A Bahamas Asset Protection Trust is formed under longstanding British Trust laws which were amended by Bahamas legislation.

Like many former British colonies, The British Trustee Act of 1893 established the formation of trusts. While the British eventually repealed this Act, the Bahamas enacted their Trust Act of 1989 protecting against forced heirs provisions (amended 1996). In 1991, the Bahamas enacted their Fraudulent Dispositions Act which strengthened asset protection trusts. In 2004, the Bahamas enacted another law allowing the creation of purpose trusts called the Purpose Trust Act.

These laws allow trusts to be formed by non-resident Settlors (Founders) to benefit non-resident Beneficiaries who pay no taxes. However, one exception exists under the 1989 Act, new trusts must pay a $50 USD revenue stamp.

The Bahamas is not a signatory to the 1986 Hague Convention on the applicable laws and the recognition of trusts. This allows the Bahamas to enact unique laws to make trusts stronger with more benefits to the Settlor and the Beneficiaries.

Background

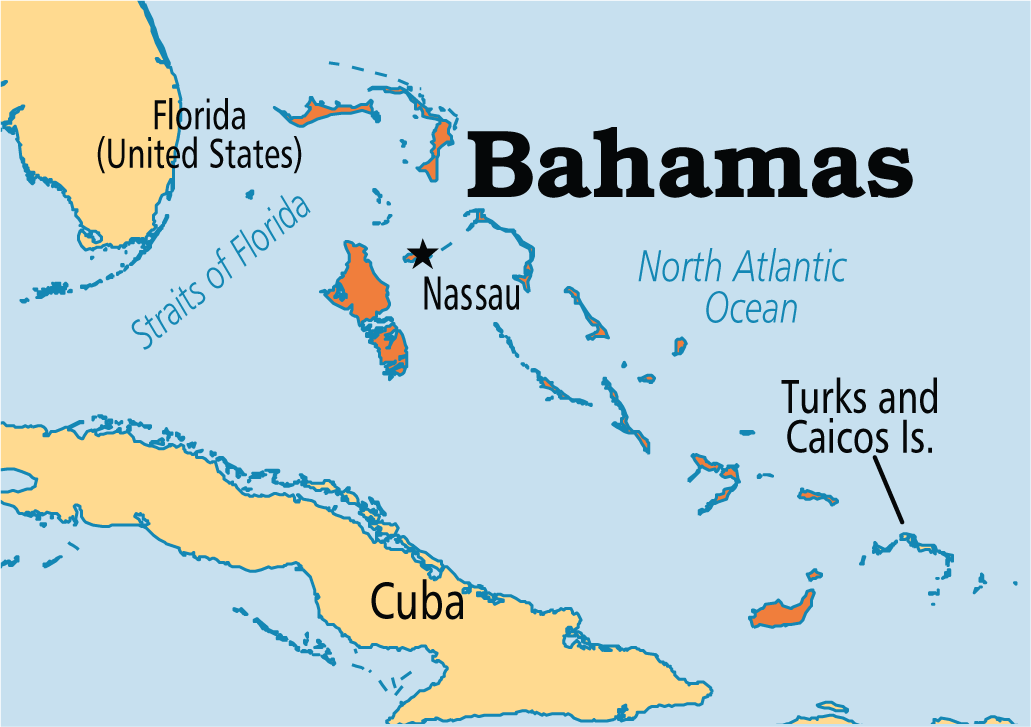

The Bahamas are officially known as the “Commonwealth of the Bahamas” located in the Atlantic Ocean near Cuba and the state of Florida. It was a British colony from 1718 until it gained its independence in 1973. Its political structure is a unitary parliamentary constitutional monarchy with a democratically elected two house Parliament which appoints its Prime Minister. It is a member of the British Commonwealth where English is its official language.

Benefits

A Bahamas Asset Protection Trust enjoys the following benefits:

• 100% Foreign: The trust’s settlor and beneficiaries can all be foreigners.

• Asset Protection: The trust holds ownership of all assets on behalf of the beneficiaries. Bahamas laws protects the trusts from foreign court seizures.

• Estate Planning: An ideal estate planning tool for global assets.

• Perpetual Life: Bahamas trusts lives are indefinite.

• No Taxes: Neither the trust or the beneficiaries are subject to taxation. However, U.S. residents and others subject to global income taxes must declare all income to their governments.

• Privacy: Neither the settlor’s or the beneficiaries’ names are part of any public records.

• Fast Formation: Trusts can be formed in one day.

• English: The official language of the Bahamas is English.

Trust Name

A Bahamas Trust can choose any name as long as it is not similar to exiting Bahamas legal entities. Normally, the word “Trust” will appear in the name.

Bahamas Trust Structure

The trust’s assets are placed in trust for the benefits of the beneficiaries. The trustee may hold the assets directly or through a holding company who shares are held by the trustee. Trustees may be corporations or natural persons. If a Bahamas company is appointed to act as a trustee, it must possess a trust license issued by The Central Bank of the Bahamas. A licensed trust company is subject to the strict Bahamas confidentiality laws where unauthorized disclosure of any trust information is a crime subjecting the offender to severe files and imprisonment. Individual Bahamas residents or foreigners do not require a license to act as a trustee.

A Bahamas Trust may be established even though all of the assets are located in other countries and the settlor and beneficiaries reside in other countries.

Further asset protection can be provided if the assets are first transferred to a Bahamas holding company and the company shares are transferred to the trustee. This will provide further protection of the assets if a creditor who will not be able to challenge the transfer of the holding company’s shares to the trustee under Bahamas laws.

Rule Against Perpetuities Abolished

The Rule Against Perpetuities Abolition Act of 2011, provides: Every trust created after December 30, 2011 can exist for an indefinite period. This law applies to Asset Protection Trusts and Purpose Trusts.

Types of Bahamas Trusts

Two types of trusts are common with foreigners: the Asset Protection Trust and the Purpose Trust. Below is a brief explanation of both trusts.

Asset Protection Trusts

Bahamas Asset Protection Trusts (APT’s) were strengthened by the Fraudulent Disposition Act, 1991. In essence, the Act protects all assets which a settlor places into a trust out of the reach of foreign civil and criminal court proceedings filed more than two years after the assets were placed into a trust. Such foreign court judgments are not recognized in the Bahamas. In addition, the creditor must commence action in the Bahamas within two years of the assets being placed in the trust. While disposition of assets with the intent to commit fraud by undervaluing them is illegal in the Bahamas, the creditor challenging the disposition has the burden to establish the Settlor’s fraudulent intent.

The 1989 Trust Act allows for the appointment of a “protector of trusts” who supervises the trustee(s) and manages them. The protector acts a bridge between the settlor and the trustee. If the settlor chooses to include a provision for the appointment of a protector in the trust instrument, the law allows the protector the following powers (unless any are excluded in the trust instrument):

• Remove and appoint beneficiaries;

• remove and appoint trustees;

• change the proper law of the trust;

• receive information about the trust and its activities; and

• instruct the trustee regarding investment of trust funds and disbursements.

The protector can be an advisor or close confident of the settlor. It is recommended that the protector not reside in the same jurisdiction as the settlor as he or she may be subject to the same courts authority which may not recognize the trust. The protector may also be a company.

Purpose Trusts

The Purpose Trust Act of 2004 governs all purpose trusts in the Bahamas. It allows for the creation of non-charitable private trusts.

This is the perfect investment platform as investors can create a purpose trust for their profit making investments without naming any beneficiaries. The purpose for the trust must be clearly established and must not contravene public policy or be involved in illegal activities.

Purpose trusts can be either discretionary or fixed. A “discretionary” trust allows the settlor to state whatever criteria he or she wishes before the beneficiaries can receive trust income and assets. A “fixed” trust provides set amounts and time frames for the beneficiaries to receive income and assets.

The types of assets a trust can hold are nearly endless, such as bank accounts, corporate stocks, commodities, securities, vehicles, antiques, jewelry, etc. The only exception are land and real properties which cannot be held by a purpose trust. The trust instrument determines when the trustee can distribute income and assets to the beneficiaries, third party individuals or legal entities, and for charitable purposes.

Purpose trusts must have an “authorized applicant” as provided in the trust instrument who enforces the purpose trust and has the authority to represent the purpose trust in court proceedings. In addition, profit making purpose trusts must appoint one trustee who is either an attorney, a licensed bank, a registered account, a trust company, or anyone approved by the Minister under the Purpose

Trust Act of 2004.

The Rule Against Perpetuity or vesting remoteness will not apply to purpose trusts. This means they can have a never ending lifespan.

Protective trusts created for the benefit of the settlor may defeat the claims of a trustee in bankruptcy if the settlor did not become bankrupt within two years of the date the assets were placed in the trust and the settlor had sufficient assets to pay the bankruptcy creditors aside from the assets placed in trust.

Estate Planning

The Bahamas trusts offer excellent estate planning vehicles as global assets can be placed in their trust to benefit the settlor’s heirs for as many generations the settlor chooses. Trust avoid time consuming costly probate proceedings as no wills are required. Upon the death of the settlor, the beneficiaries can take ownership of all assets or if the trust instrument dictates, the trust will continue to hold assets for future heirs.

Taxes

Bahamas trusts are totally tax free as there are no income taxes, no capital gains taxes, no corporate taxes, no inheritance tax, no gift tax, and no estate taxes.

Formation Time

A Bahamas trust can be formed in one day.

Conclusion

A Bahamas Asset Protection Trust enjoys the following benefits: 100% foreign ownership, no taxes, asset protection, privacy, global estate planning, perpetual lifespan, fast formation, and English is the official language.