A Comoros Islands Limited Liability Company (LLC) offers foreigners complete tax exemptions of all of their income is generated outside of the Comoros Islands. Limited liability and only one shareholder/manager for greater control are also additional benefits. Foreigners can all of the shares in their LLC.

Background

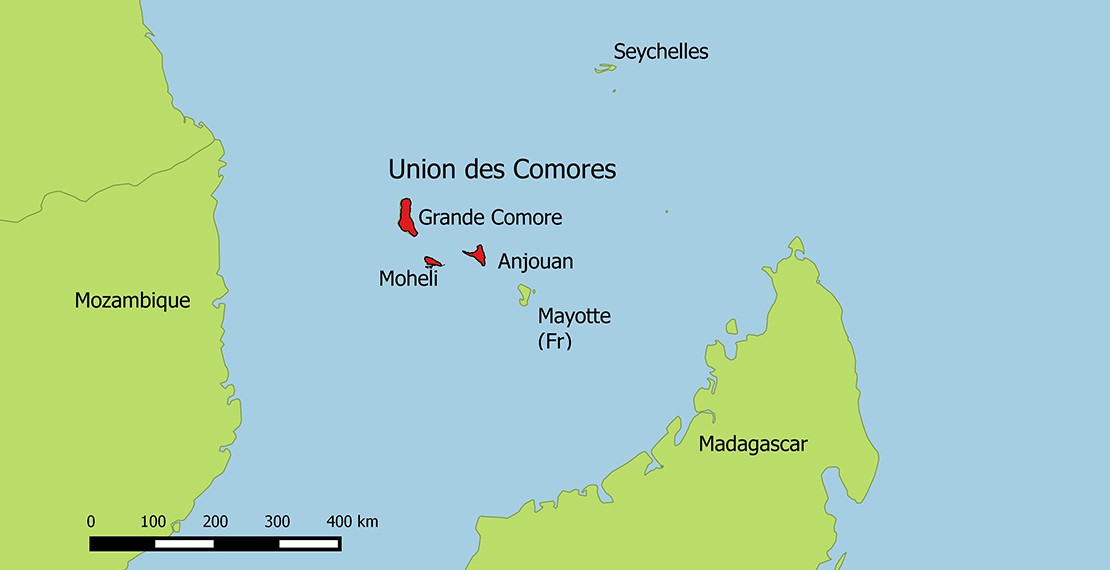

The Comoros Islands are located between Mozambique and Madagascar near the African coast. The Republic of Comoros consists of three islands: Grand Comore, Moheli, and Anjouan.

Since the Middle Ages, Islam dominated the islands. The French established a colony in 1841. In the early 1900’s, the islands were under the administration of Madagascar under French rule.

The population is overwhelming Sunni Muslim. The three official languages are: Arabic, French, and Shikomoro (Arabic and Swahili blend). Independence was gained in 1975 from the French. The Union of Comoros with a new constitution was created in 2001.

Its legal system is a mix between the French Civil Code of 1975 and Islamic law. Their judiciary is the Common Court of Justice and Arbitration.

The General Commercial Law governs all domestic corporations and companies. However, the Commercial Companies and Economic Interest Groups Law went into effect in 2014 which made their commercial laws more flexible in order to promote international investments for their economic development. Since 2014, companies can be incorporated as sole proprietors, limited liability companies, and partnerships.

Benefits

A Comoros Islands Limited Liability Company (LLC) obtains the following benefits:

• Totally Foreign Shareholders: Foreigners can own all of the LLC’s shares.

• Complete Tax Exemptions: As long as all of the income generates outside of its borders, no corporate or income taxes are imposed. However, U.S. taxpayers and everyone subject to global income taxes must declare all income to their government’s tax authorities.

• Privacy: Shareholders’ names never appear in any public records.

• Limited Liability: A shareholder’s liability is limited to his or her contribution to the share capital.

• Low Minimum Capital: Currently, the minimum authorized share capital is $1,763 USD.

• One Shareholder and One Manager: Only one shareholder and one manager are required to form the LLC where both can be the same person for greater control.

Comoros Islands Limited Liability Company (LLC) Name

The LLC must choose a company name completely different from any other business entity name in the Comoros Islands. Verification of a proposed company name can be obtained from the government Registry for free.

Since French is one of its three official languages, the LLC’s name can end with the words “Société à Responsabilité Limitée” or its abbreviation “SARL” which in English means a “Society with Limited responsibility”.

Limited Liability

Shareholders’ liabilities are limited to their contributions to the share capital.

Registration

A notarized copy of the company’s Articles of Association must be filed with the Registry.

Then, file the company’s Bylaws with the Ministry of Finance.

Finally, file documents with the Commercial Court. The following information will be required:

• List of the managers who have the power to act on behalf of the company;

• Office lease agreement;

• Declaration of capital;

• Copy of the Bylaws; and

• Manager’s criminal records investigation report.

Shareholders

A minimum of one shareholder is required to form the LLC. Shareholders do have to reside in the Comoros and they can have citizenship with any country.

Shares can be issued as registered or preferential with or without voting rights.

Bearer and nominee shares are not allowed.

Managers

At least one manager is required to be appointed to form the LLC. The manager can be a natural person or a legal entity based in and residing in any country with citizenship from any country.

Minimum Share Capital

The minimum share capital for a LLC is 750,000 KMF ($1,763 USD as of July, 2017).

Taxes

The Comoros Islands taxation system is based on the French. The General Tax Code provides for a 35% corporate tax rate on Comoros source income. Companies earning more than 500 million KMF pay a 50% rate.

However, foreign source income is not taxed. Therefore, LLC’s whose sole sources of income are from outside of the Comoros Islands do not pay any taxes.

Note: U.S. taxpayers and all others subject to world income taxation must report all income to their tax agencies.

Accounting

Acceptable international standard bookkeeping and accounting practices are required. There are no required audits.

Every domestic company is required to register with the Ministry of Finance in order to receive a tax identity number for tax registration and tax return filings.

Annual tax returns are required along with an annual financial statement verifying where all income came from and that no taxes are due. Since the Comoros Islands are a territorial tax based country, only income generated within its borders are subject to corporate and income taxes.

Annual General Meetings

An annual general meeting of the shareholders is required, but the meeting can take place anywhere in the world.

Public Records

Since the names of the shareholders are not filed anywhere with the government, there are no public records revealing their identities.

Managers’ names and details are required to be filed and kept up to date with the government so their names are part of the public records.

Time for Formation

The entire process for forming and registering the LLC may take up to one week.

Shelf Companies

Shelf companies are not for sale in the Comoros Islands.

Conclusion

A Comoros Islands Limited Liability Company (LLC) has these benefits: no taxes, complete ownership by foreigners, privacy, one shareholder who can be the only manager, low minimum share capital, and limited liability.