A Guyana Private Limited Liability Company (PLLC) is the most popular legal entity which foreigners choose to set up.

The Companies Act of 1991 (amended in 1995) governs the establishment, legal activities and dissolution of all companies in Guyana.

Background

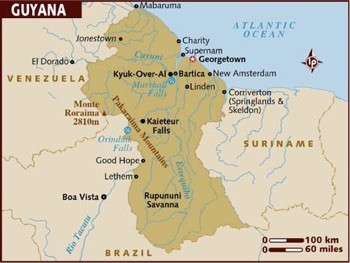

Guyana is a sovereign state located in South America’s northern mainland. It is bordered by Brazil to the south, the Atlantic Ocean to the north, Venezuela to the west, and Suriname to the east.

Guyana was a former British colony (it was called “British Honduras”) starting in 1814. It obtained independence from the United Kingdom in 1966 after 152 years of British rule. It became a Cooperative Republic in 1970. Its official name is the “Co-operative Republic of Guyana”. As a result of the long British presence, Guyana is the only country in Latin America where English is its official language.

Guyana’s political system is a mix between a presidential and Westminster government. It has a freely elected one house national assembly, a prime minister, and a president.

Its judiciary follows English Common Law.

The country’s economy depends upon agriculture, forestry, and mining (diamonds, bauxite, and gold). Over the past few years, they modernized their fiscal and financial systems attracting foreign investments.

Benefits

A Guyana Private Limited Liability Company (PLLC) offers these types of benefits:

• 100% Foreign Shareholders: The PLLC’s shares may be totally owned by foreigners.

• Limited Liability: Shareholders’ liabilities limited to their contributions to the company’s share capital.

• Two Shareholders: The law requires at least two shareholders to form a PLLC.

• One Director: Only one director is required which can be one of the shareholders for greater control.

• No Required Capital: There is no required minimum share capital amount.

• English: After 152 years as a British colony, English is its official language.

Name

The PLLC’s name cannot be the same as or resembling a company name already registered in Guyana. Possible company names may be researched and reserved in advance of the registration.

Corporations must use the word “Corporation” or the abbreviation “Inc.” at the end of their company name.

Limited companies must use the word “Limited” or its abbreviation “Ltd” at the end of their company name.

Limited Liability

A shareholder’s liability is limited to the amount contributed to the company’s share capital.

Registration

The following is the registration procedures for a new company:

• First a company name is selected, verified as an original, and reserved.

• Then a Guyana attorney must issue a Declaration of Compliance stating that the new company complies with the laws and rules of forming a new company.

• Finally the new company may be registered with the Guyana Registrar of Companies. This involves filling at application which asks for:

(a) The company name;

(b) The company’s registered office address;

(c) Description of the types of classes and maximum number of shares to be issued;

(d) Registration of the shares;

(e) Number of Directors (minimum or maximum);

(f) If any restrictions on the type of business activities will be imposed;

(g) The Incorporators’ names, addresses, occupations, and signatures; and

(h) The Directors and Secretary’s name and addresses.

The following documents must also be filed along with the application:

• Articles of Incorporation

• Notice of Director

• Consent to act as the Director

• Notice of the Secretary

• Consent to act as the Secretary

• Notice of the Registered Office

• Declaration of Compliance issued by a Guyana lawyer

• Company Bylaws

After approval, the Registrar will issue a Certificate of Incorporation.

• After registering and filing the required documents with the Registrar, the new company applies for a tax identification number with the Guyana Revenue Authority.

• Finally, the new company registers for a Value Added Tax (VAT) number within 10 days from registering with the Registrar. In addition, register with the National Insurance

Scheme to obtain the NIS employer number.

• Company Seal: Every company is required to create a company seal which can be embossed (steel) or a rubber seal (rubber stamp).

Shareholders

At least two shareholders are required to form a PLLC. The shareholders can be from any country and can reside anywhere in the world. A maximum of 20 shareholders can be in a PLLC.

Both common and preferred stocks may be issued.

Director

At least one director must be appointed to manage the PLLC. Directors may be citizens of any country and can reside anywhere in the world. One of the shareholders may be appointed as the sole director for better control of the PLLC.

Minimum Share Capital

There is no required minimum share capital.

Registered Office and Agent

Every PLLC must appoint a local registered agent and have a registered office. Every registered agent provides their office address as the registered address for their clients.

Company Secretary

PLLC’s must appoint a company secretary. The secretary maintains all required registries and records for the company. The secretary makes sure that the company complies with all laws, rules, and regulations.

Taxes

Guyana has a territorial based income tax system where only income earned within Guyana are subject to taxation. Therefore, foreign sourced income is tax free. However, this relates to income taxes, not corporate taxes which are subject to worldwide income.

Commercial companies pay a corporate tax rate of 40% on its profits in 2017. Guyana defines “commercial” as a company which sells goods which it does not manufacture amounting to at least 75% of its gross income.

Currently, non-commercial companies pay a corporate tax rate of 27.5% on their profits. This includes companies involved with investments or selling services.

Note: U.S. taxpayers and all others subject to taxation on their global income must declare all income to their tax agencies.

Accounting

Both the Companies Act and the Tax Act require adequate accounting records giving a fair and accurate view of a company’s profits, losses, and worth.

Registers must be maintained of the Directors and Officers, all meeting minutes, and resolutions adopted by Shareholders and Directors.

Financial statements filed annually must comply with International Financial Reporting Standards.

Annual Meeting

A general annual meeting of the shareholders is required.

Time for Formation

Expect the process for registering to take one week.

Shelf Companies

Shelf companies are not available for purchase in Guyana.

Conclusion

A Guyana Private Limited Liability Company (PLLC) has these benefits: total foreign shareholders, limited liability, no minimum share capital, two shareholders where one can become the sole director, and English is its official language.