Seychelles company formation with a bank account is a very popular option for people seeking financial privacy. It is very easy as you can register your Seychelles company online. Such corporations are formed under the Seychelles International Business Companies Act.

There are many robust banks in the Seychelles in which you can house your company bank account. Our organization forms companies and bank accounts in the Seychelles and has been operational starting in 1906. So, simply complete the consultation form on this page or utilize one of the phone numbers displayed above. You can get information based on your particular needs and can register your own Seychelles IBC.

Seychelles Offshore Company Benefits

The primary advantages to forming a Seychelles offshore company are as follows:

- No Taxes: Seychelles corporations (IBC) are legally exempt from taxes. This includes duties on all income and profits. That is as long as they do not conduct business within the borders of the Seychelles. An exception is that the company can have a Seychelles bank account. Keep in mind that the US taxes its citizens on worldwide income. Many other countries require those residing within its borders to, likewise, pay taxes on global income.

- Easy and Fast Incorporation: Seychelles company incorporation process is quick and efficient, and could only take one day.

- One Shareholder: Only one director and one shareholder are required to start a Seychelles IBC.

- Privacy: Seychelles IBC corporations receive a good deal of privacy and confidentiality. There is no disclosure of shareholder and director names in public records.

- Bearer Shares: Seychelles IBC corporations are allowed to issue bearer shares for further privacy of their shareholders.

- No Annual Tax Returns: Seychelles IBC’s do not have to file annual tax returns.

- Low Cost: Seychelles company formation is very affordable. Plus, they have a low annual renewal fees.

- Privacy: No information sharing agreements with other jurisdictions.

- Zero Capital Up Front: Seychelles IBC act does not require paid up capital to form a company.

- No Accounting Requirements: Unlike other jurisdictions, there is no requirement to submit accounting statements, conduct audits or report taxes. (Though you may need to report to your own government.)

- Easy to Operate: One can hold shareholders meetings, anywhere including electronically.

Seychelles Shell Company

Shell companies are available in the Seychelles for faster incorporation. These are companies that are already formed. Thus, it is a matter of placing an order and the company is shipped to you right away. You can even opt to amend the name of the company if you wish.

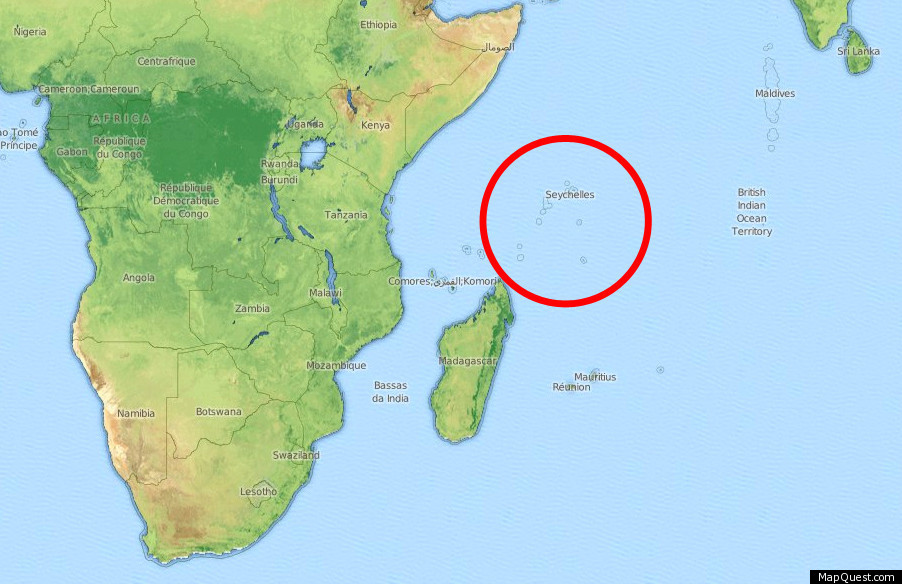

About Seychelles

Seychelles is a country and an archipelago in the Indian Ocean. The official name is the “Republic of Seychelles”. The Seychelles proclaimed independence from the United Kingdom in 1976. Its capital is Victoria. The Seychelles consists of 115 islands and is located 930 miles (1,500 kilometers) east of mainland East Africa. It has an estimated population of 91,000.

The law that governs the incorporation and management of all corporations is the Seychelles IBC Act. This Act allows for Seychelles corporations to be tax and duty exempt. To be considered a Seychelles IBC, company or limited company owners must make sure their businesses meet these requirements:

- Business cannot be conducted in Seychelles.

- Real estate cannot be purchased in the Seychelles.

- A special license is required for all banking and insurance activities, and the company’s registered agent also require a special license.

Legal Information

Corporate Name

Seychelles IBC’s must pick a unique name that is not similar to any already existing corporations.

Office Address and Local Agent

Seychelles IBC’s must have a local office and local registered agent in order to receive process server requests and official notices. The corporation is allowed to have a main address anywhere in the world.

Shareholders

Seychelles IBC’s are required to have one shareholder.

Directors and Officers

Seychelles IBC’s are required to have one director. Non-resident directors are permitted.

Authorized Capital

The standard authorized capital for a Seychelles IBC is 100,000 shares of $1 USD value.

Taxes

A Seychelles IBC is exempt from paying taxes on any duty, income, or profits. In addition, a Seychelles IBC shareholder does not pay any taxes on income he or she earns from the IBC.

A Seychelles IBC operates as an offshore corporation that is tax-free as long as it does not engage in any type of business activities within the jurisdiction of Seychelles, (except, it may enter into business with any other Seychelles IBC`s). The law also allows for all exemptions for a Seychelles IBC to stay in force for duration of 20 years from the date of incorporation.

Annual Fees

The annual fee to maintain a Seychelles corporation is $200 USD as of this writing plus registered agent fees.

Public Records

The names of Seychelles IBC shareholders, directors, and owners are not publicly disclosed.

Accounting and Audit Requirements

Seychelles IBCs are not required to file yearly tax returns.

Annual General Meeting

An annual general meeting is required for all Seychelles IBC’s.

Time Required for Incorporation

Registering a Seychelles IBC for incorporation can take a total of one to two business days. In most cases, the incorporation registration process occurs over a period of twenty-four hours.

However, additional certification (Notary and Apostil) can take another 2 to 4 business days, the exact timing has much to do with the time spent by the relevant certification offices, which can vary.

Conclusion

A Seychelles IBC receives several benefits including: No taxes paid, no filing of annual tax returns, easy and fast incorporation, only one shareholder required for incorporation, privacy as the names of the shareholders, directors, and owners are not part of the public record, bearer shares can be issued for additional privacy, and a low annual renewal fee.