s Department. Otherwise, only a Memorandum and the Articles of Association need to be filed. Normally, the registration process takes no more than one day.

Companies previously registered under the Companies Act 1992 can switch to a LLC or an IBC status if they qualify under the 2001 Act.

Formation fees for a LLC are based on the company’s authorized share capital. However, normal government fees for incorporation are $300 USD when filing the Memorandum and an additional $30 USD fee when filing the Articles of Association. On January 1st every year, the LLC must pay an annual renewal fee of $350 USD. Please keep in mind, these are only one government fees. They do not include the legally required local agent address that we provide or legal fees needed to form the company.

Asset Protection

The law contains asset protection clauses against actions originating outside the Bahamas.

Limited Liability

Shareholders’ liability is limited to their shares in the company’s capital.

Shareholders

A minimum of two shareholders are required to form a LLC in the Bahamas. Shareholders can be from any country. There is no requirement for locals to be shareholders.

Shares must be registered. Bearer shares are no longer allowed. Shares can be issued in any currency.

The law also contains provisions for the protection of minority shareholders.

Director

At least one director must be appointed to manage the LLC. The director may be a natural person or a corporation. Directors do not have to be residents of the Bahamas.

Accounting

There are no requirements for accounts. However, if accounting records are maintained there is no requirement for an audit. A register of shares must be kept indicating who the shareholders are.

Registered Office and Agent

LLC’s must appoint a local registered agent and maintain a registered office in the Bahamas.

Minimum Capital

There is no minimum capital requirement.

Annual General Meeting

There are no requirement for either an annual shareholders or directors meetings to be held in the Bahamas. In addition, meetings can be held by telephone.

Taxes

There are no corporation, income, withholding, dividends, or stamp duty taxes in the Bahamas for companies doing business outside its borders.

However, American taxpayers along with anyone subject to worldwide taxation must declare all income to their respective tax agencies.

Public Records

The public records only contain the Memorandum and Articles of Association. Only the names of the directors and officers are included in these documents. Shareholders names of LLC’s and IBC’s are not included in the public records. All records are available for public inspection.

Registration Time

A Bahamas LLC can be registered in one day.

Shelf Companies

Shelf limited liability companies are available for purchase in the Bahamas for an instant ready company.

Conclusion

A Bahamas Limited Liability Company (LLC) has these benefits: no taxes, asset protection, privacy for owners (shareholders), limited liability, 100% foreign ownership, two shareholders, one director, fast and low cost registration, no required minimum capital, and English is the official language.