A Cook Islands Foundation offers traditional foundation law with added benefits. These include added asset protections including making it more difficult for a founder’s creditors to challenge assets transfers and the validity of the foundation.

The Cook Islands Foundations Act of 2012 (the “Act”) governs the formation, registration, allowed activities, and termination of their foundations.

Foreigners can create a foundation and only have foreign beneficiaries and assets in any other countries.

Background

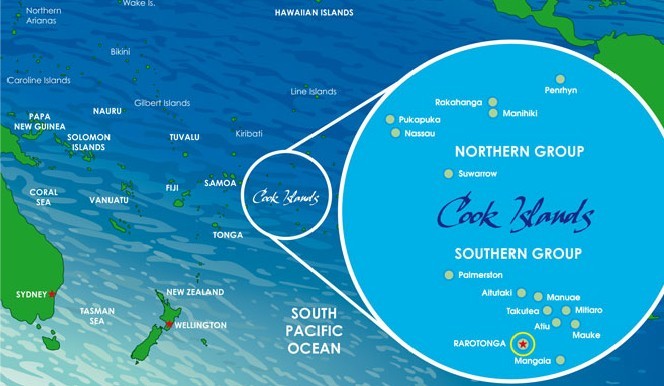

Located in the South Pacific Ocean, the Cook Islands are an Associated State and an area of the Realm of New Zealand. However, the Cook Islands were granted internal self-government in 1965 with New Zealand providing military defense and maintaining foreign relations.

Benefits

A Cook Islands Foundation can enjoy the following benefits:

• Totally Foreign: The law allows foreigners to create foundations with beneficiaries and assets located in any country.

• Privacy: The names of the founder, beneficiaries, council members, and enforcer are never in any public records. The assets descriptions and locations are not included in the public records.

• Tax Free: Foundations and beneficiaries are not subject to any type of taxes. However, beneficiaries who are U.S. taxpayers and others residing in countries taxing global income must report all income to their governments.

• Asset Protection: Other countries laws threatening the protection of assets will not be recognized. Creditors will have a difficult time challenging the foundation or the transfer of assets to it.

• Estate Planning: The laws do not recognize other countries laws regarding forced heirship. Foundations have perpetual lifespan allowing a family’s estate plan to last for many generations.

• No Minimum Capital: There are no minimum capital requirements.

• Fast Formation: Preparation and registration of documents can occur within two days.

• English: As an Associated State of New Zealand, their official language is English.

Cook Islands Foundation Name

A foundation must select a unique name so as not to conflict or cause confusion with the names of any other legal entities in the Cook Islands.

Foundations must use a name ending with the word “Foundation” so third parties know that it is a foundation and not a trust, company, or corporation.

Facts about a Foundation

A foundation is a separate legal entity like a company or a corporation and unlike a trust which is a legal agreement (contract) between a settlor and a trustee. Therefore, foundations can hold title to real property, physical objects, and be able to file lawsuits and be sued in a court of law.

While a foundation resembles a corporation, it does not have shareholders. Similar to a trust, a private foundation has beneficiaries.

Nominee founders are prohibited.

No minimum capital requirement, but founders must endow funds and/or assets to the foundation. Third parties may donate assets without being founders.

Beneficiaries are not a requirement, but foundations must have a purpose which can be charitable or non-charitable. A purpose can be to benefit a natural person or based on specific purposes or both.

Depending upon its stated purposes, a foundation can engage in commercial activities directly or through a legal entity if related to its purposes.

Duration

Foundations have no time limits regarding their lifespan.

Asset Protection

The Act specifies that the only jurisdiction for a foundation is the Cook Islands. This forces creditors to file lawsuits against foundations in the Cook Islands High Court.

The Act also will not recognize foreign court judgments or court orders including those associated with a marital divorce.

In addition, the Act places several barriers to creditors filing lawsuits against foundation in the High Court, such as a 2 year statute of limitations to file the lawsuit. This 2 year limit begins when a specific asset in question was transferred to the foundation.

Then, a creditor must prove his or her claims “beyond a reasonable doubt” which is the highest standard of proof in the U.S. and other countries. Also, there are no punitive damages which can be added to a creditor’s claims. Of course, the foundation has the right to appeal a High Court’s unfavorable decision.

Estate Planning

The Act prohibits other countries laws of forced heirship where an estate can be forced to include heirs in which the deceased willfully left out. This could include an ex-spouse, disinherited children, offspring from women who were not married to the deceased, and others a foreign law may require to be included as an heir to an estate.

The only manner in which a creditor can prevail in a lawsuit before the Cook Islands High Court against a foundation is to prove beyond a reasonable doubt that the founder intended to defraud the creditor or was insolvent when the founder’s asset (specific property) as transferred to the foundation. This is a very heavy burden.

In addition, the 2 year statute of limitations barrier is mentioned above.

Registration

Every foundation must have a written legal instrument containing basic information such as: the foundation’s name, purpose, name and address of the local registered agent. This is the only instrument filed with the Registrar.

Foundation Rules

Foundations need to create written rules which comply with the Act. Besides from the basic rules required by law, the foundation has great flexibility with what the rules state. Generally, the rules describe how the foundation operates, who the current and future beneficiaries are (or will be) and how they benefit. These rules are private and shall not be filed with the government. They are to be held by the registered agent and are not available to the public.

In addition, the rules should describe how council members will be appointed, their duties, functions, and powers. If an enforcer is appointed, what powers he or she will have. Description of how future endowments of assets will be received and how assets are distributed to the beneficiaries. Finally, how the foundation is wound up and dissolved and where the assets are to be distributed.

Founder

Founders can be from any country. They may be natural persons or legal entities. They create the foundation rules, and endow funds and assets to the foundation.

Council

Council members may be natural persons and/or legal entities. Members can be citizens of and reside in any country.

The council is not a fiduciary.

Beneficiaries

Beneficiaries may be citizens of and reside in any country.

Foundation beneficiaries have no legal or beneficial interest in the assets. All assets are owned by the foundation just like a corporation.

The council owes no fiduciary duties to the beneficiaries,

Enforcer

A foundation can appoint an enforcer to ensure that the council fulfills its duties as set forth in the foundation rules. An enforcer is similar to a protector in a trust. The foundation rules should describe the duties, functions, and powers of the enforcer including how he or she is appointed, removed, and compensated.

Registered Agent and Office

Foundations must appoint a local registered agent and maintain a registered local office which can be the registered agent’s office.

The registered agent must possess the following:

• Copy of the foundation’s rules;

• A register containing the names and addresses of the council members;

• All powers exercised by the council members by means of a written resolution.

• Enforcer’s details including date when appointed; and

• Financial records showing the foundation’s current financial position.

All of these information remains private and not accessible by the public.

Taxes

Foundations are free from corporate, income, capital gains, gift, inheritance, and estate taxes and stamp duty. Foundation distributions to the beneficiaries are not taxable. However, they may be taxable in the beneficiaries’ home country as some tax worldwide income requiring their taxpayers to declare all income to their tax authorities.

Public Records

The names of the founder, council members, enforcer, and beneficiaries are not included in any public records. The foundation’s assets are not described or their locations named in any public records.

Time for Formation

The time it takes for the preparer to create the foundation rules, instrument for registration is up to the preparer. As far as registration, all required documents can be filed in one day.

Form a Cook Islands Foundation Conclusion

A Cook Islands Foundation enjoys the following benefits: totally foreign, privacy, no taxes, fast formation, no minimum capital, strong asset protection and estate planning, and English is the official language.