The Isle of Man Private Limited Partnership is governed by The Partnership Act of 1909, The Limited Partnership Act of 2011, and The Partnership Act of 2012. A private limited partnership has the option to form as a legal entity separate from the partners.

Background

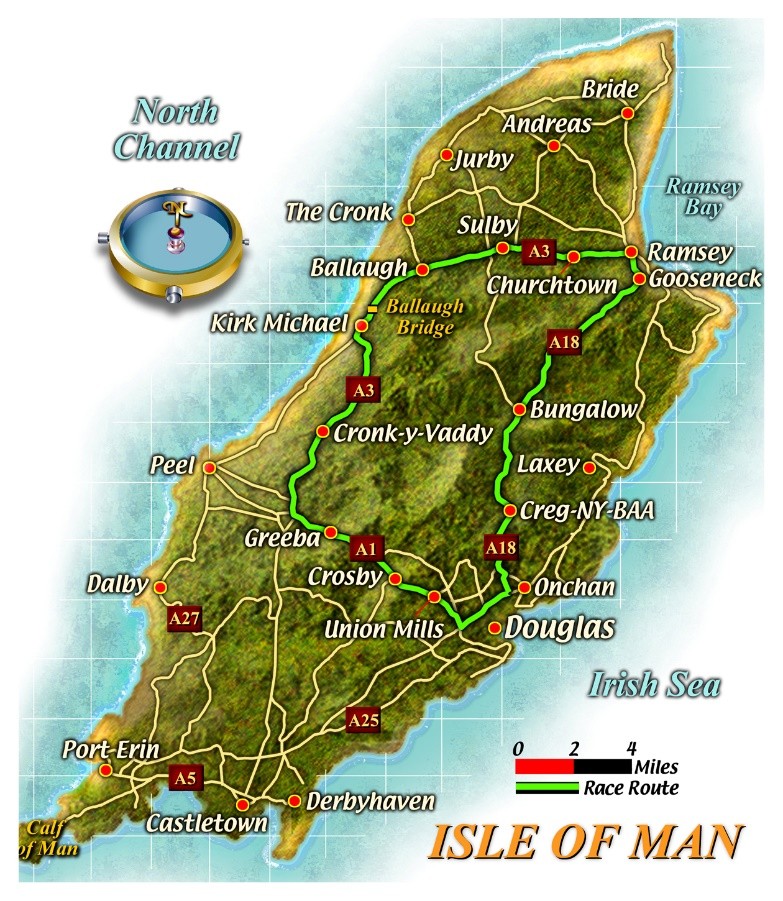

The Isle of Man is a British territory situated as an island on the British Isles. While officially a dependent British territory, this island has an internal self-governing political system with a democratically elected Parliament (known as the “Tynwald”) with two houses and an eight member Legislative Council appointed by the lower house, The House of Keys. The 24 member House of Keys are elected every five years. The Lord of Man is England’s Queen Elizabeth II who has the power of “Royal Assent” by approving all legislation passed by the Tynwald.

Benefits

An Isle of Man Limited Partnership can have these benefits:

• Total Foreign Ownership: Every partner can be a non-resident foreigner.

• Limited Liability: Limited partners are only liable for partnership debts up to their contribution.

• No Taxation: Foreign non-residents will owe no taxes for income earned outside of the Isle of Man.

• Options: A limited partnership can elect to remain as a partnership or register as a legal entity.

• Two Partners: Only a general and a limited partner are required.

• No Minimum Authorized Capital: There is no requirement for a minimum authorized capital.

• English Language: English is the official language of the Isle of Man.

Isle of Man Private Limited Partnership Name

Isle of Man partnerships cannot have the same name or resembling another partnership’s name.

If the limited partnership will be a legal entity, it must use the word “Incorporated” or the abbreviation “Inc.” at the end of its name.

Partnerships not choosing to be a legal entity must use the words “Limited Partnership” or the abbreviation “LP” at the end of their name.

Otherwise, the name can be in any language using the Latin alphabet.

The following types of business requires a formal license: banking, building societies, loans, savings, assurance, insurance, reinsurance, councils, co-operatives, trusts, municipalities, and financial services or their equivalency in a foreign language.

Trading Restrictions

Limited Partnerships may not:

• Be involved with banking, insurance, or activities suggesting an association with the two without being licensed; and

• Be involved with investments other than the investments of the partnership’s assets without being licensed.

Registration

Limited partnerships must register as such with the Companies Registry or will be presumed to be a general partnership with no limitation of liability.

The applicant must file Form LP1 with the General Registry which includes the following information:

• The partnership’s name (if a legal entity, the name will end with either “Incorporated” or “Inc.”;

• Description of the business purpose;

• Address of the principal business location;

• Partners’ names (the beneficial owners must be disclosed);

• Date business started and termination date (if not perpetual);

• Declaration of being a limited partnership;

• Description of the different limited partnership classes (if any) and amount contributed by each partner; and

• Name and address of the individual accepting process of service on the partnership’s behalf.

Legal Entity Option

The Limited Partnership Act of 2011 gives new limited partnerships the option to be formed as a legal entity separate from the partners. Limited partnerships choosing this option are similar to a corporation with unlimited capacity and perpetual succession.

Limited partnerships not choosing this option will be treated as a normal partnership and not as a legal entity.

Registered Office

Limited partnerships must maintain a local registered office. A resident agent is not required.

Limited Partners

A limited partnership must have at least one general partner with unlimited liability (SPV’s are often used) with at least one limited partner are required who are natural persons or corporations and can be a citizen or resident of any country. Limited partners are liable for the partnership’s debts only up to their contributions.

General partners have the authority to bind the entire partnership in normal third party business contracts. Limited partners cannot withdraw their contributions and cannot act as managers.

The maximum number of limited partners is twenty. Exceptions exists for lawyers, accountants, stock exchange members, and for collective investment schemes.

Minimum Authorized Capital

There is no requirement for a minimum authorized capital.

Taxes

The Isle of Man does not tax limited partnerships. Individual partners are taxed on their share of the profits if commerce or trade in conducted in the Isle of Man pursuant to the Income Tax Act of 1970. Otherwise, non-resident partners will not have to any taxes. Note: United States taxpayers are taxed on their global income, as well as, taxpayers from countries with the same taxation. They must declare all income to their governments.

Accounting

The government does not require the filing of any financial statements. But, partnerships must keep financial records reflecting the true status. Accounting documents must be kept for at least six years.

The following accounting information should be included in the accounting records:

• All funds received and spent with appropriate receipts;

• Every purchase and sales receipts; and

• The assets and liabilities of the partnership.

Accounting records created outside of the Isle of Man must be sent to the local registered office within six months.

All accounting documents must be available for inspection at the local registered office. Failure to do so will result in criminal prosecution punishable by a fine or imprisonment.

The Income Tax Assessor has the right to demand inspections at any time.

Time for Registration

A limited partnership can be registered within one to five days.

Shelf Limited Partnership

Off the shelf limited liability partnerships are available in the Isle of Man.

Conclusion

An Isle of Man Limited Partnership can have these benefits: 100% foreign ownership, no taxes, limited liability, only two partners, no minimum authorized capital, option to become a legal entity, and English is the official language in the Isle of Man.