Denmark has a law creating a Private Limited Company (PLC) in Danish called “Anpartsselskab” (ApS) established under its Danish Companies Act of 2010. This is the most popular small business type used to do business in Denmark or as an offshore vehicle. The PLC is similar to most Limited Liability Company (LLC) laws because it limits the liability of its shareholders.

Background

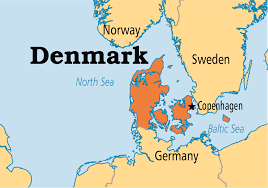

Denmark is a Nordic and Scandinavian country located in Europe bordered by Germany, Norway, and Sweden. It is officially called the Kingdom of Denmark. Its capital is Copenhagen and the official language is Danish with German and English spoken by many of its citizens. Its political system is a unitary parliamentary constitutional monarchy with a democratically elected parliament with a prime minister and a monarch. Denmark has a civil law system based more on customs than traditional common English style case law seen in the United Kingdom and the United States or codified laws seen in Germany and France.

Denmark Benefits

A Denmark Private Limited Company (PLC) has several benefits including:

• Limited Liability: Shareholders are not personally liable for the obligations of the company, but are liable only to the extent of their contributions.

• Few Restricted Business Activities: There are only seven types of business activities which a PLC cannot engage in.

• One Shareholder: A minimum of one shareholder residing in any country is required to form a LLC.

• EU Membership: Denmark is a member of the European Union (EU) opening a wider market for a PLC to do business.

• English: English is spoken by many Danish citizens.

Restricted Business Activities

A Denmark Private Limited Company (PLC) can conduct business activities in a variety except it is prohibited with engaging in the following types of business activities: assurance, banking, collective investment schemes, fund management, insurance, reinsurance, trust management, and trusteeship business.

Registration

A PLC must register at two government agencies: The Memorandum and Articles of Association are registered with the Companies Registry along with registering at the Danish Commerce and Companies Agency as well.

There are templates of the Articles of Association available from the Danish Business Authority which may be adopted with specific information regarding the individual company to supplement it.

Articles of Association

The articles of association shall include clauses about:

1) the company’s name;

2) the address of the registered office (head office) in Denmark;

3) the purpose for the company;

4) the amount of the share capital;

5) the shareholders’ voting rights;

6) the management of the company;

7) the accounting fiscal year of the company; and

8) the appointment of the auditor.

Memorandum of Association

The Memorandum of Association shall include provisions about:

1) the names and addresses of the promoters, the members of the management board and the auditor of the company;

2) the allotment of shares to the individual promoters;

3) the shares issue price; and

4) the company formation costs which the company is to discharge.

Company Name

PLC’s must pick a company name not resembling another Danish corporation or company name. Submitting more than one name for approval is recommended to facilitate the process if the first suggestion is rejected.

Company names can be in English but must use either the word “Anpartsselskab” or the abbreviation “ApS” at its end.

Office Address and Local Agent

Every PLC must have a local office address along with a local registered agent who can provide his/her office as the registered office of the PLC.

Shareholders

A minimum of one shareholder is required to for a PLC. Nominee shareholders are allowed for privacy.

Bearer shares are prohibited. A PLC can issue shares with or without voting rights, preference shares, normal shares, and redeemable shares.

Limited Liability

Shareholders are not personally liable for the obligations of the company, but are liable only to the extent of their contributions.

Directors

At least one local director must be appointed who must be a European Union (EU) resident. Other directors can reside in and be a citizen of any country, as long as; the majority of directors are EU residents. Corporations cannot be directors. Nominee directors are permitted.

Authorized Capital

The minimum authorized share capital is DKK 50,000 (approximately 6,700 Euros).

Taxes

Denmark has a sliding taxation rate from 0% to a maximum of 22%. Denmark has double taxation treaties with over 26 countries so their taxpayers will not pay taxes on the same income source twice.

Danish companies are required to file annual tax returns.

Public Records

Everything which is filed with the Danish government is accessible by the public. However, nominee directors and shareholders are allowed for privacy.

Accounting and Audit Requirements

There are no mandatory audits of a Danish PLC.

Annual General Meeting

Annual general PLC meetings are required and can be held in any country.

Time Required for Registration

A PLC can be registered in 2 to 3 business days.

Shelf Companies

Shelf companies are available to purchase in order to have faster registration.

Conclusion

A Denmark PLC has several benefits including: limited liability for its shareholders, only seven business activities are prohibited for a PLC, only one shareholder residing anywhere is required to form a PLC, Denmark is a member of the EU, English is spoken by many citizens in Denmark.