A BVI Limited Liability Company (LLC) offers foreigners a limited liability offshore company with local no taxes of any kind.

Originally, the British Virgin Islands International Business Companies Ordinance of 1984 created International Business Companies (IBC) where over 600,000 were incorporated as such until 2004 when a new law was enacted to include foreign and domestic corporations as equals which ended the IBC types of companies. The rationale was that foreign companies discriminated against local (domestic) companies and a new law was needed to eliminate this type of “discrimination” allowing domestic companies to engage in international business, trading and commerce.

NOTE: AS OF THIS WRITING BVI HAS “LIMITED COMPANIES” WHICH ARE EQUIVALENT TO CORPORATIONS IN THE U.S. THERE IS NO BVI LLC LEGISLATION. SO, THIS ARTICLE IS FOR FUTURE PURPOSES WHEN BVI DOES PASS LLC LEGISLATION. UNTIL THEN, WE RECOMMEND THE NEVIS LLC.

The BVI Companies Act of 2004 (hereinafter, the “Act”) governs the formation, acceptable activities, and termination of LLC’s. While several types of limited liability companies may be formed under the Act, the most popular with foreigners is the company limited by shares.

Foreigners may own all the shares in an LLC.

Background

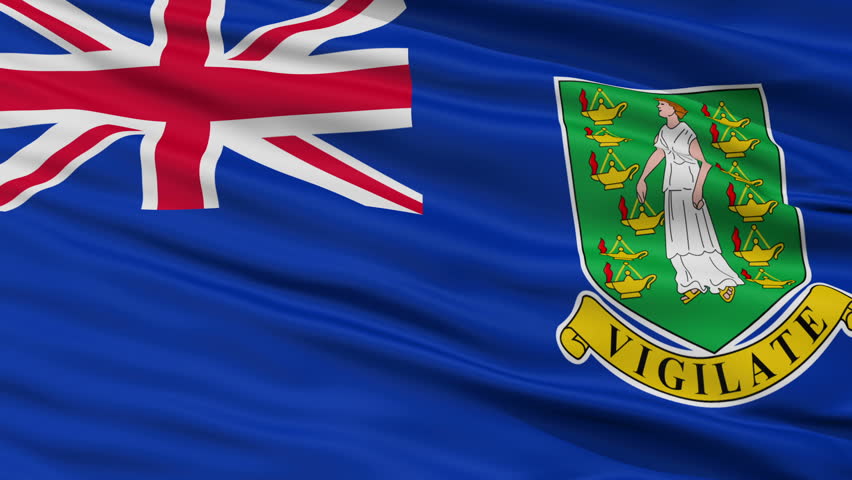

The British Virgin Islands (BVI) are located near Puerto Rico in the Caribbean. Since 1672, it has been a British territory. English is its official language.

Its political system is described as a “parliamentary dependency under constitutional monarchy” with an elected one house legislature and a premier. The monarch is England’s Queen Elizabeth II.

Currently the BVI are a British Overseas Territory which provides economic and political stability. Its low profile as an international financial center with a clean standing keeps it out of the blacklists issued by international watchdog organizations over offshore tax havens.

Benefits

A BVI Limited Liability Company (LLC) offers these benefits:

• Total Foreign Ownership: Foreigners may own all shares in the LLC.

• No Taxation: No taxes are levied against LLC’s. However, U.S. taxpayers and everyone taxed on worldwide income must declare all income to their governments.

• Limited Liability: Only contributions made to the share capital are exposed to the LLC’s creditors.

• One Shareholder/One Director: One shareholder is required who can be the only director for greater control.

• Confidential and Private: No public records exist containing the names of the beneficial owners, directors, or shareholders.

• Bearer Shares: The LLC can issue bearer shares for greater privacy.

• No Minimum Capital: There is no requirement for a minimum share capital.

• No Audits or Reporting: Financial statements do not have to be filed and no mandatory audits.

• U.S. Dollar: The U.S. Dollar is the official currency in the BVI.

• English: Since 1672, the BVI has been a British Territory with English as the official language.

BVI LLC Legal Matters

BVI Limited Liability Company (LLC) Name

Every LLC must choose a company name totally different from any other legal entity’s name in the BVI.

All of the different types of limited companies (limited by shares or guarantees) must use either the word(s) “Corporation”, “Limited”, “Incorporation”, “Sociedad Anonima”, or “Societe Anonyme” at the end of its name. In the alternative, one of these abbreviations may be used instead of the word or phrase: “Corp”, “Ltd” “Inc”, or “S.A.”.

Limited Liability

This type of company can issue shares while the shareholder enjoy limited liability. This means that the shareholders are protected from the debts and obligations of the LLC. This protection leaves the amount each shareholder contributed to the LLC’s share capital as the only funds creditors of the LLC may seize. The personal assets of each shareholder are not subject to seizure by the LLC’s creditors. However, if the shareholder failed to fully pay for his or shares in the LLC, that amount owed can be pursued by the LLC’s creditors.

The Act makes it very clear that the LLC has a separate legal identity from its shareholders. Therefore, a LLC creditor cannot sue a shareholder over the company’s debts. However, if the shareholder acted on behalf of the LLC when the company incurred the debt or liability, the creditor may file a lawsuit against the shareholder personally for the LLC’s debt or liability.

Confidentiality

The BVI requires confidentiality concerning details regarding the LLC’s beneficial owners, shareholders, and directors.

While the LLC must maintain a Register of Shareholders, a Register of Directors, and all Resolutions and Meeting Minutes; these are kept at the registered office with complete confidentiality and not made available to the public. However, shareholders have the right to inspect these documents at any time.

Neither the Register of Shareholders nor the Register of Directors are filed with the Registrar.

Registration

All documents necessary for incorporation must be filed with the Registrar of Companies (hereinafter, “Registrar”). These include the Memorandum of Association and Articles of Association.

Memorandum of Association

The Memorandum of Association must include the following information:

• Declaration that the company is a limited by shares company;

• The maximum number of shares to be issued; and

• The classes of shares (there may be more than one class) including the privileges, rights, and limitations attached to each share class.

The Memorandum can specifically provide for additional liabilities upon shareholders such as a requirement to contribute additional equity and specify when that liability must be met.

Shareholders

Only one shareholder is required. However, at the time of formation, a shareholder does not have to exist until after the incorporation until the appointment of its initial director.

Shareholder do not have to reside in the BVI and may be citizens of any country.

Bearer shares are permitted. However, the names and addresses of the actual owners must be maintained on record by a licensed custodian in his or her office. This record remains private and confidential.

Director

Only one director must be appointed to manage the LLC. Directors can be natural persons or legal entities residing (or registered) in any country and citizens from all countries.

A one shareholder LLC can have the same person or legal entity as the sole director for more control.

Officers do not have to be appointed.

Registered Office and Agent

Every LLC must appoint a local registered agent whose office may be the registered office of the LLC.

The registered agent maintains records of the directors, shareholders, resolutions, and meeting minutes which remain private and confidential and are never filed with the government nor made available to the public.

Minimum Capital

There is no requirement for a minimum authorized share capital. LLC’s must merely state how many authorized shares will be issued in its Memorandum.

Distributions

The Act requires every company to maintain a balanced sheet of net assets making the company constantly solvent with available cash flow after each distributions to its shareholders. When distributions are made, a resolution authorizing the distributions passed by a majority of the shareholders must include a statement of its solvency after distribution.

Taxes

LLC’s are exempt from all taxes including income, corporate, capital gains, estate, inheritance, gift, wealth, and stamp duty.

Note: U.S. taxpayers must report all global income to the IRS. The same for all others subject to worldwide income taxation who must disclose all income to their tax authorities.

Accounting

LLC’s are not required to file financial statements or audited account records with the government. Records must be maintained following normal international practices showing the financial situation of the company. Said records can be stored anywhere in the world.

Public Records

The only documents filed with the Registrar are the Memorandum of Association and the Articles of Association which do not contain the names of the beneficial owners, directors, or the shareholders.

Time for Incorporation

It may take from 3 to 5 business days to complete the incorporation process.

Shelf Companies

Shelf companies are for sale in the BVI.

Conclusion

A BVI Limited Liability Company (LLC) has these benefits: complete foreign ownership, no taxes, confidential, private, no minimum capital, limited liability, bearer shares, no audits or reporting, English is the official language and U.S. Dollar economy.