A Bahrain Limited Liability Company (LLC) offers foreigners no corporate tax along with other tax exemptions. Foreigners can own 100% of the shares in a LLC.

The governing law for all LLC’s is the Decree Law No. (21) of 2001. It is also known as the “Promulgating the Commercial Companies Law” of 2001 (CCL).

Foreigners wishing to own 100% of a LLC must refrain from being involved with business inside Bahrain. Many types of business activities within the country can trigger laws requiring 51% local ownership of the shares.

Background

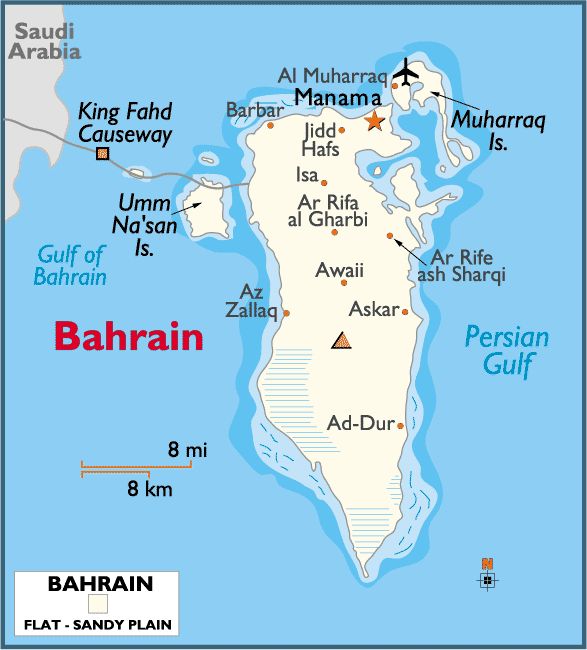

Bahrain is known as the “Kingdom of Bahrain” which is located near the Persian Gulf. Bahrain consists of 33 small islands near Saudi Arabia and Qatar. Its main industry is oil which was discovered in 1932.

Bahrain became a United Kingdom protectorate in 1913 after being part of the Ottoman Empire for many years. The British recognized the then current ruler of Bahrain, Al-Khalifa, and provided military protection in return for a significant foothold in the Gulf region. The British granted Bahrain independence in 1971 and have remained allies ever since. While Arabic is the most popular spoken language, English is its second official language.

Benefits

A Bahrain Limited Liability Company (LLC) enjoys these benefits:

• 100% Foreign Ownership: LLC’s only involved in business outside of Bahrain can be 100% owned by foreigners.

• No Taxes: LLC’s and their shareholders are not subject to any type of taxation. However, U.S. taxpayers and others residing in countries taxing global income must disclose all income to their governments.

• One Shareholder: One of the LLC’s is a Single Person Company who controls the company.

• Limited Liability: Only what is owed to complete full payment for the shares purchased becomes the shareholder’s liability if the LLC defaults on debts.

• Low Minimum Share Capital: Currently, the two private LLC’s only have a minimum share capital of $2,660 USD.

• English: After 58 years as a British protectorate, English is their second official language.

Bahrain LLC Legal Information

The company name cannot be similar to any other company or legal entity in Bahrain.

A LLC’s company name can end with “Limited” or use the abbreviation “LLC”. However, many use the name and abbreviation of one of the three types described below.

Different Types of Companies

Foreigners have the option to form three different types of limited liability companies:

1. SPC – Single Person Company which is a limited liability company for sole proprietors. Only one shareholder is required who manages the company him or herself.

2. WLL – The abbreviation stands for “With Limited Liability” which resembles European GmbH and a SàRL. The law requires a minimum of two shareholders and two directors to form. In addition, a local manager is required who is normally the company secretary.

WLL’s are not permitted to engage in banking or insurance business activities or investing funds on behalf of third parties.

3. BSC – Abbreviation for a “Bahrain Shareholding Company” resembling a Private Limited Company. Similar to a WLL, a minimum of two shareholders and directors are required along with a resident manager. This is a public joint stock company perfect for a large number of investors for large projects. The minimum share capital is $663,000 USD and a minimum of 50 shareholders. A board of directors is also required with at least three members. All shares are sold to the public and the company can be listed in the Bahrain Bourse (stock exchange).

All three provide limited liability to their shareholders and can be 100% foreign owned.

Limited Liability

A shareholder’s liability is limited to the amount owing on subscribed shares. If his or her shares are paid in full, there is no liability. If a certain amount still remains to be paid for the shares, that is the liability.

Registration

A proposed company name can be reserved by the Bahrain Companies Register.

All incorporation documents are filed with the Commercial Registration Directorate. After filing, the company details must be published in the Official Gazette.

Shareholders

The minimum requirement is two shareholders to form a LLC except for the Single Person Company (SPC). Shareholders can reside anywhere in the world and be citizens of any country. Resident shareholders are not required.

Directors

Two directors are required to form a LLC. Most companies appoint three directors to avoid tie votes. Directors may be citizens of any country and do not have to reside in Bahrain. There is no requirement for a resident director.

Officers

The only required officer a LLC must appoint is a secretary who acts as the office manager.

Registered Office

A local registered office must be maintained. Many foreigners use the office address of their lawyer or accountant.

Taxes

There are no corporate taxes, income taxes, capital gains tax, withholding tax, gift tax, estate tax, or inheritance tax. The only industry paying taxes is the oil production, refineries, and distribution companies.

Note: U.S. residents and everyone residing in a country taxing worldwide income must report all income to their tax authorities.

Minimum Authorized Share Capital

The requirement is a minimum authorized capital of only $2,660 USD for both the WLL and the SPC.

The BSC has a minimum authorized capital requirement of $663,000 USD.

The company’s capital will be divided in equal value shares not less than 50 Bahraini Dinars (50 BD). Shares may be non-negotiable and indivisible.

Incorporation cannot occur until all shares are distributed and the total value has been paid up in full. Like in kind shares (in lieu of cash) must be delivered to the company, as well.

Public Records

The names and citizenship of the directors and shareholders are included in the public records.

Time to Form

It could take up to two weeks to get the documents prepared and registered with the government.

Shelf Companies

Shelf companies are available to purchase in Bahrain.

Conclusion

A Bahrain Limited Liability Company (LLC) obtains the following benefits:100% foreign ownership, no taxes, low minimum share capital, sole shareholder for one of the LLC’s, limited liability, and English is this former British protectorate’s second official language.