A Guatemala Limited Liability Company (SRL) offers foreigners a completely tax free, limited liability with a low share capital company. Foreigners are allowed to own all of the shares in the SRL.

Guatemalan Commercial Code regulates the formation of all companies along with their legal practices and dissolution.

Background

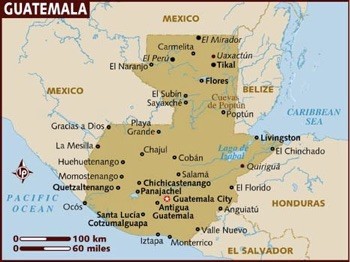

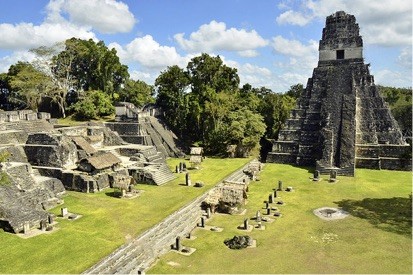

Guatemala’s roots date back to the ancient Mayans civilization. Their ruins can be visited in the jungles of Petén and in the Yucatan peninsula in neighboring Mexico. The Spanish conquered Guatemala in 1524. It remained under Spanish control for nearly 300 years when it gained its independence in 1821.

After its independence, it was the political center of the Central American Federation which included: Costa Rica, Honduras, El Salvador, Mexico, and Nicaragua.

Politically, it is described as a “republican democracy” with an elected one house legislature and a president.

Its economy is based on agriculture where bananas, coffee, and sugar are its main exports.

Foreign investment is encouraged with no laws restricting operations by foreigners. Guatemala’s Constitution guarantees equal treatment of foreign investors with local residents in promoting investments and foreign capital.

Benefits

A Guatemala Limited Liability Company (SRL) enjoys the following benefits:

• Complete Foreign Shareholders: The SRL may have all of its shares owned by foreigners.

• No Taxes: If all of the SRL’s income is foreign sourced no taxes of any kind are imposed. Note: U.S. taxpayers and everyone else paying taxes on their world income must report all income to their tax authorities.

• Low Share Capital: The minimum required authorized share capital is currently equivalent to $274 USD.

• Limited Liability: A shareholder’s liability is limited to his or her share capital contribution.

• Two Shareholders: The law requires a minimum of two shareholders to form the SRL.

• One Director: Only a minimum of one director is required to manage the SRL. One of the shareholders can be appointed as the sole director for domination of the management.

Guatemala Limited Liability Company (SRL) Name

A SRL must select a company name which is not alike or too similar to an existing company in Guatemala. Proposed company names may be checked with the Guatemala Mercantile Registry.

The company name must end with either the Spanish for Limited Liability Company which is “Sociedad de Responsabilidad Limitada” or its abbreviation “SRL”.

Limited Liability

Shareholders receive limited liability protection as only their contributions to the SRL’s share capital will be exposed if the SRL fails to pay its debts or meet its obligations.

Registration

Applications to form new companies are filed with the Register of Commercial Entities.

Applicants must execute an Articles of Incorporation and file it with the Register. A formal application form must be filled in and filed as well.

After filing, a notice of a new company formation must be published in one widely circulated newspaper (like a major daily newspaper).

Even if no taxes will ever be paid, every company must register with the local tax administration to receive a unique company tax identification number.

Even if no employees will be hired, companies must register with the Social Security Authority to receive an identification number. In addition, a proposed book of salaries must be inspected and approved by the Department of Labor.

Shareholders

The law requires a minimum of two shareholders to form the SRL. The shareholders maybe individuals or legal entities. Shareholders may reside ion and be nationals of any country.

Director

Only one director is required to manage the SRL. One of the shareholders may be appointed as the sole director for greater control of the SRL. No requirement exists for appointing a local resident as a director. Directors may be individuals or legal entities.

Minimum Share Capital

The required minimum share capital is 2,000 GTQ (equivalent to $274 USD in 2017). The share capital must be fully paid up when incorporating.

Registered Agent and Office

If none of the directors are local residents, a registered agent must be appointed to accept legal notices. Technically, the registered agent is called a legal representative which may be a local lawyer.

Either the local director, registered agent, or local company lawyer’s office address may be used as the SRL’s registered office address.

Annual Audits

Every SRL must file an audited financial statement every year with the Register of Commercial Entities. An independent Certified Public Accountant (CPA) must prepare the audited financial statement.

After approval of the new company from the Register, the accounting books and book of meeting minute’s forms must be filed with the Commercial Register for approval.

The Commercial Code requires the following types of accounting records and books for every company:

• Daily book;

• General ledger;

• Financial statements;

• Inventory book; and

• Monthly register showing sales and purchases.

These are bound books approved by the Commercial Registry and the local tax authorities. Computerized systems may also be authorized.

Taxes

Currently, the corporate tax rate is 25%. However, Guatemala is a territorial tax country where only the income earned within its borders are taxed. This means a foreign owned SRL whose only income is generated in any other country is not subject to the corporate tax.

The same applies to the personal income tax which is completely exempt if all income is earned outside of the country. This applies when non-resident shareholders receive dividends or other compensations from the SRL.

Even if no taxes are owed, an annual tax return is mandatory.

However, U.S. resident and all others subject to taxes on their global income must disclose all income to their countries’ tax agencies.

Company Formation Time

Expect the process for preparing legal documents, registering with the Register and obtaining approval to take up to two weeks.

Conclusion

A Guatemala Limited Liability Company (SRL) obtains these types of benefits: total ownership by foreigners, no taxes, limited liability, two shareholders and one director who can be a shareholder for more control, and a low minimum share capital.