A Dominica International Business Company (IBC) offers a flexible company structure with statutory privacy laws for its beneficial owners and shareholders.

The International Business Companies Act of 1996 (the “Act”) is a progressive law offering fast incorporation and privacy with a 20 year tax exemption. This Act governs the formation, registration, acceptable activities and dissolution of IBC’s.

Foreigners are encouraged to incorporate and can own all the shares of an IBC.

Background

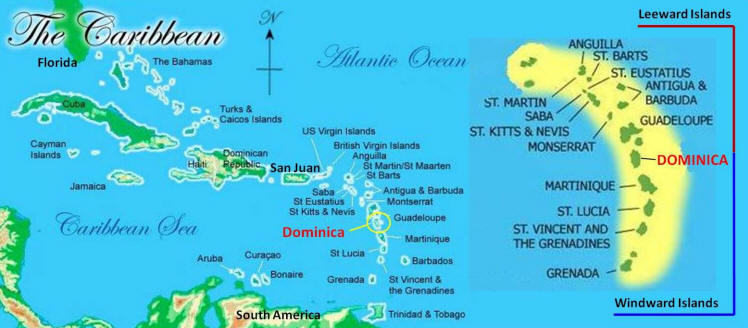

Dominica is situated in the Eastern Caribbean Sea and is officially called The Commonwealth of Dominica. A former British Colony which gained its independence in 1978 after 140 years of British rule and is officially a Constitutional Independent Democracy. Its political system is described as a unitary parliamentary republic with an elected House of Assembly legislature with a President and a Prime Minister.

English is its official language.

Benefits

A Dominica International Business Company (IBC) can take advantage of the following benefits:

• Completely Foreign: Foreigners may own 100% of the shares in an IBC.

• Tax Free: Dominica grants a 20 year exemption from all taxes upon incorporation. However, U.S. residents and others residing in countries taxing global income must report all income to their governments.

• Privacy: The names of the beneficial owners and shareholders are not included in any public records.

• Confidential: The law makes it a crime for anyone to reveal any information about an IBC without a court order or authority.

• One Shareholder/One Director: Only one shareholder is required who can become the sole director for better control.

• Low Minimum Share Capital: The minimum authorized share capital is only $100 USD.

• No Audits: Audits are not required and accounting records can be prepared in any manner.

• No Meetings: Shareholders and directors meetings are not required.

• Fast Formation: An IBC can be incorporated within one business day.

• English: After 140 years of British rule, English is the official language.

Dominica International Business Company (IBC) Name

IBC’s must adopt a company name totally different than any other legal entity in Dominica.

The company name can end with words and their appropriate abbreviations such as: indicating either an “International Business Company”, “IBC” or “Limited Liability Company”, “LLC” or “Corporation”, “Corp.” or “Limited”, “Ltd” or “Société Anonyme”, “S.A.”.

An IBC’s name cannot end with a word suggesting a government association such as “Govt”, “Government”, Royal”, “National”, “Republic”, “Dominica” or “Commonwealth”.

Neither can the name end with words implying a “bank”, “building society”, “Foundation”, or “Trust” without a license or registration as such.

Restrictions on Business Activities

An IBC cannot conduct business with Dominica residents. IBC’s cannot own real properties in Dominica.

IBC’s are also prohibited from providing company management services or maintaining a registered office for Dominica legal entities. Nor can they conduct banking, insurance, re-insurance, or trust services unless a license is applied for and issued by the government.

Registration

Along with a formal application, the incorporation documents include the Memorandum and the Articles of Association filed with the Registrar. These documents must be in English.

Upon approval, the Registrar issues a Certificate of Incorporation which is proof of the IBC’s registration.

Confidentiality

Section 112 of the Act makes it a crime if anyone discloses any information about a Dominica company without authorization or a court order. The punishment is a $25,000 USD fine and two years’ imprisonment. Official liquidators and auditors are specifically mentioned as being subject to these penalties.

Shareholder

Only a minimum of one shareholder is required to incorporate. Shareholders can live in any country and be citizens of other countries. They can be natural persons or legal entities.

Shares can be issued in bearer form for additional privacy. Also, nominee shareholders can be appointed for further privacy.

IBC’s may also issue registered shares and shares with or without par value, and voting or non-voting shares, common shares, and preferential shares.

Shares can be issued in any currency and issued for money or other valuable considerations.

Director

Only one director is required who will manage the company. The sole shareholder may be the only director for better control.

Directors can be citizens of and reside in any country. In addition, shareholders can be natural persons or legal entities. Directors do not have to be shareholders. Nominee directors are permitted for privacy.

Officers

There is no requirement for the appointment of officers like a company secretary.

Registered Agent and Office

IBC’s must appoint a local registered agent and have a registered office address which can be the registered agent’s office.

While the names of the beneficial owners are maintained at the registered office by the registered agent, they are not available to the public.

Taxes

IBC’s are given a 20 year tax exemption upon being incorporated.

Note: U.S. taxpayers and everyone paying taxes in countries taxing worldwide income must disclose all income to their tax agencies.

Minimum Share Capital

The minimum authorized share capital is $100 USD. There are no maximum limits.

Audits and Accounting

There is no requirement to appoint auditors or have accounting records audited. There is no required accounting standards or practices of for financial statements.

The following documents must be maintained at the registered office: Memorandum, Articles of Association, and the Certificate of Incorporation.

In addition, a Register of Directors must be maintained at the registered office. However, this register remains private and is not available to the public.

Annual Meetings

Annual general meetings of shareholders are not required. However, if a meeting takes place, it can be held anywhere in the world. In addition, meetings may be held by electronic means or by telephone as long as effective communications occur.

Meetings of the directors are not required.

Proxies may represent a director or shareholder and vote on his or her behalf when meetings of directors or shareholders are held.

Public Records

The Registrar does not keep the names of the shareholders and directors in its public records. While the names of the beneficial owners are kept by the registered agent, they remain private with no public access.

Time for Incorporation

IBC’s can be incorporated in one business day.

Form a Dominica International Business Company (IBC) Conclusion

A Dominica International Business Company (IBC) can utilize the following benefits: 100% foreign ownership, no taxes for 20 years, one shareholder/director for control, privacy, strict confidentiality law, low share capital, fast incorporation, no audits, no meetings, and English is an official language.