Benefits of a Niue Company

There are many benefits for company and limited company owners choosing to incorporate in Niue. These benefits include:

- Any profits the corporation makes outside of Niue are exempt from taxation.

- There typically is not any stamp duty imposed on offshore corporations in Niue.

- Corporate documents for corporate registration can be completed in any language, as long as an English translation is also provided.

- Corporate shares can be issued as either register or bearer.

- Shareholders and directors can either be private individuals or corporate entities.

- All a company or limited company needs to form a corporation is one director and one shareholder. This fact helps to speed up the efficiency of the incorporation process, making things quite easy to complete.

- Information regarding owners and directors is not made to the public, thus meaning there is confidentiality when forming a corporation in Niue. Therefore, privacy for corporations in Niue is generally upheld.

- Offshore corporations in Niue are not required to file an annual tax return. They are required, however, to pay annual license fees to avoid any penalties imposed by the government.

- Offshore corporations are not required to register the details of their first directors or any subsequent changes that may occur after incorporation. This factor allows companies a good deal of confidentiality overall.

- Company meetings can be held anywhere in the world, allowing some corporate space from restrictive practices.

- The annual registration fees for offshore corporations in Niue are extremely affordable, and typically cost about $150 yearly.

- The official language in Niue is English, making communications for Americans wishing to incorporate offshore here very beneficial.

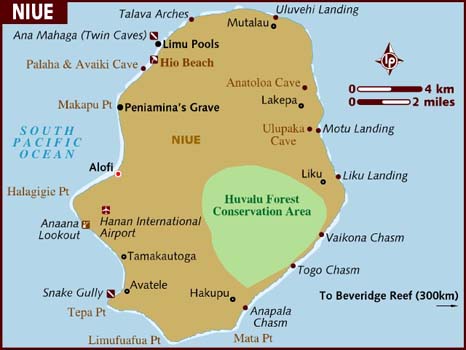

- The Island also have a planned tourism industry which is developing steadily.

- The time it takes to complete the incorporation process in Niue is relatively quick. Typically, registration can be completed in a week or less.

- The government in Niue is known to be open to foreign investors, and provides a very supportive culture and atmosphere for offshore [1]. corporations.

- Can open a bank account in the Niue company name.

Corporate Legislation

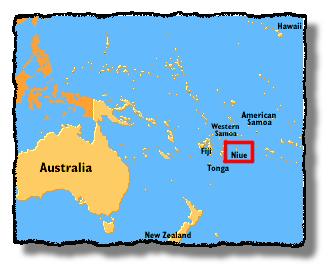

The legal system in Niue is based on the English system of common law. The Island is a self-governed country lead by an assembly of twenty members, and the head of the assembly is the Premier. Niue relies on New Zealand for defense as well as international affairs. Furthermore, Niueans are considered New Zealand citizens.

In 1984, corporate offshore legislation came to the shores of Niue with the IBC Act of 1994. The introduction of this Act allowed for insurance and trust legislation to enable the Island to offer a complete range of offshore products.

Corporate Name

Company and limited company owners wishing to incorporate in Niue must pick a unique name not registered to any other already existing corporations.

On payment of a small fee, names can be reserved for thirty days. Names can also be reserved for 72 hours free of charge.

The name of the IBC must indicate that the company has limited liability by ending in Limited, Corporation, or any foreign equivalent approved by the Registry. The following words cannot be used: Assurance, Bank, Building Society, Chamber of Commerce, Chartered, Co-operative, Imperial, Insurance, Municipal, Royal or Trust Company, or any derivatives thereof, without prior approval.

Also, the Latin alphabet must be used when selecting a name.

Office Address and Local Agent

Company and limited company owners incorporating in Niue are required to have both a registered local agent and a local office for process service requests.

Shareholders

Company and limited company owners incorporating in Niue must have at least one shareholder. A government register of shareholders is optional. Bearer shares are also allowed for company formation in Niue.

Directors and Officers

Company and limited company owners incorporating in Niue must have at least one director. Directors can be shareholders.

Companies do not need to pick local directors, and directors can reside anywhere in the world. A government register of directors is optional.

A company secretary is not required, but usually one is appointed. Corporate directors are permitted for registration in Niue.

Authorized Capital

The standard authorized capital for company and limited company owners incorporating in Niue is US $10,000 divided into 10,000 shares of US $ 1. The authorized share capital can be expressed in any currency, or in a mixture of currencies. The minimum issued capital is one share of no par value or one share of par value.

Taxes

Niue corporations are not taxed on offshore profits. Furthermore, profits made outside of Niue are exempt from taxation as far as offshore corporations are concerned.

Annual Fees

Annual registration fees for company and limited company owners incorporating in Niue includes the government fee and local agent fee. The price/cost varies but is quite reasonable.

Public Records

For Niue corporations, there is no disclosure of the beneficial owner.

There are no specific provisions governing secrecy but the common law duty of confidentiality owed by professionals to their clients applies.

Government registers of both shareholders and directors are optional.

Accounting and Audit Requirements

Filing annual returns is required for company and limited company owner incorporating in Niue to maintain company incorporation status. However, companies are typically not required to submit accounts. Still, companies are expected to keep track of financial records and transactions.

Annual General Meeting

Local annual meetings are not required for companies registering in Niue.

Time Required for Incorporation

Company and limited company owners incorporating in Niue can complete the process in as little as two to five days. However, the filing and turnaround can sometimes take longer depending on both name registration and how the company completes the documentation process.

Shelf Companies

Shelf companies are available in Niue for company and limited company owners wishing to incorporate faster.

With so many benefits for company and limited company owners incorporating in Niue available for businesses, one can see why many choose this jurisdiction for registration. With a low tax rate, and a low authorized capital requirement, Niue is a perfect place for many start-ups to build their roots. The efficient speed of the registration as well as the culturally friendly attitude towards offshore investments makes Niue a great place to incorporate.