A Barbados Limited Liability Company (LLC) is also called a “Society with a Restricted Liability” (“SRL”). There are many similarities with a typical U.S. limited liability company. On the other hand, there are several important differences between a Barbados LLC and a Barbados IBC including the ability to limit the life of an LLC and while an IBC has shareholders, an LLC has members.

The Barbados law which creates and governs Limited Liabilities Companies is called the “Societies with Restricted Liability Act” of 1995. LLC’s have the flexibility to be treated like corporations or partnerships.

Foreigners have two options when forming a LLC in Barbados:

1. International Society with Restricted Liability (“ISRL”) designed for international transactions while prohibited from doing business with citizens and residents of Barbados and acquiring land in Barbados.

2. Society with Restricted Liability (“SRL”) designed for doing local business subject to regular taxes.

This web page will focus on the ISRL.

Background

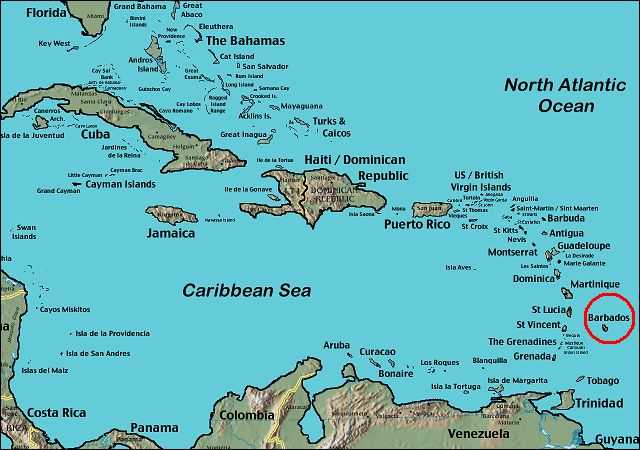

The island country of Barbados is situated in the Atlantic Ocean and the Caribbean Sea. In 1966, Barbados was granted its independence by the United Kingdom after being a colony for many years. Barbados enjoys prosperity far beyond its Caribbean neighbors.

Barbados Limited Liability Company (LLC) Benefits

A Barbados Limited Liability Company (LLC) enjoys these benefits:

• Limited Liability: Members liability is limited to the value of their total quotas.

• 100% Foreign Ownership: Foreigners can own 100% of the quotas.

• No Taxes: As long as all income is earned outside of Barbados, there are no taxes. However, Americans and taxpayers in countries taxing global income must report all income to their governments.

• One Member/Manager: Only one member is required who can also be the sole manager.

• No Minimum Capital: There is no requirement for a minimum authorized capital.

• English: As a member of the British Commonwealth, English is its official language.

Barbados Limited Liability Company Name

Every Barbados company must select a name which is not similar to any other company’s name.

The company name must include either the words “International Society with Restricted Liability” or its abbreviation “ISRL”.

Business Activities

An ISRL may not provide services or goods to residents in Barbados. However, an ISRL may do business with other ISRL’s, IBC’s, and International Banks, and licensed Exempt Insurance Companies in Barbados.

ISRL’s cannot purchase or hold land in Barbados.

Limited Liability

Member’s liability is limited to the value of their total quota (or shares) contribution to the company.

Registration

Applications must be filed by authorized services providers by the Corporate and Trust Service Providers Act of 2015. This Act regulates Barbados companies offering corporate and trust services.

Every new LLC must first be incorporated at the Corporate Affairs and Intellectual Property Office. Applicants file the Articles of Organization, notice of directors, registered office address and request for company name with the Registrar who issues a Certificate of Organization upon approval.

The Articles of Organization must include the following information

• Corporation’s proposed name;

• Purpose for the corporation;

• Corporation’s registered office address in Barbados;

• Registered agent’s name and address; and

• Name and address of each signor of the Articles of Organization.

Then, applicants must file for an ISRL license and when approved business can commence after receiving the ISRL license. ISRL’s are licensed by the International Business Division, Ministry of Industry, International Business and Small Business Development.

The application for a license must include:

• Description of the nature of the type if international business to be conducted;

• Declaration that the Societies with Restricted Liability Act of 1995 requirements have been complied with;

• Details of the quota holders and managers (including managers’ resumes).

The entire registration process can be completed in three working days. Keep in mind this does not include shipping time nor the time it takes for you to provide the legally required due diligence (know-your-client) documents.

Registered Office and Agent

Every LLC must have a registered office in Barbados where all company documents will be stored including minutes of members’ and directors’ meetings, register of membership, and accounting records.

In addition, a local registered agent must be appointed.

Company Secretary

LLC’s are not required to appoint directors. However, they are required to appoint a company secretary.

Members

Only a minimum of one member is required. Members can be citizens of and residing in any country.

In lieu of corporate shares, a LLC has what are known as “quotas” which operate like shares.

Transfers of quotas do not provide the transferee with the rights to become a members and to vote on resolutions or engage in management unless written consent is provided by the entire membership.

LLC’s may buy, redeem, and otherwise acquire quotas it issues. However, these are subject to passing a solvency test to assure that the LLC remains solvent during and after such transactions.

Pre-incorporation contracts are permitted. Redeemable quotas are also permitted.

Quotas resembling bearer shares are prohibited.

Manager

Only one manager is required who can be the sole member. Managers can be from any country and reside outside of Barbados.

Minimum Capital Requirements

There are no minimum authorized capital requirements.

Taxes

The Barbados Revenue Authority collects all taxes.

The normal corporate tax rate ranges between 0.25% and 2.5%. However, the LLC is exempt from paying corporate taxes due to its entire income being earned outside of Barbados.

LLC’s have the same tax exemptions as an IBC with an additional guarantee that the taxes and duties exemptions will remain for at least 30 years.

Note: U.S. taxpayers and everyone residing in countries who tax global income must report all income to their respective governments.

Annual Reporting and Accounting

LLC’s must keep sufficient books and accounting records to reflect the current status of solvency. An audit is not required for an ISRL unless total assets exceed $2 million USD.

Every LLC must renew its ISRL license every year on or before December 31.

The annual return must be filed by January 31 every year.

Annual financial statements may be required by the appropriate regulatory agency.

Annual General Meetings

Annual general meetings of members are required which can be held anywhere in the world. Proxies can be used for members unable to attend meetings. Meeting minutes and records of resolutions must be maintained in the registered office.

Public Records

Everything filed with the Registrar are available for public inspection. Nominee owners and quota holders are available for privacy.

Estimated Time for Registration

If all documents are timely filed and correct, the estimated time for registration is three working days. This does not include shipping time nor the time it takes for you to provide the legally required due diligence (know-your-client) documents.

Shelf Companies

Shelf companies for a LLC are available to purchase.

Form a Barbados Limited Liability Company (LLC) Conclusion

A Barbados Limited Liability Company (LLC) enjoys these benefits: limited liability, 100% foreign ownership, no taxes, one member required, one manager, no minimum capital and the official language is English.