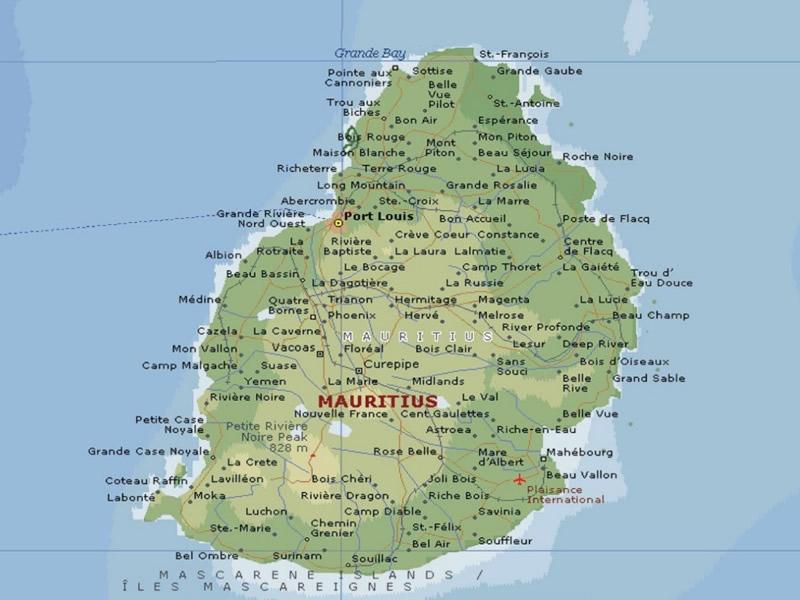

The island of Mauritius is located on the Southwest Indian Ocean near Africa. Its official name is “The Republic of Mauritius”. Its capital is Port Louis. Mauritius is also the name of the main island the country is on. Its estimated population is 1.2 million people.

A Mauritius GBC I Local Company is governed by the provisions under the Companies Act 2001.

Benefits

There are several benefits for a Mauritius GBC I Local Company including:

• Low Tax: Mauritius GBC I Local Companies have a very low income tax rate of 3%. Also, these companies qualify for benefits under the country’s tax treaty network. However, U.S. citizens and residents of countries who have worldwide taxation must declare all income to their tax authorities.

• Tax Exemptions: A Mauritius GBC 1 Local Company is exempt from all capital gains taxes. Also, they do not need to pay withholding tax on payment of dividends, interests, and royalties.

• Low Minimum Required Capital: Mauritius GBC I Local Companies only require a minimum share capital of $1 USD.

• Company or Corporate Formation Options: Mauritius GBC I Local Companies give business owners a variety of incorporation options, including incorporating as a public or private corporation, filing for a Limited Life Company status or Protected Cell Company.

• Options Regarding Shares: A GBC 1 Local Company can have registered shares, preference shares, redeemable shares and shares with or without voting rights

• One Shareholder: A Mauritius GBC 1 Local Company is required to have at least one shareholder.

Company Name

A Mauritius GBC I Local Company must register a unique name that is not similar to the names of already existing companies or corporations.

Office Address and Local Agent

A Mauritius GBC I Local Company must have a registered local agent and a local office for process service requests and official notices.

In Mauritius, only a licensed Management Company can act as a registered agent and also be the company’s secretary.

Shareholders

A Mauritius GBC 1 Local Company is required to have at least one shareholder.

Directors and Officers

A Mauritius GBC 1 Local Company must have at least one director who must be a local resident and natural citizen. In order to qualify for treaty access, the company then must name two local directors.

A Mauritius GBC 1 Local Company must also have a local registered secretary, which can also be the company’s registered local agent.

Authorized Capital

A Mauritius GBC 1 Local Company only needs to pay an authorized share capital of US $1.

Taxes

A Mauritius GBC 1 Local Company can expect to pay income taxes at a maximum rate of 3%.

Benefits are available under the Mauritius tax treaty network once the company qualifies as a tax resident in Mauritius.

Mauritius GBC 1 Local Companies are exempt from capital gains taxes and not required to pay withholding tax on dependents, interests, or royalties.

Annual Fees

A Mauritius GBC 1 Local Company pays annual renewal fees including:

- A payment to the Financial Services Commission (FSC) of Mauritius of $1,500 USD per year.

- A payment to the Registrar of Companies of Mauritius of $250 USD per year.

Public Records

Nominee share holders can be used for a Mauritius GBC 1 Local Company, but to qualify as a Mauritius GBC 1 company under the treaty, beneficial owners should be disclosed.

Company tax records and financial filings, which are required annually, are not filed as public records.

The law provides confidentiality to the effect that no disclosure on global business entities shall be made by FSC employees to any authority in Mauritius or elsewhere. However, there are a few exceptions to this rule:

- A court order regarding money laundering or arms trafficking pursuant to relevant Mauritian laws or if required under any international treaty; or

- a court order for the purpose of any official enquiry or trial relating to the trafficking of dangerous drugs and narcotics; or

- An existing agreement or treaty that Mauritius may have allowing exchange of information with other countries.

Accounting and Audit Requirements

A Mauritius GBC I Local Company must file a yearly tax return through the Mauritius Revenue Authority (MRA). In addition, a GBC 1 company must also file, at least six months after the close of the fiscal year, an audited profit and loss account and balance sheet with the Financial Services Commission (FSC). The accounts prepared for the FSC must meet their standards and requirements.

All Mauritius GBC 1 Local Companies are expected to keep records that include business accounting, meeting minutes, a members’ register, and a list of holders and officers. Furthermore, it is important for a Mauritius GBC I company to also keep an up-to-date Register of Charges and a Register of Interests. If there is a change with the company, the GBC 1 is expected to file notice of it in order to avoid penalties.

Annual General Meeting

A Mauritius GBC I Local Company must hold an annual general meeting as well as board meetings which must be held in Mauritius.

An annual meeting must be held not later than 15 months of the previous meeting and not later than 6 months after the balance sheet date of the company.

Time Required for Registration

A Mauritius GBC I Local Company can expect to wait about three weeks for the registration process to complete. This turnaround time is based on how efficiently the company submits both its registered name, and how accurately they complete the corporate registration documents.

Shelf Companies

A Mauritius GBC I Local Company can purchase shelf companies to incorporate with more ease and efficiency.

Conclusion

There are several benefits for a Mauritius GBC I Local Company including: low income tax rate of 3%, exempt from all capital gains taxes and withholding tax on payment of dividends, interests, and royalties. Only one shareholder is required to register the company. The required minimum share capital is only $1 USD. There are several options available to register either as a company or a corporation and the types of shares to issue.