Form a Brazilian Limited Liability Company (LLC) Introduction

A Brazil Limited Liability Company (LLC) has been around for over 40 years. Also known as a Brazilian Sociedade Limitada (Ltda) it is similar to the Limited Liability Company (LLC) in other countries. They are governed by the Civil Code and by Law No. 6404 of 1976 known as the “Corporation Law”.

Background

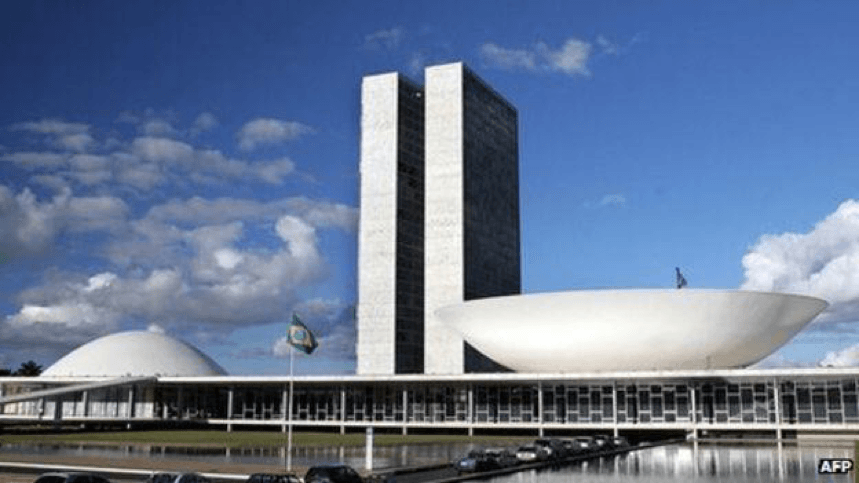

Brazil is the world’s fifth largest country by population (over 206 million) and land area (over 3.2 million square miles). Formerly known as the “Federative Republic of Brazil” it is the largest country in all of Latin America. Portuguese is its official language after having been a Portuguese colony for many years.

It is a democratically elected federal presidential constitutional republic with Brasilia as its capital and Sao Paulo is its largest city.

Brazil Limited Liability Company (LLC) Benefits

Brazil LLC’s receive many benefits including:

- Limited Liability: Members’ personal liabilities are limited to the value of their shares in the LLC.

- Two Shareholders: Only a minimum of two shareholders (members) is required to form a LLC.

- Low Minimum Authorized Share Capital: The minimum authorized share capital is only $1 USD.

- No Type of Business Restrictions: A LLC can pursue any type of business activities.

- Easy Conversion: It is easy to convert a LLC into a normal corporation (Sociedade anônima / S.A.) and vice versa.

- Low Cost Setup: The LLC (Ltda) is the simplest and cheapest way to establish a corporate presence in Brazil.

Company Name

Brazil LLC’s must maintain a unique name that is not similar to already existing companies or corporation names in Brazil.

However, the LLC company name must include the expression “Ltda” after its name.

Office Address and Local Agent

Brazil LLC’s must retain a local resident representative and have a local office address which can be located in the representative’s office. This address will be used for process service requests and official notices.

Members

A LLC must have a minimum of two members (shareholders) which can be individuals or legal entities and can reside anywhere in the world. Once formed, there must be approval by at least 75% of the current members to approve a new member.

The LLC’s capital is divided into equity units (called quotas) rather than shares and is registered instead of issuing share certificates. Members can contribute funds, credits, rights or assets; but not services at the time the LLC is formed. Ownership and the number of quotas are specified in the Articles of Association. When assets other than money are contributed by a member who later wants to transfer his/her quota title to a third party, the Articles of Association must then be amended which requires approval by of those holding title to at least 75% of the total capital.

The legal default method of allocation is based on the percentage interest in the capital. However, a LLC can allocate the sharing of profits any way it wants in the Articles of Association.

Directors

A Brazilian Limited Liability Company must have a director (manager) who can be from any country but resides in Brazil. The manager can be held personally liable to creditors of a LLC.

The LLC Resolution appointing the manager usually contains the limits and restrictions on the manager’s power. For instance, a manager may be required to obtain written authorization from the members when purchasing or selling goods over a set sum, or when purchasing or selling real estate, hiring auditing services, reorganization of the LLC, or filing for bankruptcy.

Authorized Capital

Brazil requires a minimum authorized share capital of $1 USD.

Registration

To become a LLC its Articles of Association must be filed with the local “Junta Comercial” rather than with the federal government. Each Junta Comercial can take its own time registering LLC’s. According to the World Bank, the fastest states to register a LLC are: Rio Grande do Sul and Minas Gerais. The longest are Sao Paulo, Maranhao and Ceara.

Taxes

An LLC is treated by Brazil as a company in regards to income taxation. Distributions paid to members are not taxed to the individuals, but rather at the company level which leads to creative tax planning.

However, U.S. taxpayers and others residing in countries taxing global income are required to declare all income to their taxing authorities.

Public Records

The only document which LLC’s must file with the Brazil Junta Comercial is the Articles of Association which contains the names of every quota holder, the company’s purpose, its local address, any limits on the length of its existence, and the apportionment and payment of the quota capital to its members. Thus, the names of its members are listed in the public record.

Accounting and Audit Requirements

Brazil requires the management of meeting minute’s records along with a record book containing all major resolutions and management decisions. There is no mandatory audit requirement.

Annual General Meeting

LLC’s with more than 10 members must hold an annual general meeting. Those with less than 10 members only need to hold regular meetings.

Time Required for Incorporation

Forming a Brazil LLC can take up to 3 months.

Shelf Companies

Shelf Limited Liability Companies are not available in Brazil.

Form a Brazil Limited Liability Company (LLC) Conclusion

Brazil LLC’s have some benefits including: limited liability, only two members required to form a LLC, low minimum authorized share capital, no restrictions on the type of business activities, easy conversion into a normal corporation, and it is the simplest and lowest cost way to establish a corporate presence in Brazil.