A Niue Limited Liability Company (LLC) is a separate legal entity from its shareholders. Foreign ownership of all the shares is permitted. Limited liability for the shareholders is allowed.

The Niue Companies Act of 2006 and the Companies Regulations of 2006 governs and regulates LLC’s in Niue. The Registrar of Companies handles all applications for new companies.

Background

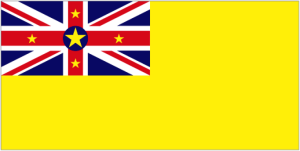

Niue is the world’s smallest self-governing country. It is an associate member of the British Commonwealth by virtue of being a Protectorate of New Zealand which retains responsibility for external affairs. Otherwise, Niue maintains control over its own internal affairs. Polynesian is its primary official language while English is its second official language. All legal documents can be prepared in English.

Benefits

A Niue Limited Liability Company (LLC) has the following benefits:

• 100% Foreign Owners: Foreigners can own 100% of the shares in a Niue LLC.

• Limited Liability: Shareholders’ liabilities are limited to their capital investment.

• No Taxation: Niue is a territorial taxation country where all income earned outside of Niue is free from corporate and income taxes. However, U.S. taxpayers and everyone taxed on global income must report their income to their tax officials.

• One Shareholder: The minimum number of shareholders is one to form a LLC in Niue.

• One Director: Only a minimum of one director is required to form the LLC.

• Privacy: None of the owners, shareholders, or directors names are part of the public records.

• No Minimum Share Capital: No minimum share capital is required.

• English: As a British Protectorate, English is its second official language. Every document can be in English.

LLC Company Name

A limited liability company must pick a name unique from all other company names in Niue. The government maintains a company registry of names already used to help applicants with choosing a unique company name.

Every LLC must include the abbreviation “LLC” at the end of their company name.

Registration

Niue LLC’s are formed by submitting the required application form along with a separate written consent form from the directors to the Registrar of Companies. After approval, a Certificate of Incorporation can be quickly sent to the applicant via email which can also be verified on the Registrar’s website.

Limited Liability

The LLC is a separate legal entity from its shareholders. The company is fully liable for all of its obligations.

Each shareholder’s liability for losses is limited to his/her company shares contribution. The only exceptions are when the company continues to do business while insolvent, or the directors provide personal guarantees for company debts, or the company acts “recklessly” in its business activities.

Once the company is unable to pay its debts and liquidation process begins, shareholder’s liabilities end unless:

• They failed to completely pay for their shares prior to the liquidation process. Then the unpaid amount must be paid to the liquidator.

• Provided personal guarantees to creditors or lenders, like suppliers and banks.

• They are company directors who traded in a “reckless” manner.

Perpetual

The LLC will continue to exist until it is removed from the Registry. It can remain in existence through numerous ownership or management changes.

Shareholders

The LLC can have a minimum of one shareholder. Unless the company’s Constitution provides otherwise, shareholders can sell or transfer their shares at any time. This allows for easy share transfers to heirs or third parties.

The company is under the control of its shareholders who all have voting rights including the election and removal of directors.

Directors

A minimum of one director can manage the company. Very often the shareholder with the largest percentage of the total shares becomes the managing director of the company.

Directors must be natural persons because corporations or other legal entities are prohibited from being directors. The company’s Constitution and the Act prescribe the duties of a director.

When a shareholder becomes a director that person has increased obligations to act responsibly and to avoid any conflict of interests.

Accounting

LLC’s must maintain the following types of company records:

• Share Issues;

• Share Register;

• Distributions to Shareholders;

• Annual General Meeting Minutes;

• Accounting Records (Financial Statements);

• Annual Returns;

• Filing Documents;

• Adopting & Modifying Rules

Registered Office

LLC’s must maintain a local registered office with a Niue physical and postal address. The physical address does not have to be the actual company’s place of business. Any change in address must be filed with the Registrar at least 5 business days before taking effect.

Minimum Share Capital

No minimum share capital is required. However, a LLC can establish any value for the company shares when registering. The initial value of shares is called “nominal value”. The company can then assign the share values in any proportion agreed to by the directors. For instance, 1,000 shares at $1 USD each have a total company capital value of $1,000. This can be divided unequally between directors such as Director A with 600 shares ($600) and Director B with 400 shares ($400).

Annual General Meetings

It is mandatory to hold annual General Shareholders Meetings. However, the initial general meeting can be held within 15 months of incorporation.

Taxes

Only income earned within Niue borders are taxed. All offshore income has no corporate or income taxation.

Note, U.S. citizens and taxpayers from countries taxing worldwide income must declare all income to their tax authorities.

Public Records

All records filed with the Registrar of Companies are available for public inspection. However, no names of owners, shareholders, or directors are disclosed because their names are never filed with the Registrar.

Registration Time

Registering a Niue LLC can take up to two business days for approval.

Shelf Companies

Shelf companies are available for purchase in Niue to make the registration process faster.

Conclusion

A Niue Limited Liability Company (LLC) has these benefits: 100% foreign ownership, limited liability, no taxes, privacy, one shareholder, one director, no required minimum share capital, and English is the official second language.