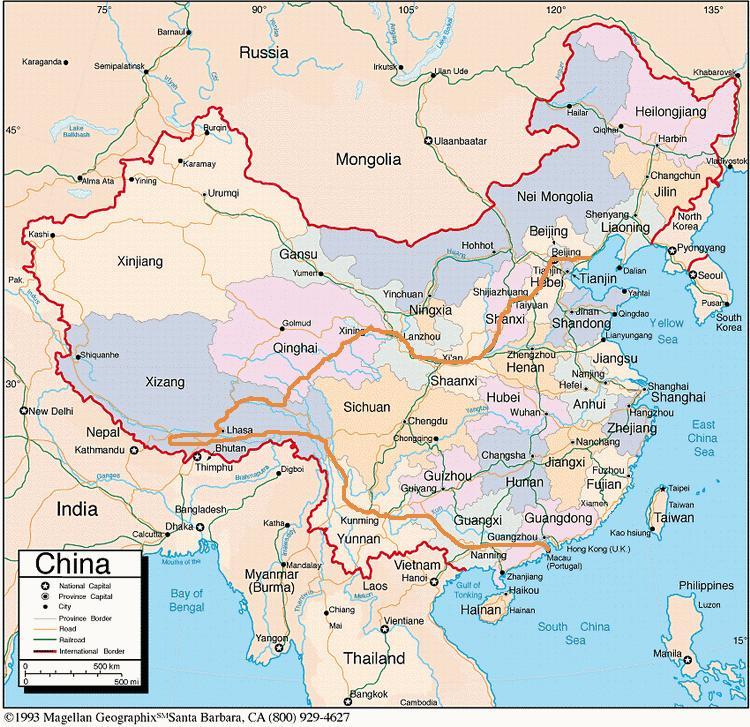

China, is officially called the “People’s Republic of China” (PRC), located in East Asia is a unitary sovereign state. It’s population is over 1.382 billion, making it the world’s most populous country. The Communist Party of China controls the state. Its capital is Beijing. It exercises jurisdiction over mainland China and two self-governing special administrative regions (Hong Kong and Macau), and claims sovereignty over Taiwan. China is a world superpower. China’s land area covers approximately 3.7 million square miles (9.6 million square kilometers) making it the world’s second largest state.

China recently emerged as a popular jurisdiction with which to incorporate. Many company owners from the United States have sought ought this region to form their business entities because of the various benefits offered by China for those incorporating there.

One popular incorporation strategy of choice is the Wholly Foreign Owned Entity (WFOE). The Chinese government establishes corporate legislation under its Chinese Company Law. WFOE’s fall under this category, and are classified as companies that have fully foreign shareholders, and fully offshore business owner(s). In a WFOE, limited liability is established by the amount of capital placed into the business. Capital can be defined as either assets or cash, and the total value of this combination defines the company’s liability.

Benefits

China offers several benefits to its foreign owned corporations including:

• Few Limits on Types of Business: China is friendly to foreign investors, especially from the U.S. Very few limits are placed on the types of business activities foreign owned corporations can engage in.

• Easy Incorporation: Foreigners do not have to travel to China to form corporations.

• No Resident Director: To make incorporation easier, there is no requirement to appoint a resident director, or resident manager, or resident partner to make the incorporation application.

• Reasonable Tax Rates: The normal corporate tax rate is 25% and the withholding tax is 10%.

• One Shareholder: Only one shareholder is required to incorporate. A minimum of one director is also required.

• Multi-Currency Bank Accounts: China allows multi-currency bank accounts for corporations. This allows conducting international business in most major foreign currencies.

Corporate Name

Chinese corporations must pick a unique name that is not similar to other corporations already in existence. It is recommended to submit a total of three desired names in order to speed up the incorporation process.

Office Address and Local Agent

In China, corporations are expected to appoint a registered agent to assist them with the incorporation process (although not legally required). An offshore company incorporating in China must also possess a local address for communication with the Chinese government.

A registered agent is recommended to help with some of the following steps:

- First, ensure that the type of business to pursue in China can qualify for approval by the Chinese government as a foreign investment. Not all types of businesses will be approved or accepted in China, this is where a local registered agent can be of great assistance to make sure the business strategy is completely legal before applying to incorporate.

- To incorporate in China, the owner of the corporation must provide the necessary documents from its home region demonstrating that it is an existing corporate entity. Along with this, proof that the investor or the individual is allowed to act on behalf of the foreign company or corporation. Lastly, the financial capabilities of the business in its home country also must be documented.

- One important step the corporation must complete in China that is not common to other jurisdictions offering offshore incorporation is to obtain approval of one’s business enterprise from the appropriate government authority. This step is required for registration.

Shareholders

To incorporate in China, corporations are expected to have at least one shareholder.

Directors and Officers

Corporations must have at least one director to incorporate in China. Resident directors are not required.

Authorized Capital

In China, the minimum authorized capital is 100K RMB.

Taxes

The corporate tax rate in China is 25%, and withholding taxes are 10%.

Annual Fees

Annual renewal fees in China typically cost 50K RMB.

Public Records

Nominee shareholders and directors are available in China which are options for privacy and confidentiality. China keeps a list of this information, which is available on public record, but the information that needs to be shared and documented for the public record are minimal.

Accounting and Audit Requirements

Companies in China are expected to maintain business and financial records for monthly, quarterly, and annual evaluations.

A few other business documents also need to be submitted to obtain Chinese Government Approval. This documentation is made up of:

–A budget of salary and benefits. Salaries and benefits for the employees that will work for the company need to be provided and operate alongside Chinese expectations. All of these items will be included in the initial investment. This information must be provided in Chinese.

–Other documentation may be required depending on what the general concept and operating strategy of the business is. Some types of businesses require more documentation than others.

Annual General Meeting

An annual general meeting is required of corporations in China.

Time Required for Incorporation

Obtaining approval for a new corporation can take up to two to five months, mostly depending on where the company is incorporating and how large the company is. Some of the investor fees can vary region by region in China as well.

Shelf Companies

In China, corporations can opt to use shelf companies in order to complete their incorporation faster.

To speed up the process of forming the WFOE in China, investors often create a special purpose company to have that entity act as the Chinese investor. In fact, this process is so common, those regulating corporate formation in China are entirely used to seeing this action take place. Still, these Chinese regulators will ensure that the offshore investor exists as a real business in operation. Many investors form these types of companies in Hong Kong since the tax benefits for the corporation are increased with this move.

Conclusion

Gone are the old communist closed society days when foreigners could not do business in China. While not being as easy to form new corporations as in popular tax haven countries, the opportunity exists to do business in China. Some of the benefits for incorporating in China include: one shareholder can form a corporation, most industries are available for corporations owned by foreigners to get involved in, while no local resident director is required it is recommended to smooth the incorporation process, the tax rates are reasonable, and the availability of multi-currency bank accounts makes processing billing and payments much easier.