A Belgium Limited Liability Company (BVBA) is similar to a UK Limited Liability Company (LLC). The shareholders liabilities are limited to the value of their share capital in which they subscribed. The official name for a BVBA is “Besloten Vennootschap met Beperkte Aansprakelijkheid”.

The BVBA can be totally owned by foreigners making it the most popular Belgium company to form by foreigners.

Background

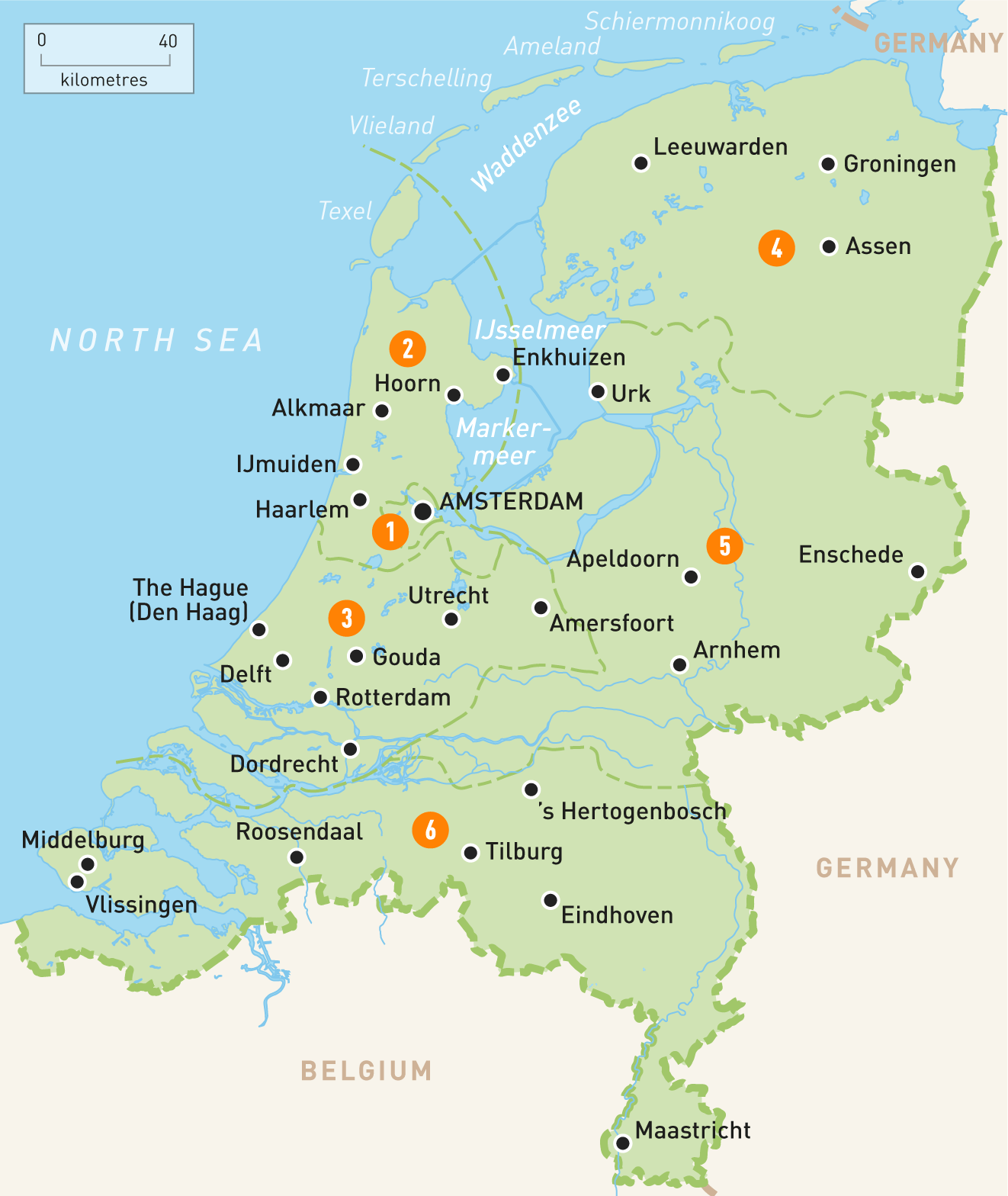

Belgium is a sovereign state located in Western Europe bordered by Germany, the Netherlands, France, Luxembourg, and the North Sea. The official name is “The Kingdom of Belgium” because it is ruled by a monarch.

Belgium has two main linguistic groups. The Flemish community consisting of Dutch speaking citizens comprising around 59% of the total population. Then there is the Walloon population speaking French comprising 41% of the population. There is also a small German speaking population living near the border with Germany.

Its political system is described as a “federal parliamentary constitutional monarchy”. The country is ruled by a monarch, but has a constitution with an elected federal parliament consisting of two houses and a prime minister.

Belgium is one of the six original founding members of the European Union (EU).

Belgium Limited Liability Company (BVBA) Benefits

A Belgium Limited Liability Company (BVBA) offers the following benefits:

• Foreigners can own all Shares: BVBA’s shares can be totally owned by foreigners.

• Limited Liability: A shareholder’s liability is limited to his or her contribution to the share capital.

• One Shareholder and One Director: The sole shareholder can appoint him or herself as the only director to control the BVBA.

• Low Capital: The required minimum share capital is 18,500 Euro with two thirds paid up when incorporating.

• EU Member: Belgium is a member of the European Union (EU) allowing more opportunities to conduct business through Europe.

Belgium Limited Liability Company (BVBA) Name

Company names must be unique and not resembling other names of legal entities in Belgium. Available company name checks can be performed prior to applying to form a new company. Proposed company names may be reserved for up to 10 days.

The company name must include the abbreviation “BVBA” at the end of its name.

Financial Plan

Incorporating a Belgium company requires filing a Financial Plan with the government.

A Financial Plan must include the following information:

• Creating an accounting system with initial parameter settings;

• Drafting an accounting plan;

• Entry and classification of accounting documents;

• Describing and justifying the initial capital amount; and

• Showing the initial capital covering the first two years of operations.

Incorporation

• First, the proposed company name must be available and approval can be obtained in one day.

• Then, the initial capital must be deposited with a local bank which will issue a certificate verifying that the amount is held in a blocked account.

• Next, the Financial Plan is filed with a notary.

• Then, notice of the new company will be published in the Official Gazette of Belgium.

• The Deed of Incorporation is filed with the Register Office and with the local Commercial Court.

• The Register Office will include the new company in its Register of Legal Persons. Then issues a unique identification number for the new company.

• Register with the local VAT Administration to obtain a unique VAT number.

• Then the company registers with the Social Insurance Fund within 3 months after incorporation.

Limited Liability

Shareholders only liability is limited to their share capital contributions.

Shareholders

A minimum of one shareholder is required to create a BVBA. Shareholders can be of any nationality residing anywhere. Shareholders can be an individual or a corporation. There is no maximum limit to the number of shareholders.

The shares are issued in a registered form. Transfers of shares are limited. The registered office must maintain a “Shareholders Register”.

Directors

One director must be appointed to manage the BVBA. A sole shareholder may be appointed as the only director for complete control of the company. Directors can be citizens of any country residing anywhere. Appointing a local director is not required.

Directors may be natural persons or corporations. Belgium requires directors to have professional and educational qualifications.

Registered Office

Belgium companies must have a local office address so legal papers can be served and legal notices received. Normally, the company setting up the BVBA offers its office address for the BVBA to use as its registered office.

An important point is that the location of the registered office determines which language will be the official one. If the office is based in Flanders, the official language will be Dutch. If in Brussels, the official language can be either Dutch or French. If in the Walloon region, the official language is French.

Minimum Capital

The required minimum share capital is 18,550 Euro where two thirds must be paid up when incorporating if there is only one shareholder. If there are two shareholders each one must pay one third of the minimum share capital prior to incorporation.

Taxes

Currently, the general corporate tax rate is nearly 34%. However, a lower (sliding scale) tax rate applies to companies where an individual owns more than 50% of the shares. Depending upon the company’s equity capital, the tax rate can be reduced down to 24% to 27%.

Note: U.S. taxpayers must report all global income to the IRS. All others subject to global income taxes must disclose all income to their governments.

Accounting

Filing an annual financial statement with the government is mandatory within 7 months from the end of the fiscal year. An auditor is required to prepare the financial statements. The financial statement must be presented and approved during the annual general meeting.

Companies classified as “Small” can file a simplified financial statement without requiring the services of an auditor.

Annual General Meeting

An annual general shareholders’ meeting must be held.

Formation Time

It may take up to two weeks to file and be approved to form a BVBA.

Shelf Companies

Shelf companies are available to purchase in Belgium.

Conclusion

A Belgium Limited Liability Company (BVBA) has the following benefits: complete ownership of all shares by foreigners, limited liability, low minimum share capital, EU membership, and one shareholder who can be the only director.