NOTE: As of 2019, there are no more GBC II entities. The new structure is the formation of a Mauritius company with a Global Business License (GBL). We form Mauritius companies. So, the following article talks about the prior company type. The new one is a GBL.

Setting up a company in Mauritius is regulated by corporate legislation in Mauritius called the Companies Act of 2001. With the passing of this act, Mauritius became a modern financial hub. The GBC II Company falls under the Global Business Category 2 (GBC II) area of the Companies Act, which focuses on offshore non-tax residents in Mauritius. GBC IIs are not able to access the numerous Double Taxation Treaties which Mauritius has signed with other countries.

Other corporate legislation that influences the business sector in Mauritius includes the Financial Services Act of 2007 and the Finance (Miscellaneous Provisions) Act of 2012.

Difference Between GBC I and GBC II (GBC 1 and GBC 2)

The difference between the Mauritius GBC I and GBC II were that the GBC I was for local business owners and the GBC II was the offshore company in Mauritius that was created for people who do not live in the country. GBC stands for Global Business Company.

The following table summarizes the key differences that existed between the Mauritius GBC 1 and GBC 2 when both were available.

| Mauritius GBC I | Mauritius GBC II |

|---|---|

| For operating a business within Mauritius | Private offshore company for foreign owners |

| Taxed at 15% | Tax exempt |

| Must have a resident secretary | 100% foreign owners/officers/directors acceptable. |

| Human director only | Can have a corporate or human director |

| Must hold annual meeting | Optional |

| Must file audited accounts | Audited account filing not required |

| Filed in 15-20 days | Filed within 5 days typically |

For simplicity, the GBC II Company will be referred to as a Mauritius Corporation in this explanation.

Information about Mauritius

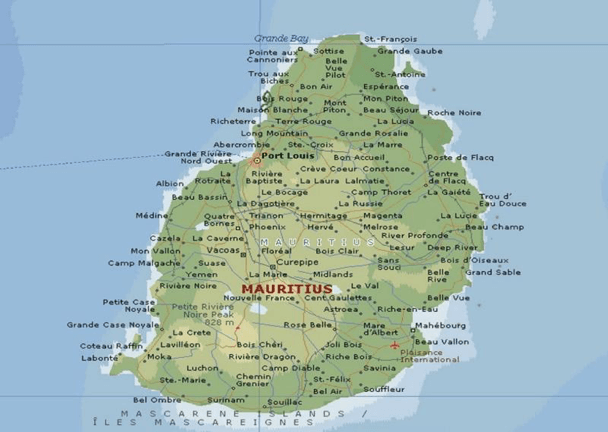

Mauritius previously was a British Colony, achieving independence in 1968 and then joining the Commonwealth. Its government is a parliamentary democracy following the British style. English is the primary language.

Below are some important benefits of a company registration in Mauritius

Mauritius Company Formation Cost

For the cost of forming a company in Mauritius visit the order section of this website by clicking on the link above or use the inquiry form or number on this page to discuss details with a staff member.

Advantages of Registering a Company in Mauritius

- Privacy: Nominee directors and shareholders can be appointed to appear on all public documents and registrations in order to offer increased privacy and confidentiality. There are no disclosures of beneficial ownership of a Mauritius corporation.

- One Director & Shareholder: One person can form a Mauritius Corporation and totally control its operations. There is no requirement for a local registered secretary as many other countries require. In other words, a one person Mauritius company is legal.

- Foreign Directors & Shareholders: There are no requirements for either the directors or shareholders to be natural citizens of Mauritius, and they can reside anywhere in the world.

- No Minimum Authorized Capital: This makes it easier for start-ups to incorporate in Mauritius.

- No Corporate Taxation: Mauritius corporations do not pay corporate taxes.

- No Annual Tax Return: Mauritius does not require filing annual tax returns.

- Foreigner Friendly: Mauritius has a stable, friendly government towards foreigners and their companies to do business there and invites offshore investors.

- Corporate Shares Flexibility: Mauritius allows registered shares and a variety of other shares such as preferred, redeemable, and fractional.

- Fast Incorporation: Registering a Mauritius corporation is quick and efficient. The entire time to complete registration can be done in as little as three days.

Corporate Name

A new Mauritius corporation must select a unique name that is not similar to any existing corporations.

Mauritius corporations must use wording that denotes the existence of the corporation in its name. These words include: Limited, Corporation, Incorporated, and Public Limited Company or their relevant abbreviations.

Office Address and Local Agent

Mauritius corporations are required to have both a registered local agent and local office address for process server requests and legal notices.

Shareholders

Mauritius corporations are required to have at least one shareholder.

Shareholders do not need to be local residents and can reside anywhere in the world.

Directors and Officers Mauritius corporations are required to have at least one director.

Directors do not need to be local residents and can reside anywhere in the world.

Directors and shareholders can be the same individuals.

Mauritius does not require its corporations to have a local registered secretary.

Authorized Capital A Mauritius corporation requires no minimum capital although at least one share must be issued and paid for.

Taxes

A corporation holding a Category 2 Global Business License does not pay any taxes on its worldwide profits to the Mauritius government.

Annual Fees

The annual renewal fee for corporations is £899

Public Records

Documents and records of the business are required to be maintained at the corporation’s registered office. These documents, however, will not be made available to the public. A Mauritius corporation can appoint nominee shareholders and directors for increased privacy.

Accounting and Audit Requirements

A Mauritius corporation must keep business records at the company’s registered office.

These records include business accounting, meeting minutes, a members’ register, and a list of shareholders and officers.

A Mauritius corporation is not required, to file a yearly tax return to the Mauritius Revenue Authority (MRA).

Annual General Meeting

A Mauritius corporation is required to hold an annual general meeting.

Time Required for Incorporation

A Mauritius corporation can expect to wait about three days for the registration process to complete. This turnaround time is based on how efficiently the company submits both its registered name, and how accurately they complete the corporate registration documents.

Shelf Corporations

Anyone can purchase shelf corporation for faster incorporation and efficiency.

Mauritius Company Formation Conclusion

You can form a Mauritius Corporation quickly which offers privacy, one person ownership, no corporate taxes, and complete foreign ownership.