A Cook Islands Limited Liability Company (LLC) follows the LLC laws in the United States. In addition, Cook Islands legislation added benefits to their LLC’s not seen in the U.S.

Their International Limited Liability Companies Act of 2008 (the Act) governs LLC’s formation, provides asset protection benefits, and their termination.

LLC’s are a hybrid of a corporation with a partnership protecting members from debts of the LLC. The LLC is a separate legal entity from its members and managers. Lawsuits against a member will not have any effect on the LLC and its assets. Foreign court judgments, orders, and injunctions against a member cannot be enforced against the LLC and its assets.

Foreigners can own 100% of the membership shares.

Background

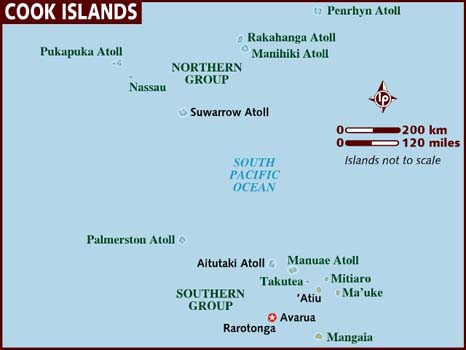

The Cook Islands are located in the South Pacific near New Zealand with whom they are in association with while still being a self-governed nation. New Zealand handles their foreign affairs and island’s defense. It is regarded as a constitutional monarchy with England’s Queen Elizabeth II as its official monarch. English is spoken by over 85% of its population and is one of its official languages.

Benefits

A Cook Islands Limited Liability Company (LLC) can take advantage of the following benefits:

• Total Foreign Ownership: Foreigners can own all of the membership shares.

• No Taxes: LLC’s pay no taxes of any type in the Cook Islands. However, U.S. residents must disclose all global income to the IRS as do taxpayers in countries taxing world income with their tax authorities.

• Privacy: There are no public records regarding beneficial owners, members, managers, and financial or accounting records.

• Asset Protection: The laws make it very difficult for creditors in any country from challenging the LLC’s assets. Even successful claims against one member will not affect the LLC’s assets.

• English: More than 85% of the population speaks English which is one of its official languages.

Cook Islands Limited Liability Company (LLC) Name

LLC’s must choose a company name different from any other legal entity’s name in the Cook Islands.

LLC’s must include the words “Limited Liability Company” or its abbreviation “LLC” at the end of their company name.

Registration

The registered agent must submit a document to the Registrar containing the following information:

• LLC’s name;

• LLC’s registered agent’s name and address; and

• LLC’s registered address.

Asset Protection

The Act introduced unique asset protection benefits for their LLC’s including:

• Section 45(6) specifies that the only remedy for a creditor against a LLC’s member’s interests is to apply for a charging order from the Cook Islands Courts.

• Section 45(5) prevents creditors from seeking aggravated, punitive, or exemplary damages in an application for a charging order.

• Section 45(13) states that foreign court orders and judgments will not be recognized.

• Section 45(14) provides that any foreign court proceedings and orders against a LLC and its members to seize any assets held by the LLC will not be recognized or enforced.

• Section 45(7) makes it clear that even if a charging order is granted in favor of a creditor; it shall not constitute a lien against a member’s interests in the LLC, and it will not provide the creditor with any rights of assignment to the LLC’s members rights.

• Section 45(8) also makes it clear that the charging order creditor cannot interfere with the management of the LLC including sale of assets, cannot seize any assets of the LLC, cannot restrict the business of the LLC, and cannot dissolve the LLC.

In essence, a foreign creditor can file a lawsuit in the Cook Islands against a LLC member for debts owed. However, prior foreign court proceedings, judgments, and orders will not be recognized. If the creditor prevails, the charging order will be against the individual member and not against the LLC or any of its assets. This results in a personal charging order against the individual member and any assets he or she may have in the Cook Islands which are not part of the LLC’s assets until they are distributed to the individual member.

In addition, the Act sets a two year statute of limitations for creditors to file claims challenging transfer of specific assets to the LLC. As long as the donor was solvent after transferring assets to the LLC, claims against the LLC’s assets will be barred.

Members

The minimum number of members in order to form a LLC is one. Members can be natives and residents of any country. They can also be either natural persons or corporate bodies.

Managers

Only one manager is required. The manager can be a citizen of and reside in any country. Managers may be natural persons or corporations.

Registered Agent

LLC’s must appoint a local registered agent. However, they do not have to maintain a local registered office, A LLC’s main office can be located anywhere in the world.

Taxes

There are no taxes of any kind levied upon LLC’s. The members will not be subject to income taxes when receiving income or assets from the LLC.

However, United States residents and all taxpayers subject to worldwide income taxation must disclose all income to their tax authorities.

Meetings

Annual meetings are required for the membership, but can be held anywhere.

Manager’s meetings can also be held anywhere.

Officers

Officers such as a company secretary are not required. If any are appointed, they can be citizens of and residing in any country.

Audits and Accounting

There are no requirements to conducting audits or filing accounting records or financial statements with the government.

Public Records

The names of the beneficial owners, members, and managers are not included in any public records. Financial statements and accounting records are not filed with the government keeping them private.

Time to Establish

Most LLC’s can be formed in three business days.

Form a Cook Islands Limited Liability Company (LLC) Conclusion

A Cook Islands Limited Liability Company (LLC) can use any of the following benefits: complete ownership, no taxation, privacy, asset protection, and English is one of its official languages.