A Lithuanian Private Limited Company provides foreigners with a one shareholder who can be the sole director with a low corporate tax rate in a European Union member country.

The Lithuanian words for a private limited company are “Uždaroji Akcine Bendrove” with an abbreviation of “UAB”.

Background

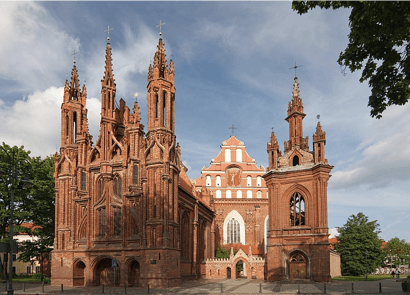

Lithuania is a country in the Baltic region of Northern Europe. It is officially called the “Republic of Lithuania”. A former satellite of the Soviet Union after WW II, it gained its independence from Russia in 1991. It joined the European Union (EU) in 2004.

Politically, it can be described as a “unitary semi-presidential republic” with an elected one house legislature and a president and a prime minister.

Benefits

A Lithuanian Private Limited Company (UAB) offers the following benefits to foreigners:

• Full Foreign Ownership: The UAB’s shares may be completely owned by foreigners.

• 5% Corporate Tax Rate: Small UAB’s with fewer than 10 employees currently earning less than $164,000 USD per year only pay a corporate tax rate of 5% on their profits. Note: U.S. taxpayers and everyone paying taxes on their global income must disclose all income to their governments.

• Low Share Capital: Currently, the required minimum share capital is $3,280 USD.

• Limited Liability: A shareholder’s liability limited to the share capital contribution.

• One Shareholder and One Director: The minimum requires sole shareholder can be the required sole director.

• Management Board Option: The shareholders may manage themselves or opt to appoint a management board.

• Fast Incorporation: Lithuania has an online application process for one day incorporation.

• European Union: Lithuania is a full member of the European Union (EU).

Lithuanian Private Limited Company (UAB) Name

The UAB must never select a company name exactly alike or too similar to another company’s name in Lithuania. Applicants can check with the Trae Register to see if a proposed company name is available and reserve it before applying.

Either the words “Uždaroji Akcine Bendrove” must appear at the end of the company name or their initials “UAB”.

Registration

Applications for a new company are made with the Ministry of Justice’s Centre of Registers at the Register of Legal Entities of Lithuania (hereinafter the Trade Register).

The first step is to open a local bank account depositing the required minimum share capital. The bank will provide a certificate proving the deposit was made which will be filed with the Trade Register.

An electronic signature will be required if the applicant wishes to apply online. The three ways to obtain a “qualified electronic signature” include:

1. Mobile network operators can issue mobile electronic signatures; or

2. Obtain a Lithuanian public servant or national identity card issued by the Ministry of Interior; or

3. The Centre of Registers can issue a secure e-token with embedded electronic signature.

If registering at the Register in person or through a legal representative, the registration of the UAB along with the corporate tax and social security insurance can be done at the same time. The following information and documents must be filed:

• Application form;

• Copy of the Articles of Association;

• Minutes of the statutory meeting authorizing the formation of the UAB;

• Founding Agreement authoring formation of the UAB;

• Name of the initial shareholders; and

• Whether a management board or supervisory council will appointed.

Within six working days from the time all required documents are filed, the Trade Register approves the new com any and issues a Certificate of Incorporation.

All of the records with the Register are public and available for public inspection.

Limited Liability

Shareholders liabilities for the company’s debts and obligations only up to their share capital contributions.

Shareholder

One shareholder can set up the UAB. Shareholders can be natural persons or legal entities from any country.

The shares in a UAB cannot be traded on the stock exchange. Otherwise, this would become a “public” and not a “private” company.

The maximum number of shareholders permitted is 250.

Director

A single director may manage the company who may be the sole shareholder in order to exert ultimate control over the UAB.

Management

The UAB is self-managed by the shareholders. The management structure is determined during the first general meeting of the shareholders.

While there is no requirement for a board of directors or a supervising council, since the number of shareholders may reach a maximum of 250, the UAB can establish a management board.

Minimum Share Capital

The minimum required share capital for the UAB is 10,000 LTL (in 2017, approximately $3,280 USD). The share capital amount must be subscribed in the Articles of Association. The minimum registered capital must be deposited in a local bank account with at least 25% having to be paid up.

The capital is separated into shares which are for private sale and not for sale to the public like being offered on the stock exchange.

Registered Office and Agent

Every company must obtain a local registered office address and hire a local registered agent to receive official notices and legal documents. The registered agent’s office address can be used as the UAB’s registered address.

Taxes

The standard corporate tax rate is 15%. However, the tax can be reduced to 5% for companies meeting these requirements:

• Annual income is less than 500,000 Lithuanian Litas (in 2017 approximately $164,000 USD); and

• Has less than 10 employees.

Capital gains are taxed at a 15% rate. The dividends tax is also a 15% rate.

The Value Added Tax (VAT) is 21%. However, certain goods and services are reduced to 0% up to 9% maximum rates for heat and

hot water, books, at 0%. Pharmacy medicines are 5% and accommodations pay a 9% rate.

Tax Incentives

Tax incentives exist for foreign companies who invest more than 1 million Euro with at least 75% of the company’s business occurring in the Free Economic Zone get an exemption from the corporate tax for the fists 5 years with the corporate tax reduced by 50% for the next 10 years.

Foreign companies investing less than 1 million Euro but is located in the Free Economic Zone are exempt from the VAT and the real estate tax.

However, U.S. residents and all others paying taxes on their world income must report all income to their tax authorities.

Accounting

Annual audits will be required if the UAB’s annual turnover exceeds 1.4 million Euro. Otherwise, no audits will be required.

Public Records

All records of the Register are open for public inspection.

Time to Incorporate. Using their online application service allows for same day incorporation.

Shelf Companies

Shelf UAB companies are available to purchase in Lithuania.

Conclusion

A Lithuanian Private Limited Company (UAB) provides the following benefits: foreign ownership of all shares, low corporate tax, limited liability, fast incorporation, one shareholder who can be the only director, and EU membership.