What are the best offshore company jurisdictions? First, what is the most common reason someone sets up an offshore company? Asset protection from lawsuits tends to be the most pressing concern. Many individuals wish to protect their assets from a variety of attacks. In an increasingly litigious world, this can include greedy creditors, bitter spouses, as well as disgruntled employees or business partners. A business owners in America can lose everything they have worked long and hard for when a passerby slips on a puddle of ice on their property. A doctor risks his or her entire practice when a patient is dissatisfied with the results of their medical intervention. There are predatory plaintiffs lurking everywhere. Asset owners need to do their research. Then the need to follow up on that research and take action ensuring the safety and security of their assets.

The best offshore jurisdictions offer a number of benefits over comparable structures established on U.S. soil. Nevis has several advantages over other international locations. However, it is not wise to approach asset planning with a cookie cutter mindset. Despite its many pluses as an asset protection jurisdiction, Nevis cannot claim to be the ideal location for everyone. Belize offers a number of benefits as well, and so does the jurisdiction of Cook Islands. The best way to protect your assets is to contact an asset protection expert. They can help you craft a tailored-made plan that is just right for you. There are phone numbers and an inquiry form on this page to do just that.

Best Offshore Companies in the World

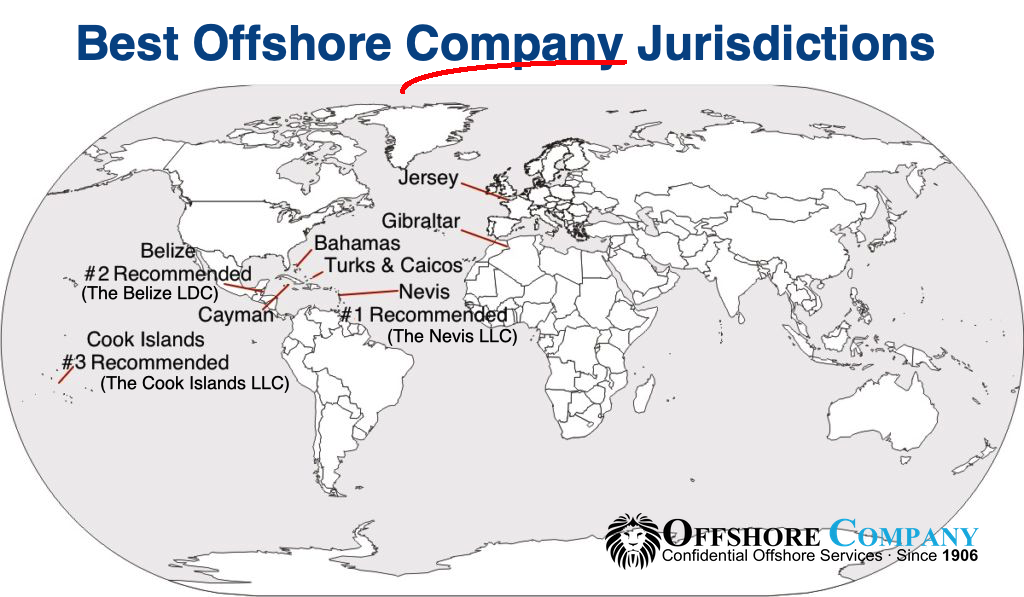

Let’s get straight to the point. We will discuss the details below. Here is a list of the best offshore company jurisdictions in the world.

- Nevis – Especially the Nevis LLC.

- Cook Islands – Namely, the Cook Islands LLC. (The Cook Islands Trust is the best offshore asset protection trust.)

- Belize – Especially the Belize LDC.

Keep reading for further information. Remember when Motorola was the best cell phone on the market? Now Apple and Samsung have left them in the dust. There are many formerly well-ranked jurisdictions that have been pummeled by law revisions in competing financial havens. Cayman Islands, BVI, Bermuda, Isle of Man, the Channel Islands, and Jersey come to mind. These jurisdictions suck their thumbs while other legislatures that pay attention to the needs of the ever-changing demands of the modern offshore company client.

Offshore Jurisdiction Advantages

The laws in the best offshore jurisdictions in large part (if not entirely) favor asset owners. This makes perfect sense since income from the asset protection industry makes up a big chunk of these countries’ economies. One example is the Cook Islands International Limited Liability Company Act 2008. The act allows LLC owners to structure their companies according to its own rules, rather than external statutory requirements. Members and managers simply need to make sure that the provisions in their operating agreement are lawful. If so, Cook Islands LLCs are free to define the nature and business activity of their LLC as they see fit. Setting up a domestic LLC is quite different. Domestically, company principles must adhere to strict statutory requirements that may vary from one state to another.

Additionally, no offshore jurisdiction automatically honors foreign judgments. Most require plaintiffs to try cases against an LLC set up within their jurisdiction in the local court. This often means the creditor or plaintiff has to post a bond, which can be quite steep. This was the case in Nevis, which required a $100,000 bond before one could file a lawsuit against a Nevis LLC. It got even better in 2018 when the Nevis legislature gave the High Court the authority to set the bond for any amount, including more than the $100,000 cap. Belize goes even further and can require up to 50 percent of the claim amount, or BZ$50,000, whichever is greater.

High Burden of Proof for Your Opponent

Not only is it expensive to mount a case in an offshore jurisdiction, the foreign courts also demand a high level of proof. Creditors and plaintiffs must prove beyond a reasonable doubt that the debtor or defendant acted with malicious intent to defraud them or to withhold their assets from them. In the U.S., the law only applies this level of proof in criminal cases. It is not an easy bar to jump. These and other factors make offshore jurisdictions much preferred for asset protection structures such as trusts and LLCs over their domestic counterparts.

Best Offshore Company Jurisdiction: Nevis

As already stated previously, there is no single best offshore jurisdiction that will be suitable for everyone. Each location has its own comparative strengths and weaknesses. It is the individual who is seeking to establish the company—his or her current needs and future plans—that determines the ideal offshore company domicile.

That said, we rank Nevis as the best offshore company jurisdiction. Namely, we place the Nevis LLC in the top slot. Why? First, because it’s statutes are the strongest for one of the most important reasons people set up companies offshore: asset protection from lawsuits. Second, Nevis has a fast, efficient and affordable setup process. Third, Nevis has consistently improved its laws over the years, keeping ahead of competitive has-been jurisdictions such as the Cayman Islands, BVI and Bermuda.

Nevis was one of the first international jurisdictions that enacted a modern Limited Liability Company Ordinance (1984). As a result, its LLC statutes are robust and resistive to challenges. This ordinance has been improved upon in more recent years, once in 1995 and again in 2015. These improvements have further enhanced and strengthened the asset protection features of a Nevis LLC. For instance, under its laws, Nevis provides the same level of protection for single-member LLCs and multi-member LLCs. Single-member LLCs established within a U.S. jurisdiction do not enjoy the same protection as multi-member LLCs in most states. This is a major advantage for individuals who have assets to protect but who, for one reason or another, are not in positions to establish multi-member LLCs.

Nevis LLC Asset Protection Provisions

A big barrier to lawsuits and judgment enforcement against a Nevis LLC member is as follows. The new Section 43A addresses fraudulent conveyance of assets transferred into an LLC. It restricts how creditors of an LLC member can recover assets that a member has placed into the company. It is almost identical to the verbiage used in §24 of Nevis’ international trust law (the Nevis International Exempt Trust Ordinance). Wherein, it states that a creditor needs to prove beyond a reasonable doubt that the transfer into the entity was intended to defraud the creditor. (And not just any creditor, but that particular creditor.) Defraud in this sense relates to a civil matter not a criminal one. It deals with a debtor who is trying to keep assets away from a creditor.

Most such statutes in the US, UK and Australia, for example state that the creditor must prove his or her case by a preponderance of the evidence (51% to 49%, for example). In Nevis, however, creditors of a member of a Nevis LLC (or Nevis trust for that matter) must prove their fraudulent conveyance claims beyond a reasonable doubt (about 97% to 3%). Furthermore, creditors of a Nevis LLC member must prove that the member was rendered insolvent, including the entire market value of the assets in the LLC. A creditor must make this claim within two years of LLC formation and funding.

Moreover, making such a claim requires that the creditor posts a bond in Nevis courts of $100,000, for example. So, the creditor must pay a bond before filing a case in Nevis.

Thus, a judgment creditor only has up to two years to bring a charging order case against a member of a Nevis LLC. If they beat this timeline, they part with $100,000 (more or less) for the privilege of filing such a case in court. A charging order is a legal device that protects the assets of an LLC from being used to satisfy the debts of a member. It states that the creditor can receive the distributions that would have been given to that member. However, it does not allow the creditor to seize or control that member’s share in the company. This is the only recognized remedy against most offshore LLCs, including a Nevis LLC.

But wait, there’s more. Even if someone has a charging order against a Nevis LLC member’s interest, the creditor cannot force the LLC management to make distributions. Thus, in most cases, the creditor gets nothing.

On top of this, if it was a U.S. creditor, Revenue Ruling 77-137 has another surprise in store. Since the creditor has the right to receive that member’s share of distributions, the IRS requires the creditor to pay the taxes on that member’s share of the profits…whether the creditor receives the actual distributions of those profits or not. That’s right. The creditor pays the taxes on the debtor-member’s share of the profits whether or not the creditor actually receives them. After three years, the charging order against a Nevis LLC member expires and is not renewable.

Those are some of the main reasons why we rate the Nevis LLC as the best offshore company.

#2 Offshore Company Jurisdiction: Cook Islands

The Cook Islands International Limited Liability Companies Act 2008 contains key asset protection features that reflect the vital importance of this industry to the islands. In a number of the best offshore company jurisdictions, the charging order is the only creditor remedy available. Cook Islands, however, clearly define and delineate the limits of this remedy in their LLC legislation. This eliminates any ambiguity in the interpretation of a charging order as it relates to a Cook Islands LLC.

First, like other most jurisdictions, a creditor with a charging order against a Cook Islands LLC member does not earn the right to exercise membership rights. This means the creditor cannot interfere with the management of the LLC, restrict its business, or liquidate its assets. Additionally, members with a charging order against them can continue to exercise their membership rights as if the courts had not issued the charging order. Finally, Cook Islands legislation does not attach any exemplary or aggravated fees, i.e. punitive damages to a charging order. A creditor is entitled only to the amount in their claim—should they be able to collect on it.

#3 Offshore Company Jurisdiction: Belize

The Belizean equivalent of an LLC is an LDC, or a limited duration company. A Belizean LDC has a 50-year lifespan and, at that time, can be extended for another 50-years. Some jurisdictions only give LLCs 30-year lifespans. One of the most common ways that a creditor or plaintiff uses to penetrate the asset protection shield of an LLC is a fraudulent transfer claim. A fraudulent transfer claim means that the debtor intentionally transferred his or her assets to an asset protection structure to prevent a creditor from gaining access to them.

An asset protection structure can include LLCs, as well as trusts, foundations, and other similar vehicles. Under Belizean law, capital contributions cannot be challenged as fraudulent transfers. Capital contributions refer to the assets that were used to fund or establish an LDC. Additionally, any transfer of assets occurring after the establishment of a Belizean LDC is also exempt from a fraudulent conveyance claim, as long as the transfer occurred in exchange for a capital interest in the LDC.

Belize also imposes a relatively brief statute of limitations on a fraudulent transfer claim against a Belizean LDC. A creditor must file a claim within two years of an asset transfer to an LDC, or one year from the time the member established and funded the LDC. Keeping in mind that Belize does not entertain fraudulent transfer claims against capital contributions, it becomes clear how limiting these time constrictions truly are. This point, alone, makes it one of the best offshore company jurisdictions.

Setting up an LDC in Belize is also comparatively more affordable than in other offshore jurisdictions. This is a result of the competition for offshore assets that currently exists among several international jurisdictions. An asset owner seeking to establish an offshore LLC faces a dizzying number of attractive options. This only underscores the need for the guidance of an experienced asset protection professional. They can help you decide the type of strategies that will best safeguard your assets.

Conclusion

As an asset protection structure, an LLC, provides a clear edge for business owners and professionals, such as physicians and engineers. It separates the affairs of their business or line of work from their personal lives. This is true whether someone sets up the LLC within the United States or in an offshore location. If someone sues a doctor or other business owner as an individual, the creditor or plaintiff cannot go after the assets housed within an LLC. Thus, this is so, even if someone sued the owner of the same LLC individually.

An offshore LLC, however, has distinct advantages over its U.S. based counterpart. From statutory regulations that favor asset owners to restrictive interpretations of legal remedies, offshore jurisdictions send a clear message to LLC founders. They are stating that the protection of their clients’ assets is their paramount concern. For asset owners tired of the onslaught of threats against their hard-earned assets, this is welcome news indeed.

The best offshore company jurisdictions each have their own advantages and disadvantages. If you do decide to place your assets in an offshore protection structure, be sure to secure the advice of a seasoned asset protection specialist. The sheer number of available options may surprise you. Wherever you decide to domicile your asset protection structure, do it before you face a threat in court. Heed the wise words of one of the original Founding Fathers, Benjamin Franklin: “An ounce of prevention is worth a pound of cure.”