A Bonaire Private Foundation provides foreigners with a flexible legal entity. Greater asset protection is provided because as a legal entity the foundation owns all of the contributed assets keeping them further out of the reach from future creditors of the founder and the beneficiaries. In addition, founders have the option to create a purpose foundation with no named beneficiaries.

The Dutch name is “Stichting Particulier Fonds”, abbreviated “SPF”. As a private foundation, the SPF does not have to be formed for non-profit, social, or charitable purposes.

Background

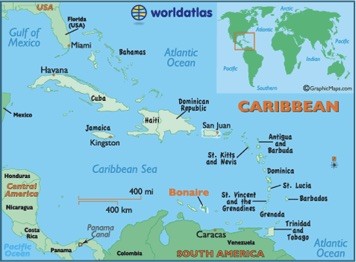

Bonaire is a Dutch island in the Caribbean.

From 1636 to 1800, Bonaire was a Dutch colony. Britain conquered Bonaire from 1800 to 1803 and again from 1807 to 1816 when it was returned to the Netherlands and became part of the Netherland Antilles. In 2010, Bonaire voted to remain under Dutch control when the Netherland Antilles dissolved. It became part of the Kingdom of the Netherlands.

Private Foundation Benefits

A Bonaire Private Foundation provides foreigners with these types of benefits:

• Full Foreign Participation: Foreigners can form a foundation with all of the beneficiaries and managing board members being foreigners.

• Privacy: No foundation records are files with the government keeping all information private.

• No Taxation: A foundation pays no taxes. However, U.S. taxpayers must report all global income to the IRS. Everyone else paying taxes on global income must declare all income to their governments.

• Flexibility: Founders maintain great flexibility with how a foundation is managed.

• Business Activities: The law allows private foundations to be engaged in all types of business activities for profit.

• Estate Planning: Private foundations may be perpetual allowing unlimited estate planning benefits to the founder’s family for generations.

• Asset Protection: Since the foundation can own all of the assets, future creditors of the founder and beneficiaries may be prevented from seizing them.

• Fast Formation: A foundation could be formed in one business day.

• English: While not an official language, most tourists are English speaking so many residents speak English.

Private Foundation Name

The SPF must choose a unique name so as not to be confused with other legal entities with the same or similar names in Bonaire.

The law requires adding the word “Foundation” at the end of its name. Many private foundations are named after its founder, but it is not required.

Formation

Similar to common foundations, a private foundation is incorporated with a deed signed in front of a civil law notary in Bonaire. The deed transfers ownership of named assets from the founder to the foundation.

In addition, Articles of Association are executed which are explained below.

Articles of Association

Bonaire refers to what other countries call the foundation’s written instrument (Charter, Constitution, Deed) the “Articles of Association”. Similar to a limited liability company’s Articles of Association, the SPF’s Articles provide the terms and conditions for setting up a business structure.

Great flexibility exists for the founder when drafting the Articles to name specific beneficiaries or to name them in a separate private document or not to name any beneficiaries because the foundation is formed for a purpose rather than benefiting beneficiaries.

Another example of its flexibility is upon termination, the Articles may provide that the assets be distributed to someone other than the beneficiaries. Or, the Articles may specify that the SPF will not take title to the assets but rather only act as a custodian or a trustee administering and managing the assets on behalf of third parties. Therefore, the SPF may become a vehicle only for economic transfer without transferring control over the assets.

Purpose

The purpose of the SPF may be conducting business or an enterprise for profit.

Book 2 of the Civil Code provides that foundations are encouraged to invest their assets and may do so actively. No limits exist regarding the types of investments a private foundation can engage in. The SPF can manage its assets (equities, investments, etc.), participate as a partner in a limited or general partnership, or act as a holding company which under the Civil Code are not regarded as “conducting a business”.

Duration

SPF’s may be formed as perpetual (unlimited lifespan), for a specific period of time, or if a specific event occurs. SPF’s dissolve by resolution of the managing board unless the Articles specify differently such as the authority to dissolve exists with the founder or incorporator.

Founder

The person creating the private foundation is known as the “founder”. Founders may be nationals of any country and can reside anywhere outside of Bonaire.

Beneficiaries

As discussed earlier, the SPF can either be a “purpose” foundation or it can name beneficiaries who will benefit from the assets transferred to the foundation. Beneficiaries, like the founder, may be citizens of any country and live anywhere outside of Bonaire as “non-resident” beneficiaries.

In regards to the SPF’s assets, the beneficiaries by law are considered “economic owners” in that they do not hold title but can expect benefiting from the income produced by the assets and/or eventual ownership of the assets.

Managing Board

The SPF differs from a corporation because it does not have shareholders or members nor capita; divided into quotas or shares. Therefore, the managing board is not subjected to any control by members or shareholders. The Articles appoint the initial managing board. Vacancies cause by death, incapacity, or retirement are filled at the discretion of the remaining board members unless the Articles specify otherwise.

Members can be of any nationality and reside anywhere.

Taxes

Since 2011, the corporate tax was abolished and replaced with what is called a “yield” tax. When a company earns profits and retains them, no taxes are imposed. Only when the profits are distributed to the shareholders or members will the yield tax at a 5% rate be imposed.

Since Bonaire is treated as a municipality by the Netherlands government, the normal Dutch corporate tax of 25% applies to all profits unless the legal entity qualifies as a Bonaire resident entity.

Foundations and trusts formed in Bonaire are automatically treated as Bonaire resident and are not subject to any taxes.

Note: U.S. taxpayers are still required to report all world income to the IRS. Everyone else subject to taxes on their world income must report all of their income to their tax agencies.

Public Records

The SPF does not register with the government. Therefore, there are no public records pertaining to foundations in Bonaire.

Formation Time

As quickly as the Deed and Articles of Association can be prepared and signatures notarized determines the formation time. Many formation companies can accomplish this in one business day.

Conclusion

A Bonaire Private Foundation allows foreigners to take advantage of these benefits: complete foreign participation, allowed to actively conduct business for profit, tax free, privacy, estate planning, asset protection, fast formation, founder control, and English is popular.