A Jersey Exempt Company formation is largely based on English common law with some French modifications. Its legislative laws are the English Companies Act of 1948 which has been amended by the Jersey Companies Law of 1991.

Jersey companies involved with international business and trade are known as “exempt” companies and cannot engage in trade or business within Jersey. A normal resident Jersey company is not tax exempt.

Foreigners can own all the shares in a Jersey Company.

Background

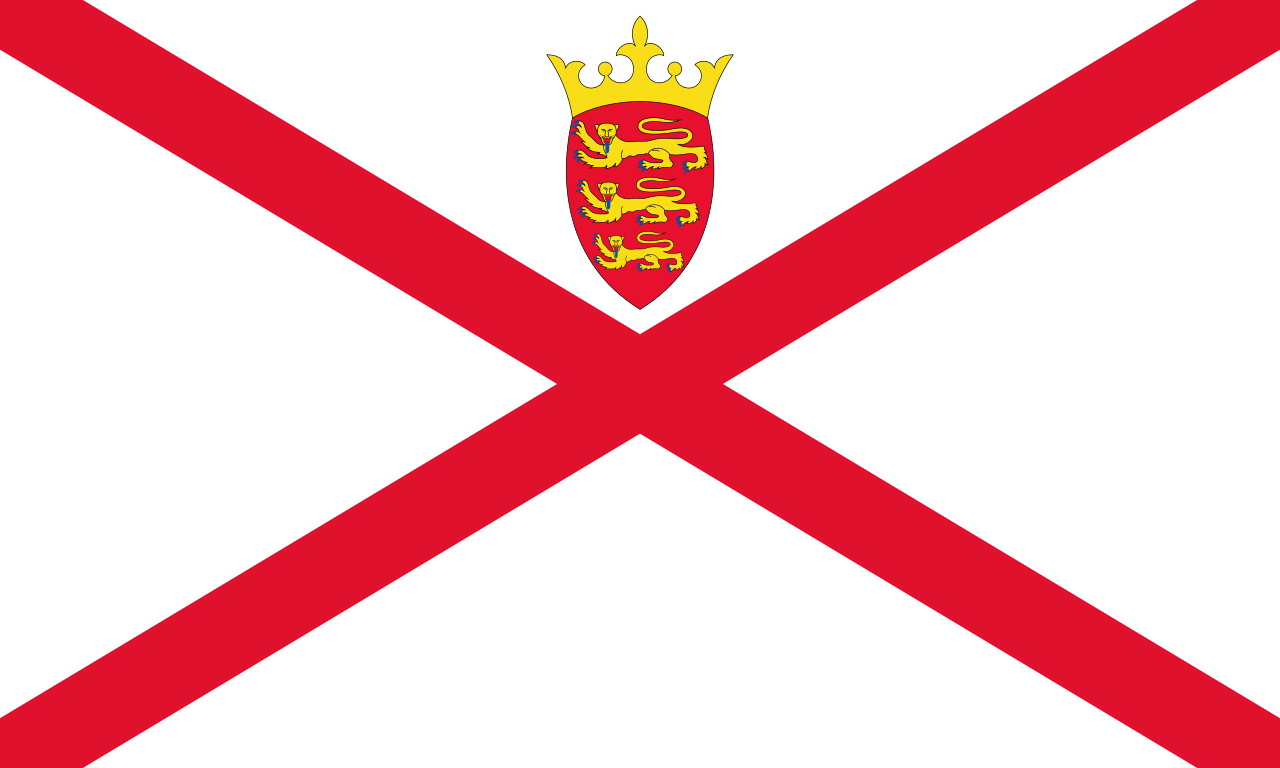

Jersey is one of the Channel Islands located between France and England. The Channel Islands have been under the United Kingdom’s control since 1066. Politically, Jersey is not officially part of the United Kingdom, but rather a British Crown Dependency which is self-governing.

Financial services are the main source of income for Jersey with tourism coming as the second main source.

Jersey has its own Jersey Pound currency which is on par with the British Pound. Their notes and coins are interchangeable with the British Pound.

Jersey Exempt Company Benefits

A Jersey Exempt Company enjoys these benefits:

• Complete Foreign Ownership: Foreigners can own all of the shares in the company.

• No Taxation: Exempt companies not engaging in any type of business inside Jersey pay no corporate tax. However, U.S. taxpayers must disclose to the IRS all global income as do taxpayers in other countries taxing worldwide income disclose to their governments.

• Two Shareholders: The minimum requirement is two shareholders to incorporate.

• One Director: Only one director is required to incorporate.

• Low Share Capital: A minimum of 1 GBP is the required authorized share capital.

• English: As a British Crown Dependency, English is its official language.

Jersey Exempt Company Name

Company names cannot be identical or similar to names of existing companies or other legal entities.

Names including well known multi-national companies require prior written consent. Names cannot imply illegal activities. Names cannot imply government or royal patronage whether local or foreign without written consent. The word “International” can only be used by companies which trade internationally.

Company names can be in any language using the Latin alphabet on the condition that an adequate translation into English is included with the application.

Certain company names require a license including: bank, loans, savings, building society, assurance, insurance, council, chamber of commerce, co-operative, finance, trust, trustee, and Jersey.

Limited liability companies must include “Limited” or “Avec Responsabilite Limitee” or their abbreviations “Ltd” or “SARL”.

Incorporation

Submit the Memorandum and Articles of Association to the Financial Services Commission. In addition, provide notification of the shareholders and directors’ names, addresses, and nationalities. Also, the registered office address, beneficial owners’ character references and details regarding the company’s investment and/or trading activities.

Change of Beneficial Ownership

After incorporation, if the beneficial ownership should change immediate notice to the Financial Services Commission must occur.

Trusts are required to disclose information regarding the settlor, trustees, and instigators.

Public companies are required to file a copy of the most recent annual report.

Registered Office

A registered office in Jersey must be maintained.

Shareholders

A minimum of two shareholders is required to incorporate a company. Information regarding shareholders are available for public inspection. Shareholders can be nationals and residents of any country.

The types of issued shares include: preference shares, redeemable shares, registered shares, non-redeemable shares, and shares with or without voting rights.

Directors

Only a minimum of one director is required. Directors can be individuals from any country and do not have to be Jersey residents. Corporate bodies may also be directors as long as they are licensed in Jersey to conduct trust company services pursuant to the Jersey Financial Services Law of 1998.

Company Secretary

Every company must appoint a company secretary who can either be a corporate body or an individual. Secretaries can be citizens of any country and do not have to be Jersey residents.

A sole director company cannot have its director serve as the company secretary as well.

Authorized Share Capital

The minimum authorized share capital is 1 GBP. Typically, it is 10,000 GBP.

Minimum Issued Capital

Equivalent to the value of issued shares to the subscribers at 1 GBP (or equivalent foreign currency). Issued shares must be paid fully in cash.

Taxes

Every company incorporated or considered exempt companies in Jersey pay the corporate tax rate of 0% unless they are:

• Rental and property development companies which pay a 20% tax rate;

• Utility companies (i.e. gas, electricity, water, etc.) pay a 20% tax rate; and

• Financial services providers (i.e. banks, financial services companies, trusts, etc.) pay a 10% tax rate.

Resident companies are either incorporated in Jersey or managed and controlled in Jersey and engage in trade or business within Jersey. The corporate tax rate for a resident company is 20% on worldwide income.

Note: United States taxpayers must notify the IRS of all global income along with taxpayers from other countries taxing global income.

GST Tax

The Jersey Goods and Services Tax (GST) is a sales tax of domestically consumed goods (whether local or imported) and services. The current rate is 5%.

Financial Statements

There is no requirement to file audited financial statements with the government. However, every company must keep financial records reflecting the true financial condition of the company.

Accounting record kept outside of Jersey must be forwarded to the company’s local registered office within six month intervals.

Public Records

Shareholders and directors names, nationalities, and addresses are part of the public records available for public inspection.

Incorporation Time

Expect that the entire process will take from 10 to 14 days.

Shelf Companies

Shelf companies are not available in Jersey due to the requirement of disclosing trading activities and beneficial ownership.

Conclusion

A Jersey Exempt Company can enjoy these benefits: 100% foreign owners, no taxes, two shareholders, one director, low share capital, English is their official language.