A Switzerland Corporation / S.A. (Société Anonyme) is also known as an “AG” or “PLC” is a highly respected company. Foreigners can form a Swiss S.A. and own all the shares.

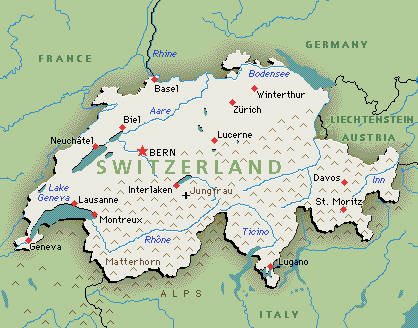

Switzerland’s Civil Code governs all commercial entities. However, instead of a centralized federal registration system, each of the 26 cantons (like a state or a province) each business is domiciled in one canton. Every canton has its own Commercial Register (Registre du Commerce/Handelsregister).

Background

Switzerland is located in Western-Central Europe. It has 26 cantons (similar to states and provinces) forming a federal republic which is why its official name is the “Swiss Confederation”.

The official languages are: German, French, Italian, and Romansh. Its population is estimated at 8.5 million. Citizens in the Eastern part of Switzerland speak French while citizens in the Western part speak German.

Its political system is a federal semi-direct democracy under a multi-party parliamentary directorial republic with an Upper and Lower House legislature.

Switzerland Corporation /. S.A. Benefits

A Switzerland Corporation (S.A.) has these benefits:

• Foreign Ownership: Foreigners can own all the shares in a S.A.

• Anonymous: Shareholders’ names are not listed in the government’s Public Registry.

• Nominees: For added privacy, nominee shareholders and directors are available.

• Bearer Shares: The issuance of bearer shares for the privacy of its shareholders is permitted.

• One Shareholder: Only one shareholder is required to form a S.A.

• One Director: S.A.’s only require a minimum of one director who can be the sole shareholder.

Switzerland Corporation (S.A.) Company Name

Like every country, a Swiss Corporation must select a company name not similar with any other legal entity. Prior to incorporating, the proposed company name availability can be verified with the government’s Company Registry.

The company name must end with either the words “Société Anonyme” or its abbreviation “S.A.”.

Formation

The S.A. must be registered with the Swiss Company Registry and the Swiss Commercial Registry.

The incorporator must appear before a notary to sign the necessary formation documents which includes the Public Deed of Incorporation and the Articles of Association. The Register then issues a Registration Certificate for the new corporation. Then the names of the shareholders along with the Articles of Association are published by the Registrar kin the official Commercial Gazette.

The entire registration process may take from 3 to 5 working days.

Articles of Association

The Articles of Association for a S.A. must include the following information:

• Corporation name;

• Corporation address in Switzerland;

• Purpose for the corporation;

• Share capital total amount and number of shares issued;

• Shareholder and general meetings conditions; and

• Appointment of administrators and auditors.

Shareholders

Only one shareholder is required to form a S.A. corporation. The sole shareholder may be an employee of the corporation. There is no limit on the number of shareholders. Nominee shareholders are allowed.

Simple share transfers are allowed without any formalities or restrictions.

Cash and “in-kind” share contributions are allowed.

Directors

A minimum of one director must be appointed to manage the corporation. The director must be a Swiss resident. Only natural persons can be appointed as directors. One director can consist of the entire Board of Directors for a single shareholder company. Multiple board membership requires at least one of them to be a Swiss resident. A nominee Swiss resident director may be appointed.

By law, when more than one member is on the board each member must sign approved resolutions and decisions, unless the Articles of Association provide otherwise.

Registered Agent and Office

Every S.A. has to have a local office address and a local registered agent to accept official notices and service of process.

Annual General Meeting

Annual general shareholders meetings are required. General meetings are normally called by the Board of Directors. In some situations, it may be called by the company auditor. A shareholder owning more than an aggregate par value of at least 1 million Swiss Francs or more than 10% of the stated capital can request the Board of Directors to call for a general meeting.

Minimum Share Capital

The required minimum share capital is 100,000 CHF. When incorporating, at least 50% of the minimum share capital must be fully paid. In-kind contributions are allowed in lieu of cash.

Accounting and Auditors

Accounting and bookkeeping are mandatory and must adhere to internationally accepted standards. Annual financial statements are required to be filed with the government.

Normally all financial statement must be reviewed by an auditor. However, small S.A.’s with less than 10 employees the shareholders have the option to not require an auditor’s review.

Taxes

Each S.A. files its own tax returns as a separate corporation. New corporations are required to apply with the Federal Tax Administration after incorporation is approved by the Commercial Register.

Taxes are levied by each canton which has different tax rates and the federal government. The corporate tax rates may vary based on these ranges:

•Cantonal tax on capital: 0.05% – 0.3%

•Cantonal tax on profits: 5.9% – 16%

•Direct federal taxes on profits: 8.5%

•Total tax burden: 14.5% – 25%

Switzerland has the lowest VAT (Sales Tax) in Europe at 8%. New corporations must register for a VAT number with the local Federal Tax Administration.

Public Records

The names of directors and shareholders are part of the public records of the Commercial Registry which are accessible to the public.

Time for Registration

A new S.A. can be formed between 3 to 5 business days.

Shelf Companies

There are no shelf companies available to purchase.

Form a Switzerland Corporation (S.A.) Conclusion

A Switzerland Corporation (S.A.) has these benefits: 100% foreign ownership, one shareholder, one director, anonymous ownership, bearer shares are permitted, and nominee shareholders and directors available.