A Chile Limited Liability Company (SRL) provides foreigners with limited liability protection. Limited liability companies in Chile are known as a “Sociedad de Responsabilidad Limitada (SRL) which translates into “Society with Limited Responsibility”. Foreigners can own all of the shares in a SRL.

Another option for foreigners is to form a typical corporation called a “Sociedad Anónima” (SA) which translates into an “Anonymous Society”. However, the SA like a normal corporation is for larger investments with many shareholders and more complicated to form and requires additional accounting record keeping and audited account filings.

The third option is perfect for sole entrepreneurs who want their own company with no other shareholders. In 2007, Chile enacted a law allowing for a one shareholder corporation called Simplified Corporation (Sociedad por Acciones) known as a “SpA”. The procedures for setting up a SRL described below can mostly be used by a SpA except the Public Deed becomes a private document.

Background

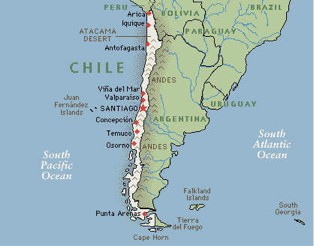

Chile is a long narrow country in South America. Its official name is the “Republic of Chile” or in Spanish is called the “República de Chile”. The Andes Mountains borders its east and on the west lies the Pacific Ocean. Peru borders the north while the northeast is bordered by Bolivia, the east by Argentina, and the south lies the Drake Passage.

Spain colonized Chile in the mid-16th century. Chile declared independence from Spain in 1818. Currently, its political system is described as a “unitary presidential constitutional republic” with an elected president and a two house National Congress.

Today, Chile has one of the most stable governments and prosperous economy in all of South America. It ranks high regarding business competitiveness, human development, income per capita, economic freedom, state of peace, low percentage of corruption, globalization, and democratic development. Chile was a founding member of the United Nations.

Limited Liability Company (SRL) Benefits

A Chile Limited Liability Company (SRL) offers these type of benefits:

• All Shares Owned by Foreigners: Al the shares in a SRL may be owned by foreigners.

• Limited Liability: Shareholders’ liabilities limited by their share capital contributions.

• Two Shareholders: The minimum requirement is two shareholders to form a SRL.

• One Director: The shareholders can appoint only one director.

• No Reporting: SRL’s do not file audited accounts or financial statements with the government.

• No Minimum Capital: SRL’s have no required share capital minimum.

Limited Liability Company (SRL) Name

Company names must never be exactly alike or too similar to any other legal entity’s company name in Chile. Before registering, a company name check for the availability of proposed company names is performed with the Companies Registry.

It is recommended to have up to three alternative company names in case the first two are rejected. The reasons for rejection include being too similar to an existing registered company name, or it implies state sponsorship, or uses words requiring special licenses like: “Bank”, “Group”, or “Insurance”.

The Spanish abbreviation “SRL” must be included at the end of the company name.

Limited Liability

A shareholder has his or her liability limited to the contribution towards the share capital.

Formation Procedure

The following steps must be fulfilled in order to form a SRL:

• Execute a Power of Attorney in English and Spanish for the formation company to act on behalf of the applicant.

• Sign a prepared Public Deed which forms the company.

• The Articles of Incorporation are filed with the Commerce Register (Conservador de Comercio).

• The company name and details are published in the Official Gazette (Diario Oficial).

• The Chilean IRS (Tax Agency) provides the company with an identification tax number.

• Upon approval of the application, the company is registered in the Commercial Registry and a Certificate of Registration is sent by email.

• At this point the company is ready to conduct business.

What the Company Formation Entity does

The company formation entity does the following services:

• Prepares the Public Deed and the Bylaws (Memorandum) for the SRL.

• Then signs them in front of a notary in the capital city of Santiago.

• The company is then registered with the Commercial Register in Santiago by filling in and signing registration forms and paying the filing fees.

• The Articles of Incorporation are notarized and recorded in a Public Deed with an excerpt published in the

Official Gazette and with the Commercial Registry.

• Obtains Identification Numbers for the foreign shareholders (RUT).

• Obtains the Company Identification Number (RUT).

• Receives the Certificate of Registration.

Shareholders

There is a minimum requirement for two shareholder to form a SRL. Shareholders can be citizens of any country residing anywhere. They may also be individuals or legal entities.

The maximum number of shareholders is 50.

Directors

There are no requirements regarding the number of directors to manage a SRL. The two (or more) shareholders can decide on one of them to be the only director responsible for managing the company. They may choose to have three or more directors comprising a board of directors. However, selecting two or even numbers of directors can result in tie votes which would be impractical for getting things done.

They can also agree on an outside third party director to manage the company. This could be desirable when none of the shareholders have the knowledge or experience running a company.

Share Capital

There is no required minimum share capital.

Registered Agent

A local registered agent must be appointed. The agent’s office address can become the registered office address for a SRL.

Accounting

SRL’s are not required to file financial statements or perform audits with the government.

Taxes

In 2017, the income tax for business profits involving non-resident foreign shareholders is 35%. This is enforced by a dividends withholding tax of 35% for distributions to foreign shareholders.

Domicile and resident shareholders are subject to a 25% income rate on their distributions from the company’s profits.

Note: U.S. taxpayers must declare all world income to their IRS as do everyone residing in countries taxing global income who must report all income to their tax authorities.

Formation Time

Expect up to one month for the registration and approval from the government to form a SRL in Chile.

Conclusion

A Chile Limited Liability Company (SRL) contains these benefits: complete foreign ownership, limited liability, two shareholders, one director, no minimum share capital, no audits or account filings.