A Marshall Islands Limited Liability Company (LLC) is governed by the Marshall Islands Limited Liability Company Act of 1996. The LLC registers with the government as a separate company from its members.

The LLC combines the best features of a partnership with an International Business Corporation (IBC). Limited liability is afforded to its members by protecting personal liability in excess of the capital investment. Similar to a partnership, LLC members can allocate losses and gains with flexibility. LLC’s are ideal for passive investments like real estate, venture capital projects, research and development projects, technology and oil. Parent-subsidiary structures for large international corporations can conveniently utilize LLC’s because either a legal entity or a natural person may be a member.

Members can choose not to be managers in a LLC by designating “managers” to run the company. Even if a member chooses to actively manage the LLC, he or she can retain limited liability privileges.

Background

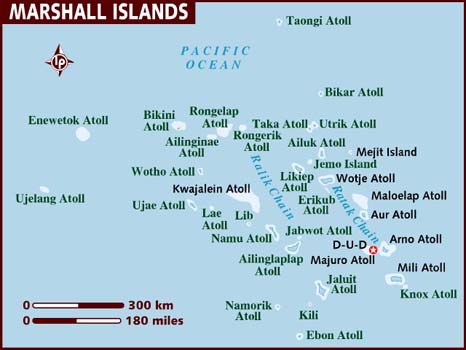

The Marshall Islands are a group of islands situated in the Pacific Ocean. Officially known as the “Republic of the Marshall Islands”. The Spanish first colonized them in then1500’s and then in 1884 they were sold to Germany. The Japanese occupied the islands during World War I. The United States conquered them during World War II and controlled them as a territory until 1979 when they were granted independence. Because of the American influence, English became its official second language and the U.S. Dollar is its official currency. Politically, they have a unitary parliamentary republic system with an elected president and a legislature.

Marshall Islands LLC Benefits

A Marshall Islands Limited Liability Company (LLC) enjoys these benefits:

• Complete Foreign Owners: Foreigners can consist of the complete membership in a LLC.

• Limited Liability: Members’ liability are limited to their capital investment.

• Privacy: Members names are not part of any public records.

• No Taxes: LLC’s do not pay any taxes as long as they do not conduct business in the Marshall Islands. However, United States citizens and anyone obliged to pay income tax on worldwide income must notify their governments of all income.

• One Member: The minimum number of members is one to form a LLC.

• One Manager: The LLC can be managed by only one manager who can be the sole member.

• Fast Registration: Registration of a LLC only takes one business day.

• No Auditing or Accounting Required: LLC’s can adopt any accounting criteria and audits are not required.

• English: As a former U.S. territory, English is the official second language.

• U.S. Dollar: Its official currency is the U.S. Dollar.

Legal and Tax Information

Marshall Islands LLC Company Name

Marshall Islands LLC’s cannot choose a name similar to other companies. The company name can be in any language with the Roman alphabet.

Two names can be reserved with the government for up to 6 months for free.

While not required, it is recommended that a LLC name include one of the following words or its abbreviation: “Limited Company” or “Limited Corporation”.

SERIES LLC

The Marshall Islands offers the opportunity to form a different type of LLC called the “Series LLC” (SLLC) which is based upon the Delaware SLLC in the U.S.

This is a LLC containing separate units (called “series”) which operate independently from the other units. Each unit in a SLLC can own separate assets with different members and managers completely autonomous from the other units. Each unit operates independently and isolated from the liabilities of the other units. In essence, one client can have multiple LLC’s with different assets and risks under the umbrella of one LLC. This saves time and costs from having to form separate independent LLC’s for each assets or groups of members.

Trading Restrictions

LLC’s cannot conduct business activities inside the Marshall Islands. LLC’s are also prohibited from engaging in assurance, banks, collective investment offers, any type of insurance services, reinsurance, trust services, trust managements and fund managing services.

Registration

There are two required documents to be filed with the Registrar of Corporations to form a LLC:

1. Certificate of Formation – This establishes the LLC.

2. Operating Agreement – Defines the structure, organization, and management of the LLC with the rights and duties of the members and managers defined. Is similar to a Partnership Agreement.

Documents can be written in English.

The Registrar them issues a Certificate of Formation which establishes the LLC.

Limited Liability

LLC members are protected from personal liability in excess of their capital investment. Similar to a partnership, the LLC can be flexible with designating gains, losses, and management responsibilities. However, unlike a limited partnership where the general partner is personally liable for losses, a LLC’s members can be involved with the management without risk of personal liabilities.

Members

Members can be natural persons or legal entities from anywhere in the world. The LLC’s management structure determines the rights of members. For instance, if members equally manage a LLC, it contains the characteristics of a general partnership. If only select members have the right to manage, then the LLC becomes similar to a limited partnership. If outside managers run the LLC, it takes on a shareholder type of legal entity.

A LLC does not have to issue shares.

Management

LLC members can choose not to participate in the running of the day to day business affairs. Like shareholders, they can appoint one or more managers to run the LLC. On the other hand, members can choose to actively participate in the daily management without liability exposure.

Accounting and Audits

Audited financial accounts are not required in The Marshall Islands. Likewise, annual returns are not required. In fact, the government does not require any accounting criteria or internationally accepted procedures.

Registered Agent and Office

Every LLC must appoint a registered agent and maintain a local office address.

Minimum Authorized Capital

No minimum authorized capital is required.

Annual General Meetings

Annual general meetings are not required for either shareholders or the board of directors. If meetings are called, they can be held anywhere.

Taxation

All non-resident companies are exempt from having to pay any taxes including, income, corporate, capital gains, dividends withholding, and stamp duty since 1990 when The Marshall Islands Associations Law was legislated.

However, Americans and taxpayers from countries which tax global incomes are required to proclaim all income to their tax authorities.

Public Records

Members’ names are not in any documents filed with the Registrar and thus are never part of the public records.

Registration Time

It is estimated that registering a LLC can take one business day.

Shelf Companies

Shelf LLC companies are available in the Marshall Islands.

Conclusion

A Marshall Islands Limited Liability Company (LLC) enjoys these benefits: total foreign ownership, no taxation, limited liability, privacy, one member can be the only manager, one business day registration, no required audits, LLC free to choose any accounting criteria, English is the second official language, and its official currency is the U.S. Dollar.