A Suriname Private Foundation (SPF) offers foreigners a separate legal entity with its own assets and liabilities for asset protection and estate planning purposes. Any foreigner may create a SPF to benefit his or her family who do not reside in Suriname.

Background

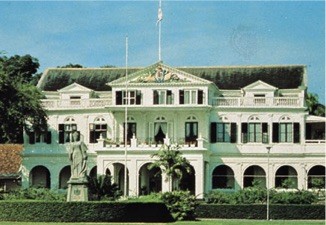

Suriname is a former Kingdom of the Netherlands territory before becoming independent in 1975. The influence that the Netherlands has had in Suriname can be seen by the architecture of many buildings in this small South American country. In addition, Dutch is its official language and the country adopted Dutch civil laws as their own.

Officially it is called the “Republic of Suriname” because its political system is that of a republic with a one house democratically elected parliament.

Suriname is bordered by Guyana which a former British colony was called “British Honduras” with English as its official language. Another country bordering Suriname is Brazil a former Portuguese colony where Portuguese is its official language. French Guiana is the other bordering country and as its name implies used to be a French colony. These four countries are the only non-Spanish speaking countries in all of Latin America.

Benefits

A Suriname Private Foundation (SPF) provides foreigners with these type of benefits:

• Complete Foreign Participants: The SPF may be created by foreigners to benefit other foreigners with assets in countries outside of Suriname.

• Tax Exempt: The SPF and the beneficiaries are exempt from all taxation. Note: U.S. taxpayers and anyone paying taxes on global income must report all income to their governments.

• Privacy: Foundations do not register with the government assuring all information remains private.

• Fast Establishment: Depending upon the speed of the preparer, the SPK can be established in one day.

• Asset Protection: The SPF owns all of the assets preventing future creditors of the beneficiaries and founder from filing claims against the assets.

• Estate Planning: SPF’s offer a perfect vehicle for family estate planning.

• English: Even though Dutch is the official language, legal documents may be prepared in English.

Suriname Private Foundation (SPF) Name

The SPF must select a name not being used by another legal entity in Suriname.

The Dutch translation for a “Private Foundation” is “Particuliere Stichting” where either word may be used or simply the abbreviation for a Suriname Private Foundation as “SPF”. As an alternative, the word “Foundation” may also be used at the end of its name.

Difference from a Corporation

A foundation differs from a corporation by not having shareholders or members, nor capital separated into shares. Unlike a corporate board of directors who answers to their shareholders, the foundation’s board does not answer to members or shareholders.

A foundation also differs from a limited liability company by not having any capital, quotas, or members.

Asset Protection

The founder may transfer ownership of all of his or her assets at the time of forming the foundation with a notarial deed. Or, the founder may transfer some initial assets and more later on.

All of the assets are owned by the foundation which is a separate legal entity. After the founder transfers ownership of his or her assets to the foundation, future creditors will be unable to seize the assets to pay for the founder’s debts.

The beneficiaries do not own the foundation’s assets. They may be classified as “beneficial owners” or “economic owners” which implies possible ownership of the assets at a future time. Until then, the beneficiaries’ creditors will not be able to attach or seize the foundation’s assets to pay for the beneficiaries’ debts.

Establishment

The SPF can be established with a notarial deed signed in front of a civil law notary in Suriname. If the founder is not able to travel to Suriname, an authorized legal representative may execute the necessary signature in front of a local notary.

Similar to a corporation, a foundation executes Articles of Incorporation which sets forth the rules and terms for managing the foundation and administering its assets. The Articles must include the name of the foundation and its purpose, along with appointing the first management board and how managing directors are appointed and removed, the local registered address, and how the assets will be distributed upon dissolution of the foundation.

Founder

The founder is the person who creates the private foundation for either a purpose based upon a future event or on behalf of specific persons.

Suriname places no restrictions as to the nationality or place of residence of a founder.

Management

The initial management board is designated in the Articles of Incorporation which states how they may be removed and replaced and compensated. Unless the Articles state otherwise, the initial management board fills vacancies at their sole discretion. The Articles may designate another person to appoint new board members.

The managing board consists of one or more directors while managing the foundation. The Articles provides the powers of the management board. In addition, the Articles may provide for a supervisory board to supervise the managing board and designates what powers the supervisory board has.

Beneficiaries

The ones benefiting from the foundation are known as the “beneficiaries”. No restrictions exist regarding what nationalities or places of residency any of the beneficiaries can have.

Taxes

Income taxes are only imposed on residents on their worldwide income. Non-residents only pay taxes on income from certain sources in Suriname.

Capital gains are taxed when only derived from Suriname sources.

There are no gift taxes in Suriname.

An association may distribute shares in the profits exempt from all taxation as long as the association’s purpose is not related to professional or business activities by the members.

Therefore, a private foundation with a non-resident founder, non-resident beneficiaries, and with all assets located outside of Suriname obtains the same tax treatment as an association. Since the beneficiaries are not engaged in any business or professional income producing activities, the income or distribution of assets to the beneficiaries will be exempt from all taxes.

However, U.S. residents and all others paying taxes on worldwide income must report all income to their tax authorities.

Public Records

Foundations do not register with the government. Therefore, all details regarding the foundation, its founder, the beneficiaries, and assets remain private and not part of any public records.

Time for Establishment

The SPF can be established in one day depending upon the speed of the preparer.

Conclusion

A Suriname Private Foundation (SPF) offers foreigners these benefits: full foreign participation, total tax exemptions, privacy, fast formation, estate planning, asset protection, and all documents can be prepared in English.