A Turks and Caicos Exempt Company provides foreigners with a tax exempt company for 20 years if any new tax is created.

The Companies Amendment Act No. 2 of 1992 created exempt companies as an alternative to the International Business Company (IBC) which was created under the Companies Act of 1981. Exempt companies are more modern and faster to incorporate than the IBC’s.

Foreigners may own all of the shares in an exempt company.

Background

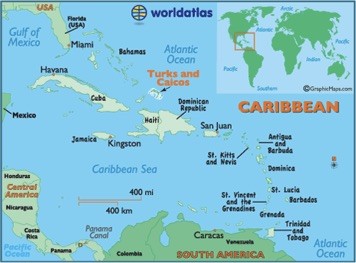

The Turks and Caicos Islands are situated in the Atlantic Ocean in the West Indies region. The closest well known islands are the Bahamas.

From 1765 to 1799 they were under French control. In 1799, the British annexed the islands to become part of the Bahamas. After the Bahamas gained independence in 1976, the Turks and Caicos Islands remained a British dependency. As a result, English is their official language.

Its political structure can be described as a British dependency with a constitution under the monarchy of England’s Queen Elizabeth II. It has a democratically elected one house legislative assembly with a premier.

Benefits

A Turks and Caicos Exempt Company offers foreigners these types of benefits:

• Complete Ownership: Exempt company shares may be completely owned by foreigners.

• Total Tax Exemptions: Exempt companies guaranteed to be exempt if new taxes are created over the next 20 years. Currently, no taxes of any kind are imposed. However, U.S. taxpayers and everyone paying taxes on their world income must disclose all income to their governments.

• Privacy: Beneficial owners, shareholders, and directors names are not part of any public records.

• Low Share Capital: No minimum share capital required. Most exempt companies elect a $5,000 USD share capital.

• Fast Incorporation: Entire incorporation process takes two working days.

• One Shareholder and One Director: Only one shareholder and one director required who can be the same person for greater control.

• No Accounting: No filings of annual accounting or tax returns required.

• English: As a British dependency for the past 218 years, English is the only official language.

• Limited Liability Option: An exempt company has the option to incorporate as a limited liability company.

Turks and Caicos Exempt Company Name

A Turks and Caicos Exempt Company must not select a company name resembling another legal entity’s name in the same jurisdiction. Company names may not suggest or infer government or royal patronage. While English is the official language, the company name may be written using Chinese or Latin alphabet characters as long as a certified translation is attached.

Exempt companies must include one of the following words or abbreviation at the end of its name: “Exempt”, “Limited”, “Incorporated”, or “Corporation”.

A specific business license is required for the following types of business activities: bank, loans, savings, insurance, funds management, indemnity, investing funds, trust, trustee, underwriters, and co-operatives.

Restrictions on Business Activities

Exempt companies cannot engage in active business activities within the Turks and Caicos Islands. They cannot own real estate on the islands. They cannot sell their shares to the public or solicit funds from the public.

In addition, the following types of business activities are prohibited: banking, collective investment schemes, fund management, insurance, reinsurance, assurance, or providing investment advice.

Limited Liability

Companies have the option to choose to become limited liability companies when applying as a new company with the Registrar of Companies. This means that their shareholders will enjoy their liability limited to their contributions to the share capital if the company is sued or can’t pay its debts or entails other legal obligations.

If they choose this option, they must set the maximum lifespan (duration) at 50 years. This mean they give up their right to become a perpetual (lifetime) company.

In addition, they must include either the words “Limited Liability” at the end of their company name or use its abbreviation “LLC”.

Incorporation

All applications for new companies are filed with the Companies Registry. The two required documents for filing are the Memorandum and the Articles of Association which must be signed by the subscriber. These documents must contain the following information:

• Proposed company name;

• Local registered office address;

• Company’s objectives;

• Declaration of limited liability for its members; and

• Declaration that all business activities will be conducted outside of the Turks and Caicos Islands.

After receiving approval of its incorporation, the exempt company must publish the location of its office address in the Official Gazette.

Every document must be prepared in English.

Note: no disclosure of beneficial ownership is required to the government.

Shareholder

The required minimum shareholders to form an exempt company is one.

Anyone of majority age living in any country and a national of any nation may become a shareholder.

Permitted classes of shares include: bearer shares, registered shares, preference shares, shares with or without par value, redeemable shares, and shares with or without voting rights.

Director

A minimum of one director is required to manage the exempt company.

Directors may be citizens of any country and can reside anywhere. They can be natural persons or corporate bodies.

Company Secretary

The law requires appointing a company secretary. Either a natural person or a corporate body can be appointed as the company secretary. There is no requirement to appoint a local resident as the secretary.

Minimum Share Capital

While no requirement exists for a minimum share capital; due to a large increase in the registration fee paid when incorporating, most exempt companies choose an authorized share capital of $5,000 USD. These can be divided into 5,000 common voting shares at $1 USD each.

Authorized shares capital exceeding $5,000 USD pay a 1% increase in fees up to $50,000 USD and then 0.5% of amounts above that up to $100,000 USD where the fee amounts to 0.1% above that amount.

Taxation

The Turks and Caicos Islands do not have corporate taxes, income taxes, capital gains taxes, gift taxes, or inheritance taxes.

However, exempt companies are guaranteed that for the next 20 years from the date of incorporation, if a new tax is created, they will be exempt.

Note: U.S. taxpayers and all others subject to taxation of their global income must report all income to their tax authorities.

Accounting

Financial records prepared in internationally accepted accounting practices must be maintain demonstrating a true, accurate financial condition of the company.

Otherwise, there are no filing of financial statements or auditing accounting records required.

Public Records

Beneficial owners are never disclosed to the government. The names of the shareholders and directors remain private.

Time to Incorporate

Expect the registration and approval process to take two working days.

Shelf Companies

Shelf companies are available to purchase in the Turks and Caicos Islands.

Conclusion

A Turks and Caicos Exempt Company provides the following benefits: foreign ownership of all shares, no taxation, privacy, fast formation, low share capital, one shareholder can become the only director for more control, English as the official language, and option to choose LLC protection.