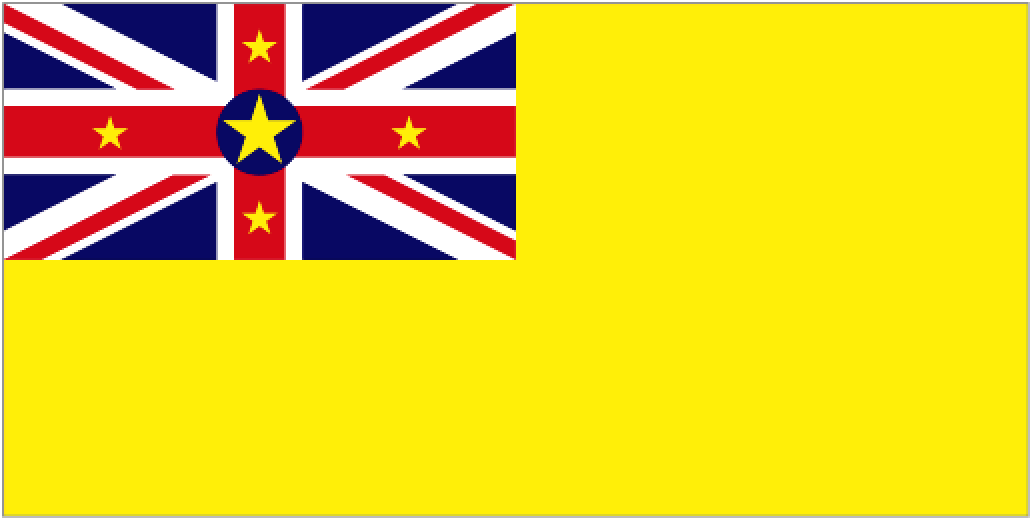

Niue is an island country in the South Pacific Ocean near The Cook Islands and New Zealand. Its land area is 100 square miles (260 square kilometers). Its approximate population of 1,700 is mainly Polynesian. Locals commonly refer to the island as “The Rock”, in reference to its traditional name “Rock of Polynesia”.

Niue is a self-governing state led by an assembly of twenty members with the head of the assembly is its Premier in free association with New Zealand. Its capitol is the village of Alofi. Niueans are citizens of New Zealand.

Niue’s legal system is based on the English Common Law system. Niue relies on New Zealand for its military defense as well as international affairs.

Niue enacted corporate offshore legislation with the IBC Act of 1994. The introduction of this Act allowed for insurance and trust legislation to enable the Island to offer a complete range of offshore products.

Benefits

There are many benefits for a Niue corporation including:

• No Taxes: All profits earned by Niue corporations outside its borders are not taxed. However, U.S. citizens and those residing in countries which tax worldwide income are required to report their income to their tax authorities.

• No Stamp Duty: Niue does not impose a stamp duty on goods and products imported in its country by its corporations.

• English is popular: While corporate documents can be in any language, and English translation is required. English speaking investors find this to be very convenient.

• Bearer Shares are allowed: Niue corporations are permitted to issue bearer shares for the privacy of the shareholders.

• One Shareholder: Niue allows a minimum of one shareholder to form a corporation. In addition, only one director is required and both can either be a natural person or a corporation.

• Privacy: Niue corporations will not have their shareholders and directors named in public records.

• No Tax Returns: Niue does not require its offshore corporations to file annual tax returns. The only annual filings are the corporate renewal fees.

• Confidentiality: After incorporation, offshore corporations are not required to register any changes in directors or other significant changes.

• No Annual Meetings Anywhere: Corporation annual meetings are not required.

• Low Renewal Fee: Niue corporations only pay $150 USD for their annual renewal fee.

Corporate Name

Niue corporations must pick a unique name not registered to any other already existing corporations. Names can also be reserved for 72 hours free of charge. Or, names can be reserved for thirty days after paying a small fee. The Latin alphabet must be used when selecting a name.

The following words cannot be used: Assurance, Building Society, Bank, Chamber of Commerce, Co-operative, Chartered, Imperial, Municipal, Insurance, Royal or Trust Company, or any equivalents, without prior approval.

Office Address and Local Agent

Niue corporations are required to have both a registered local agent and a local office address for process service requests and official notices.

Shareholders

Niue corporations must have at least one shareholder. A government register of shareholders is optional. Bearer shares are also allowed for Niue corporations.

Directors and Officers

Niue corporations must have at least one director. Directors can be shareholders and can reside anywhere in the world. A government register of directors is optional.

A company secretary is not required, but typically one is appointed.

Authorized Capital

The normal authorized capital for Niue corporations is $10,000 USD divided in to 10,000 shares of $1 USD. The authorized share capital can be expressed in any currency, or in a mixture of currencies. The minimum issued capital is one share of no par value or one share of par value.

Taxes

Niue corporations are not taxed on offshore profits. They are taxed if they earn income doing business inside Niue borders.

Annual Fees

Annual registration fees for Niue corporations typically costs about $150 USD.

Public Records

For Niue corporations, there is no disclosure of the beneficial owner, directors, or shareholders as the registration of their names with the government is optional.

While there are no specific laws governing secrecy, the common law duty of confidentiality owed by professionals to their clients applies.

Accounting and Audit Requirements

Niue corporations must file annual returns to maintain company incorporation status. However, corporations are typically not required to file accounting records. But, corporations are expected to keep track of their financial records and transactions.

Annual General Meeting

Local annual meetings are not required for Niue corporations.

Time Required for Incorporation

Niue incorporation process is estimated to be completed in as little as two to five days. However, the filing and turnaround can sometimes take longer depending on both the name registration and how the corporation completes the documentation requirements.

Shelf Corporations

Shelf corporations are available in Niue for faster incorporation.

Conclusion

Niue offers its corporations many benefits including: no corporate or income taxes, no tax return filings, no stamp duty, privacy, one shareholder incorporation, popularity of the English language, a low authorized capital requirement, no annual meetings required, bearer shares, and low renewal fees.