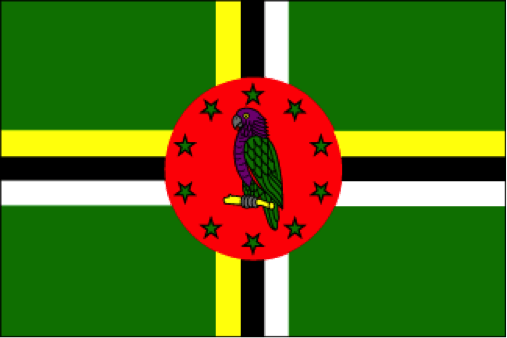

Dominica is a medium-sized island that can be found in the Eastern Caribbean, between Martinique, on its south end, and Guadeloupe, on the north side. Known officially as the Commonwealth of Dominica, its growing population now boasts of about seventy-thousand people. Most of the individuals living in Dominica reside in its capital city of Roseau. One of the best things about the island is its central location in the Caribbean, which makes it a fantastic access point to the islands surrounding it.

In Dominica, English is the official language. This helps to make it an easier jurisdiction for many business owners to communicate. It also offers many business friendly options to offshore investors from the United States and abroad, such as the ability use the company to open bank accounts in many countries in the Caribbean, Europe, Asia, and others. Furthermore, many offshore investors have found that Dominica has been an ideal place in which to form corporations since it offers much to offshore company owners looking to incorporate in a business friendly, convenient and beneficial jurisdiction.

Dominica provides several different opportunities that allow business owners to succeed and hold assets securely and privately. Stability in government is certainly a plus, as the Democratic government in Dominica is not only strong but interested in allowing for offshore investors to incorporate on its shores. For example, Dominica’s laws focus on offering offshore corporations both privacy and security when performing business in its jurisdiction.

Furthermore, to incorporate in Dominica typically costs far less than incorporating a company or limited company in other jurisdictions. Forming an offshore bank account in Dominica is also traditionally less costly as well.

Corporate Privacy and Asset Protection

Dominica bases its offshore legal regulations on the International Business Companies Act of 1996. By using the IBC Act to base its legislation standards, many benefits are thus offered to offshore corporations that are formed in this jurisdiction. Some of these benefits focus on corporate asset protection strategy as well as privacy for those owning and managing the offshore corporation. Furthermore, the incorporation process itself in Dominica is incredibly smooth and organized, granting a good deal of confidentiality to shareholders because of the IBC Act, section 12 as you will see next.

There exists a certain level of legislative importance around the IBC Act, section 12, for corporations forming in Dominica. This importance has to do with the confidentiality promised to owners, officers, directors, and the like participating in offshore corporations in this jurisdiction. Privacy is guaranteed unless something occurs, such as potential criminal activities. If so, evidence of such must be submitted and a court order must be issued. In general, though, the Beneficial Owners, or shareholders, of a Dominica corporation are not shared with the public. With the benefits of privacy, as well as speedy and an affordable incorporation process, Dominica emerges as a beneficial place for investors to form an offshore corporation.

Benefits of Incorporating in Dominica

There are several benefits open to limited company (corporation) owners choosing to incorporate in Dominica. These include:

- There is no capital gains tax applied to offshore corporations in Dominica.

- There is no estate tax required of offshore corporations in Dominica.

- No death tax (estate tax) is applied to offshore corporations in Dominica.

- Dominica offers a good deal of freedom as well to the company owners wishing to incorporate in this jurisdiction. For example, an IBC’s movement of funds is free from exchange controls.

- More freedom is also provided to offshore corporations in Dominica as far as the selection of directors and shareholders is concerned. For instance, directors and shareholders may be private individuals or business entities. So, a corporate director can simply be another company.

- Furthermore, there is no requirement for residency for the directors and shareholders. So, these individuals or entities can reside anywhere in the world.

- Dominica also offers an opportunity for corporations when dealing with share issue, as these can be assigned with or without Par Value.

- Dominica has no requirement for the corporation to hold directors’ meetings.

- Dominica offers many tax advantages to corporations. However, those offshore corporation owners located in the US need to remember that they are still taxed on all income they earn across the world. So, be sure to have a CPA file the proper tax returns, if required.

How to Incorporate in Dominica

A business owner wishing to incorporate in Dominica must abide by the following steps:

- First, the company must be registered through an agent (such as this one). You will provide your agent with a unique name for your company. Your agent will reserve that potential name. This process needs to be completed through the government office and is typically reserved for less than a day. Your Dominica agent has access to an online database to search for unique company names and will verify it.

- Second, the company needs to work with an approved specialist (such as this one) to complete the articles of incorporation as well as the list of directors. The Company Act present in Dominica also requires a company to make by-laws, but this can be done at another time. Once the articles of incorporation and directors list are complete, the company can then have the specialist submit the registration to the government office responsible for filing companies.

- Third, the company, after completing registration, will be given a Certificate of Incorporation from the government filing office.

- Fourth, the company must submit the certificate of incorporation to the Tax Authority to receive a taxpayer ID, as well as register for VAT if the company makes more in Dominica than EC 120,000 yearly. To complete this registration process, a form needs to be completed. Once this step is done, the tax ID is released immediately.

- Last, to complete the incorporation process if the company has Dominica employees, the company or limited company must register as an employer with the Social Security Institute. The corporation then gets an employer number for social security and needs to verify social security numbers of all employees when hiring them.

With so many benefits and an easy incorporation process that is both efficient and affordable, it is easy to see why many savvy business owners select Dominica as a jurisdiction with which to incorporate. Not only does Dominica offers many tax benefits and corporate freedom to its offshore businesses, but it also provides substantial privacy and confidentiality benefits to both directors and shareholders. Furthermore, with a stable and democratic government, and a legal and regulatory process that is friendly to offshore corporations, more and more international investors are likely to flock to this region to incorporate.