A Belize Foundation is a hybrid between a company and a trust. The foundation incorporates the management structure and legal persona of a company with the donor and beneficiary features of a trust. The foundation can be formed solely by foreigners who can maintain control. The foundation is a separate and independent legal entity.

The Belize International Foundations Act of 2010 (amended 2013) governs the formation and dissolution of all foundations. The 2013 amendments allowed foreigners to become council members for numerous foundations without having to apply for a professional license. Only a Belize citizen who wishes to sit on more than one foundation council must obtain a license. For a side-by-side view of different countries, visit this offshore foundations comparison table.

Belize Foundation Advantages

The following are some of the many advantages offered by a Belize Foundation:

• Preservation of wealth from economic, political, or family crisis;

• Faster method to transfer assets to one’s heirs;

• Estate planning to avoid interference with one’s home country’s archaic laws;

• Consolidation of global assets ownership;

• Eliminate probate, estate and inheritance taxes.

Background

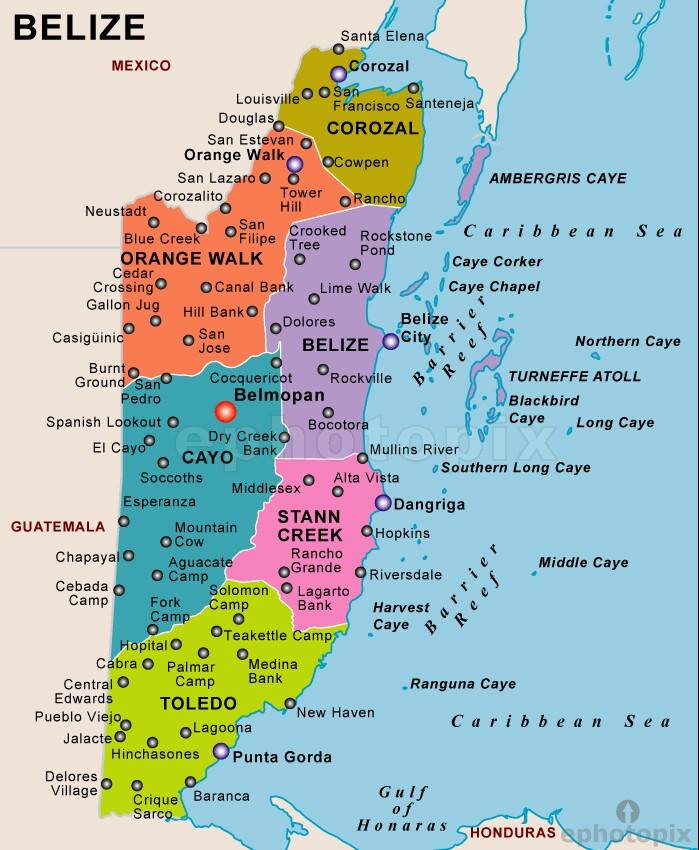

Belize is a Central America country located on the eastern coast. It used to be called British Honduras, but changed its name after being granted independence from the United Kingdom in 1981. Its political structure is a unitary parliamentary constitutional monarchy with Britain’s Queen Elizabeth II as its monarch and an elected two house national assembly with a prime minister.

Belize Foundation Benefits

A Belize Foundation has the following benefits:

• No Taxation: There are no taxes of any kind if all parties and assets are from outside of Belize. Note, U.S. taxpayers and those from countries taxing global income must disclose all income to their tax authorities.

• Total Foreign Ownership: The founder, beneficiaries and assets can all be from outside of Belize.

• Asset Protection: A Belize foundation provides complete worldwide asset protection. The foundation owns all of the assets transferred from the founder. As a separate legal entity, the foundation isolates the assets from the founder and the beneficiaries.

• Estate Planning: The founder and the beneficiaries do not own any of the assets and the foundation maintains total control regarding the distribution of the assets to the beneficiaries. The foundation can own the assets for generations and distribute income to the beneficiaries and their heirs for many generations.

• Privacy: The names of the founder, beneficiaries, and protector are not included in the public records.

• No Minimum Capital: There is no minimum capital requirement for foundations.

• English: Belize official language is English.

Legal and Tax Information

Belize Foundation Name

Foundations cannot select a name the same as or similar to another Belize foundation. Nor can a name be misleading as to its activities or identity.

The Foundation’s name must end with the word “Foundation” or one of its abbreviations “Fdn” or “Found”. Other languages may be used than English, but only those using the Roman alphabet with proper translation of “Foundation” and its abbreviations.

Asset Protection

The Belize foundation owns all properties and assets transferred to it from the founder as it is a legal entity in itself. This isolates all assets from the founder.

Foundation Charter

The foundation charter is the official document creating a foundation in Belize. The Act requires every Charter to include the following information:

1. The Foundation’s name;

2. The Founder’s name and address;

3. The Foundation’s purpose;

4. The initial property endowment with the registered agent’s certified confirmation;

5. Designation of the beneficiaries;

6. Designation of the duration of existence (indefinite or fixed period of time);

7. The Secretary’s name and address (if one is appointed);

8. The Registered Agent’s name and address;

9. The names and addresses of the foundation council members (nominee members are permitted); and

10. Other important provisions regarding the foundation’s management.

Registration

The Belize International Foundations Act of 2010 requires a foundation to be created by executing a foundation charter or a similar document by a founder and the foundation council members. Said document contains the founder’s disposition of title, rights, or interest in assets for a specific purpose. This document is then filed with the Registrar, but not accessible to the public.

Within 30 days from the date of this document, an application will be made with the Registrar for entry into the Register of International Foundations. The Registrar will then enter the name of the foundation into the Register of International Foundations, provide a registration number, and issue a Certificate of Establishment containing the following information:

• Date of registration;

• Foundation’s name;

• Registered agent’s name and address; and

• Registration number.

This will establish the foundation as a separate and independent legal entity which can file lawsuits and be sued in a court of law. Only the Certificate of Establishment will be made part of the public records which the public can inspect.

When property is disposed to and accepted by the foundation’s council, the property will be irrevocably owned by the foundation.

Founder

The founder of a foundation is the one who creates it and may consist of more than one person. Founders may be individuals or corporate bodies. A founder may also be its only beneficiary. However, the founder cannot be the protector. The founder and anyone contributing assets to a foundation without full consideration cannot be a Belize resident.

Foundation Council

The foundation council manages, represents, and acts on behalf of the foundation with all third parties. Its powers and duties must be in accordance with the foundation’s charter.

Protector

The foundation’s charter may provide for the selection of a protector. This is typically someone known and trusted by the founder. The foundation’s charter will specify the protector’s powers, duties, rights, and responsibilities. The foundation’s by-laws may also provide such specifications of the protector. The protector will never be a foundation council member. The protector owes a fiduciary duty to the founder, beneficiaries, and the foundation.

Beneficiaries

The beneficiaries are the people named in the foundation’s charter or by-laws either specifically by name or referring to an identifiable class. Beneficiaries are the ones entitled to the benefits described in the foundation’s charter or by-laws.

Foundations may be formed with no beneficiaries as long as there is a specific clear purpose for its existence described in the foundation’s charter.

Foundation’s Purpose

Foundations can be created for charitable or non-charitable purposes; or for no purpose other than to benefit a beneficiary or the founder.

A foundation may be created with no beneficiaries as long as there is a clear specific purpose as described in the foundation’s charter.

Registered Office

Every foundation will have a registered office address in Belize.

Duration of a Foundation

Foundations can be created with a perpetual lifespan or for a definite time period.

Foundation’s Registered Agent

Foundations have the option to appoint a local registered agent or a foundation secretary.

Minimum Capital

There is no required minimum authorized capital for a foundation.

Registered Office

Before registering, a Foundation must maintain a registered office address in Belize which can be the address of an appointed registered agent or the foundation secretary.

Annual Meeting

Annual meetings are not required.

Accounting

There are no requirements for the maintenance of books and accounting records. This is up to the discretion of the foundation council.

No matter what accounting practices are adopted, beneficiaries have the right to full access of all records.

The government does not require any filings of books, account records, or any audits.

Taxes

As long as all of the assets, beneficiaries, the founder, and all contributions made to the foundation originate and are located outside of Belize, the following taxes are exempt:

• Corporate taxes;

• Income taxes;

• Capital gains tax;

• Wealth tax;

• Assets tax;

• Withholding tax;

• Gift tax;

• Inheritance tax;

• Estate tax;

• Distributions tax;

• Profits tax;

• Stamp duties;

• Business tax; and

• Estate duty tax.

Public Records

The Registrar only provides the public with the following information regarding a foundation:

• Foundation’s name;

• Registered agent’s name and address; and

• Registration date of the foundation.

The founder, protector, and beneficiaries names are not part of any public records. While the foundation council member’s names are included in the foundation charter, the law allows the appointment of nominee council members even though the charter is not made available to the public.

Estimated Time to Register

It is estimated that the entire registration process may take up to two weeks.

Shelf Foundations

Shelf foundations are not available for purchase as they are unique.

Form a Belize Foundation Conclusion

A Belize Foundation has the following benefits: 100% foreign owner and control, no taxes, asset protection, estate planning, privacy, no minimum capital, and English is the official language.