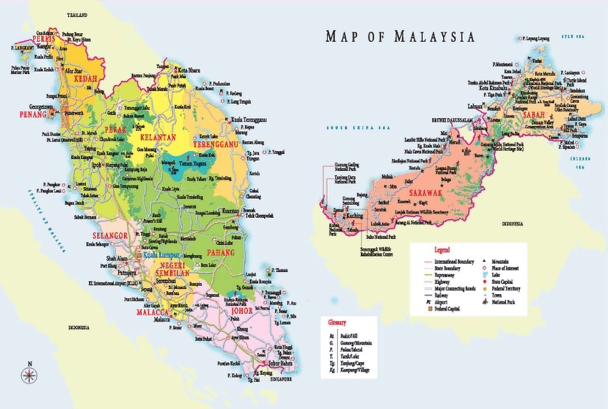

Company registration in Malaysia offers many benefits to business owners. It is a popular choice for foreigners looking to incorporate. We will discuss benefits and how to open a company in Malaysia. Company registration in Malaysia for a foreigner owning 100% of the company is also possible, depending on the industry.

First, let’s discuss why this has become such common place in which to incorporate. The benefits of forming a corporation in Malaysia include the following:

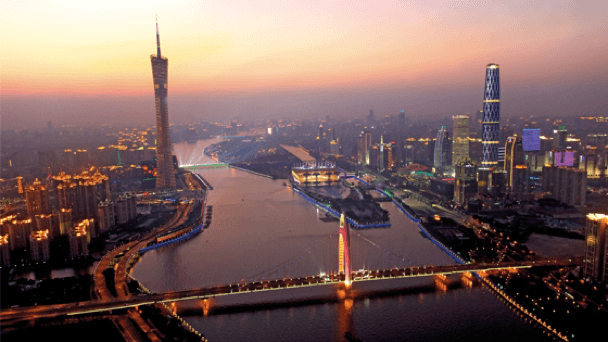

- There is a significant amount of consumer demand in both local and foreign Asian markets, and the owner of a Malaysian corporation benefits from easy access to this potential business.

- Start-up costs in Malaysia are relatively low when compared to Singapore. Malaysia’s monthly office rental per square meter is four (4) times less than the rates in Singapore. The wage rate in Malaysia is forty percent (40%) less than that of Singapore.

- Malaysia has sixty-eight double taxation treaties, meaning corporations being formed in this jurisdiction will benefit from this lower tax cost, as a result.

- Withholding taxes are not levied on dividends that are generated outside of the jurisdiction.

- There are no business restrictions on Malaysian corporations on repatriation of capital, profits, dividends, and royalties.

- Malaysia offers liberal governmental policies to its corporations and offers many attractive incentives.

Corporate Legislation

Corporate legislation in Malaysia follows the Companies Act of 1965. According to the requirements of this act, all companies submit annual filings with the SSM. This filing includes the company annual return, which must be updated during the company’s Annual General Meeting either during the year or within 14 days after the date that the Annual General Meeting ends. When this is complete, the company must file its annual return as well as a certificate providing a list of the company’s members. A director or by the manager or secretary of the company must sign these papers. The documents must be filed together with the Audited Financial Statements within one month of the completion of the AGM.

Corporate Name

Prior to forming a corporation, the one desiring company formation must come up with a unique corporate name that does not resemble any previously registered corporate name. Once this step is completed, your agent (such as this one) must register the desired name into the proper registration system to gain approval from the proper government office in Malaysia.

Since May 16, 2013, it is mandatory for your agent to conduct company name search and reservation online for Malaysian company incorporation. The company secretary must prepare the incorporation documents for the company following the approval of the name reservation application by the government commission that files companies in Malaysia.

Office Address and Local Agent

Those choosing to incorporate in Malaysia must have a local office address and local registered agent (which will be provided by your agent). The registered office in Malaysia is where all communications and notices may be addressed. It is normal practice in Malaysia to have the secretarial office as the registered office.

Companies can have a different main address located anywhere in the world.

Shareholders

Business owners planning to incorporate in Malaysia must pick at least one company shareholder.

Directors and Officers

Limited company owners incorporating in Malaysia must have at least one director that is at least eighteen years old and residing in Malaysia. This director also cannot be bankrupt, nor convicted of a crime or imprisoned for at least five years. Also, this person can be a permanent resident, or a foreigner with a Resident Talent Pass (RPT), permanent resident (PR), or MM2H holder. A nominee resident director can also be utilized for this purpose, which can be provided by your agent.

Companies incorporating in Malaysia must also make sure to have at least one company secretary. This appointed company secretary needs to be a member of at least one of the prescribed professional bodies or licensed by the SSM.

Authorized Capital

The authorized share capital for company and limited company owners deciding to incorporate in Malaysia can vary, and estimates follow the conditions in the chart below, as of this writing:

| AUTHORIZED SHARE CAPITAL (RM) | GOVERNMENT FEES (RM) |

| Up to 400,000 | 1,000 |

| 400,001 – 500,000 | 3,000 |

| 500,001 – 1 million | 5,000 |

| 1,000,001 – 5 million | 8,000 |

| 5,000,001 – 10 million | 10,000 |

| 10,000,001 – 25 million | 20,000 |

| 25,000,001 – 50 million | 40,000 |

| 50,000,001 – 100 million | 50,000 |

| 100,000,001 and above | 70,000 |

Please keep in mind that the above government fees are thought to be accurate as this is written. By the time you call the office here or use the contact form to inquire, the government may have changed these amounts. Also bear in mind that there are additional fees for company formation an the agent, office and Malaysian director.

Taxes

Companies need to register for the Goods and Services Tax (GST) if they meet certain requirements. Business owners incorporating in Malaysia need to register for the GST if their annual gross income exceeds RM500,000.

Annual Fees

Those incorporating in Malaysia must pay an annual fee of RM1,000 payable to SSM for registration as of this writing, plus miscellaneous reasonable agency fees.

Public Records

Confidentiality can be maintained for company owners incorporating in Malaysia through the use of nominee directors and shareholders.

Accounting and Audit Requirements

Those deciding to incorporate in Malaysia must pick a fiscal year end. This fiscal year end date can occur anytime within eighteen months of the completed incorporation. Companies are required to keep track of their income and expenses, and to do general bookkeeping that is both maintained and up-to-date.

Each year, every corporation is required to prepare its accounts. Approved auditors in Malaysia must audit these accounts annually. The corporation is required to appoint one or more approved Malaysian auditors to handle these yearly accounts. Furthermore, these audited accounts need to be made ready for the Annual General Meeting so that the shareholders of the company can either adopt or approve the documents. Once this procedure is completed, the audited accounts then have to be filed with the SSM, alongside the company’s annual returns.

Annual General Meeting

For the business owners planning to incorporate in Malaysia, a yearly meeting is required in order to nominate directors, and for tax and accounting purposes.

The Annual General Meeting (AGM) must take place within six months from the end of the accounting year. For newly incorporated businesses, the meeting must occur within 18 months from the date of incorporation.

During the meeting, the company must make sure to have its audited accounts adopted or approved by the company shareholders.

Time Required for Incorporation

Most people incorporating in Malaysia find that the entire process, from the signing of documents to their submission to registration, takes about five to ten days to complete, plus shipping time.

However, in Malaysia the timeline of incorporation can vary depending on how accurate and complete the incorporation documents submitted by the company are. Also, time can sometimes be difficult to estimate since the process depends on the availability & stability of the government’s computer system.

Shelf Companies

Shelf companies are available in Malaysia for wishing to have corporations in their hands faster.