A Romanian Limited Liability Company (LLC) limits the liability of its shareholders. Only one shareholder is required. Only a minimum capital of 45 Euro is required to form.

Romanian law which governs a limited liability company called a “Societate cu Raspundere Limitata” (S.R.L.) allows total foreigner ownership. Foreign investors are treated just like Romanian investors under the law with equal rights to start a business and form a legal entity.

Background

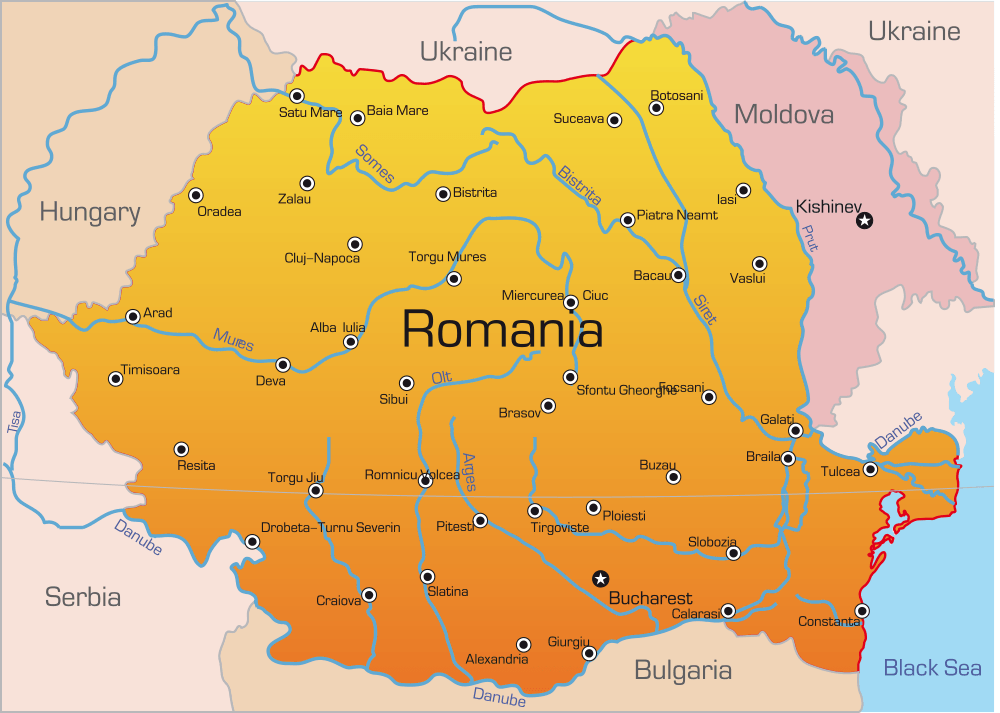

Romania is a South Eastern European country and a full member of the European Union (EU). Its political structure is a unitary semi-presidential republic. It has a two house Parliament.

Benefits

A Romanian Limited Liability Company (LLC) can have these types of benefits:

• Totally Foreign Owned: Foreigners can own the entire LLC.

• Limited Liability: Shareholders’ liabilities are limited to their subscribed capital contributions.

• Fast Approval: The LLC can be approved in three work days.

• One Shareholder: A minimum of one shareholder is required to form a LLC.

• One Director: LLC’s can have one director or more if desired.

• Privacy: Shareholders’ names do not appear in any public records.

• E U Membership: Romania has full membership in the European Union.

Limited Liability Company (LLC) Name

The name of a LLC cannot be similar to any other Romanian company. The Trade Register Office can reserve a company name before registering.

Every LLC must end its company name with either the words “Limited Liability Company” or its abbreviation “LLC”.

A company name claiming a specific geographic location or claiming to be associated with Romania or any of its agencies must obtain prior approval from the government.

Registration

A new LLC must file the following information with the National Trade Register Office:

• Articles of Incorporation;

• Corporate shareholders’ Articles of Incorporation;

• Certificates of Incorporation by respective governments of corporate shareholders;

• Trade Register Office excerpts from the country where corporate shareholders are incorporated;

• Letter of creditworthiness from a bank or financial institution on behalf of each corporate shareholder;

• Copy of director’s ID (passport, national ID, etc.); and

• Formal filled in application form.

Within 30 days of registering for incorporation, the company must register with the Romania Fiscal Authority.

Upon successfully filing all required documents and information, it will normally take three business days to process them.

After approval, the newly registered company must register with the Labor Authority, Social Security Authority, and the Tax Authority.

Limited Liability

A shareholder’s liability is limited to the subscribed capital contribution.

Shares

A minimum of one shareholder is required to form a LLC. The maximum number of permitted shareholders is 50.

A shareholder can be a foreigner living in another country. Shareholders can be legal entities or individuals who can only be the single shareholder in one limited liability company at a time. In addition, a LLC cannot have another LLC as its sole shareholder.

Shares cannot be sold to the general public or even outsiders without prior approval by at least 75% of the shareholders.

Bearer shares are not permitted for a LLC to issue.

Directors

The LLC can be managed by one or more directors. The Articles of Incorporation may provide the names of the appointed directors. Or, they can be appointed during a Shareholders’ General Meeting.

Only natural persons can be appointed as directors.

Legal Representative

In addition to appointing a director, the LLC must also appoint a legal representative who will interact with the government and third parties.

Minimum Capital

Currently, the required minimum capital is 45 Euro. The registered minimum authorized capital must be at least 200 RON. The minimum registered share capital value is 10 RON. LLC’s have the option to issue shares or social parts.

LLC shares are prohibited from being used as collateral for loans. In addition, LLC shares cannot be freely exchanged. In essence, a LLC is a private company and not a public one.

Registered Office Address

Every LLC must maintain a local registered physical office address which cannot be a P.O. Box. The reason for this is that Romania requires a physical office location to accept legal notices, service of process, and to be contacted by the tax authorities.

Taxes

Romania’s normal corporate tax rate is 16%.

The Value Added Tax (VAT) in Romania is a flat 19%. Registration for a VAT number is mandatory for all companies conducting business within Romania. However, non-resident owned LCC’s who will not conduct business within Romania has the option to register for a VAT number in case the company conducts future commerce in Romania.

Accounting

If the LCC has more than 15 shareholders, the appointment of an auditor is mandatory.

Not every LCC is required to conduct an audit as the law and certain types of business activities may trigger the requirement for audits. However, a financial auditor may be appointed if a resolution requiring one is passed at a shareholders’ general meeting.

Annual General Meetings

LLC’s must hold an annual general meeting of its shareholders. A quorum requires at least 3/4 of the total amount of shares to attend. A simple majority can pass resolutions.

Public Records

While individual shareholder’s names will not appear in any public records, corporate shareholders names are part of the public records. In addition, the names of the directors are also part of the public records.

Time for Registration

LLC’s can expect the registration process to be completed in three business days.

Shelf Companies

Shelf companies are available in Romania.

Conclusion

A Romanian Limited Liability Company (LLC) enjoys these benefits: complete foreign ownership, limited liability, one shareholder, one director, privacy, quick approval, and membership in the European Union.