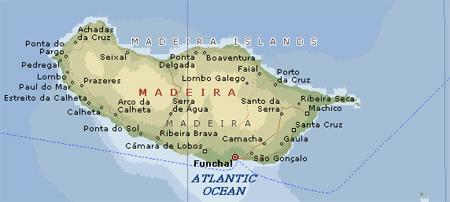

Madeira is a Portuguese archipelago situated in the North Atlantic Ocean, southwest of Portugal and north of Tenerife, Canary Islands. Its total population is estimated at 270,000 and its land area is just less than 250 square miles (400 square kilometers).

Since 1976, the archipelago has been an Autonomous region of Portugal just like Azores, located to the northwest. It includes the islands of Madeira, the Desertas, and Porto Santo. The region has administrative and political autonomy through the Administrative Political Statue of the Autonomous Region of Madeira provided for in the Portuguese Constitution. The autonomous region is an integral part of the European Union.

Madeira corporations are considered to be Portuguese. Therefore, the corporate legislation they follow is the Portuguese Companies Code. Also, Madeira exists as part of the European Union. As such, their companies are not considered “offshore,” but as Portuguese companies with certain tax benefits, as outlined in EC Treaty, Article 299.

Benefits

Madeira recently emerged as a beneficial jurisdiction with which to incorporate. Madeira, as part of the European Union, offers an amount of credibility not typically offered by other offshore jurisdictions. Madeira corporations will benefit by being considered Portuguese. Furthermore, Madeira provides effective tax breaks for its corporations, which make it a very attractive jurisdiction for many investors. With its stability of government, and excellent connections with the European Union as well as providing beneficial double taxation treaty assistance, Madeira emerges as a strong jurisdiction for incorporation. There are some tremendous incentives that the government offers to attract investors.

There are many benefits for choosing to incorporate in Madeira which include:

• One Shareholder: A minimum of only one shareholder is required to form a Madeira “unipersonal” corporation. Otherwise, all other corporations must have a minimum of two shareholders.

• Bearer Shares: Madeira corporations can issue bearer corporate shares for the shareholder’s privacy or issue normal registered shares.

• Free Zone: Madeira allows for its corporations to be located in an international Free Trade Zone (FTZ). Making them exempt from both income and capital gains taxes.

• International Entity Business Status is available to certain industries in Madeira. Businesses that obtain this status exist outside the scope of the Government Sales Tax (GST). Most of the corporations that qualify are not providing goods and services to the region, but instead work as trust or fund corporations.

• EU Corporation Status: Corporations from Madeira are not considered “offshore” since Madeira is a part of the European Union, according to the EC Treaty, Article 299. A Madeira corporation is considered a Portuguese business with special tax benefits.

• EU Residency: As a Portuguese company, a Madeira IBC company can provide a Certificate of Residence issued by the Portuguese Tax Agency.

• EU VAT numbers can be obtained for Madeira corporations.

• 5% Corporate Tax: Madeira corporations formed as an International Business Corporation (IBC) will only pay 5% corporate taxes until 2020.

• No Dividends Withholding Tax: A Madeira corporation can remit dividends to non-residents without incurring withholding taxes, as long as the corporation is correctly formed.

• Superior Workforce: Madeira offers a skilled workforce speaking multiple languages at affordable wages.

• Low Cost of Living: Compared to other EU corporations, Madeira offers employee low wages, and low operating costs. Energy, telecommunications and rental costs are very low in Madeira. It costs nearly 50% less to live in Madeira compared to other EU countries.

Corporate Name

Madeira corporations are required to have a corporate name not already in use or registered with another corporation.

If the company has only one member, the corporation’s name must end with “Sociedade Unipessoal” or word “Unipesso.”

Office Address and Local Agent

Madeira corporations are required to have a registered agent and a registered local office and for process service and official notices.

Shareholders

Madeira corporations are required to have at least two shareholders, although in some cases, one is allowed, if a “unipersonal” corporation is formed. This type of Private Limited Liability Corporation is known as an “LDA” with one owner. LDAs with one owner are restricted from owning other unipersonal corporations. Furthermore, there are no requirements for shareholders to reside in Madeira. Corporations can issue shares as registered or to a bearer.

Directors and Officers

Company and limited company owners incorporating in Madeira must have a minimum of one director. LDAs cannot appoint corporate directors. Either shareholders or third parties can be directors of the corporation.

Directors must be stated in the corporation’s Articles of Association, and can be elected or removed from office at the corporation’s annual meeting by the shareholders. The Directors can be remunerated or non-remunerated.

Corporations are required to have an auditor, elected at their annual general meeting. Both the auditor and the directors are responsible for submitting yearly tax and auditing information, as required by Madeira’s government.

Authorized Capital

The minimum authorized capital is €50,000. The capital is divided into shares with or without a nominal value, each representing the same fraction as in the capital.

Taxes

Corporations in Madeira formed as an IBC will only pay 5% corporate taxes until 2020.

Annual Fees

The annual fee for Madeira corporations is $1,800 EUR.

Public Records

The only public records are the Articles of Association which lists the names of the directors, but not the registered shareholders.

Corporate registered shares allow the issuer to know at any time the identity of its holders where the records are only kept at the corporate office.

Accounting and Audit Requirements

Annual accounts must be submitted to the local tax authorities even in cases where there is neither liability to taxation nor any activity.

Annual General Meeting

A Shareholders meeting must be held at least once a year to approve the annual accounts and can be held whenever required by law or deemed convenient by the board of directors or supervisory board, or shareholders.

Time Required for Incorporation

The estimated time required for incorporation in Madeira is 15 to 30 days.

Shelf Corporations

Shelf corporations are available in Portugal for those wishing to incorporate more quickly.

Conclusion

Madeira offers many unique benefits such as: EU corporation status, International Entity Business Status exempt from Sales Taxes, 5% corporate tax until 2020, low cost of living and low wages for a superior workforce, the option to be located in a Free Zone with its tax breaks, one shareholder corporations, and the ability to issue bearer shares for greater privacy.