A Mexico Limited Liability Company (LLC) is known as a Sociedad de Responsabilidad Limitada (S.de R.L.) in Spanish. It has the same benefits and features as many LLC’s in the U.S. Foreigners can own all of the shares in a Mexico LLC. A Mexico LLC is a corporate entity (rather than a partnership) consisting of at least two shareholders who all enjoy limited liability. However, some countries (like the United States) treat a S. de R.L. like a partnership for tax purposes.

The Mexican General Law for Commercial Entities governs the formation, activities, and dissolution of LLC’s. In Spanish it is called “Ley General de Sociedades Mercantiles” (“LGSM”). The LGSM regulates five different kind of commercial companies including LLC’s.

This is a perfect legal entity structure for small businesses by offering flexibility, control, and simplified management. Mexican LLC’s can be formed to be:

- Mexican subsidiaries for international companies;

- Conduct import-export activities;

- Owning stocks in other corporations;

- Holding company for global assets; and

- Joint Ventures.

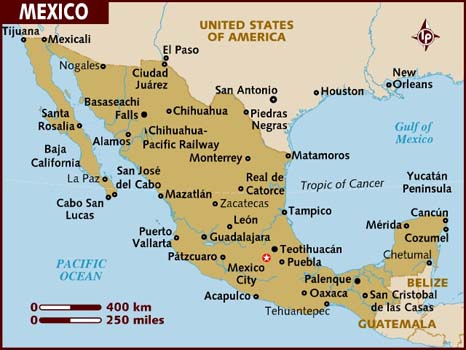

Mexican Background

Mexico is a federal republic consisting of many states under their federal government. Its official name is the “United Mexican States”. Its political system is officially a federal presidential constitutional republic with an elected President and two legislative branches (Congress) consisting of the Upper House (Senate) and Lower House (Chamber of Deputies).

Mexico LLC Benefits

A Mexico Limited Liability Company (LLC) has these benefits:

- 100% Foreign Ownership: Foreigners can own all of the shares in a Mexico LLC.

- Limited Liability: A shareholder’s liability is limited to the capital investment.

- No Corporate Tax: LLC’s are treated like partnerships for tax purposes where income passes through the LLC directly to the shareholders. Note that U.S. taxpayers and everyone obliged to pay income taxes on global income must declare all income to their tax agency.

- Two Shareholders: The minimum number of shareholders is two to form a LLC which is favored by small companies seeking limited liability.

- One Manager: The LLC can be managed by only one Administrator or by a Board of Directors if the shareholders choose.

- Low Minimum Share Capital: Currently, the required minimum share capital is less than $300 USD.

Mexico LLC Company Name

A limited liability company must select a name unique from all other legal entities names in Mexico.

The LLC’s name must end with the following abbreviation, “S. de R.L.” which is the abbreviation for Sociedad de Responsabilidad Limitada. A shorter abbreviation of “SRL” has been approved by the Mexican government.

Registration

LLC’s are formed after the Federal Mexican Ministry of Foreign Affairs approves the proposed company name. The Articles of Incorporation must have notarized signatures and state the purpose and types of business activities which the LLC will engage in. The Articles of Incorporation are registered with several government offices like the Public Registry of Commerce, the Ministry of Commerce, and Ministry of Treasury.

Limited Liability

Shareholders are only liable up to their contributions to the company.

Shareholders

The LLC must have a minimum of two shareholders up to a maximum of 50.

Shares can be sold on public stock exchanges. Transferring shares can only occur by approval of a majority of the shareholders or when the company dissolves. However, the Organizational Agreement may stipulate different methods.

LLC’s cannot issue different classes of stock. However, a LLC may offer specific stockholders certain “privileges” regarding voting rights.

Stock certificates are not issued. Stock ownership is verified by inclusion in the LLC’s Shareholders Register.

Unless the Organizational Agreement states otherwise, each shareholder will have one vote for every 1,000 MX Pesos of contribution.

Profits and losses are shared by the shareholders based on their percentage of share ownership of the company’s capital.

Management

LLC’s must be managed either by an Administrator or by a Board of Directors.

Authority over the LLC rests with the shareholders and may be exerted via General Shareholders’ Meetings.

Auditors

A LLC has the option to appoint an auditor or an auditing board by the shareholders. The auditor can either be a shareholder or an outside third party. Detailed annual financial reports for the shareholders are required unless the Organizational Agreement provides otherwise.

Registered Office and Agent

Every LLC must maintain an office address in Mexico.

A local professional registered agent must be appointed who can be a natural person or a company.

Minimal Share Capital

The required minimum share capital is 3,000 MX Pesos (currently around $270 USD).

General Meetings

General Shareholders Meetings are required. However, meetings may occur annually or whenever called as specified in the Organizational Agreement.

The manner in which these meetings may be conducted depends upon the requirements set forth in the Organizational Agreement which can expand or limit statutory laws. For instance, the Organizational Agreement may allow specific decisions to be made without calling a General Meeting like admitting new shareholders, modifying the Organizational Agreement, and hiring or firing managers.

Taxes

LLC’s, like every commercial entity in Mexico, must file monthly tax returns.

Mexico treats LLC’s as a partnership for income tax purposes allowing a pass through of income directly to the partners without a corporation tax.

Note, U.S. citizens and taxpayers from countries taxing global income must report all income to their tax agency.

Public Records

All records filed with the Public Registry of Commerce are available for public inspection. However, only the original Articles of Incorporation are filed with the Registry.

Registration Time

It is estimated that registering a Mexico LLC can take up to four weeks for approval.

Shelf Companies

Shelf companies are available for purchase in Mexico which will speed up the registration process.

Mexico LLC Conclusion

A Mexico Limited Liability Company (LLC) has these benefits: 100% foreign ownership, limited liability, no corporate tax, income tax treatment like a partnership, two shareholders to form the LLC, only one manager and low minimum share capital.