A Cook Islands Trust provides for the most powerful offshore asset protection. The Cook Islands are situated South of the US state of Hawaii. They exhibit the most dominant asset protection trust case law history on the planet. It is not a matter of theoretical protection. We have conducted extensive research on every case the courts have put it to the test. In every case we studied, a properly established trust provided protection for the client’s assets. Most notably, there are two cases in which the wealthiest legal powerhouse in the world – the US government – was the one attempting to penetrate the trust. One important note: We do not knowingly establish an offshore trust to protect assets from the United States government. We are merely making an observation.

How Does a Cook Islands Trust Protect Me?

A court in your area says, “Give us the money.” So, you put together a letter and mail it to the trustee. You inform them that your local judge has ordered you to bring back the funds. The trustee is required to follow the instructions provided in the Cook Islands Trust deed, which is the document on which the trust is drafted. The asset protection trust states that the trustee is prevented from letting the funds out of the trust when the beneficiary is acting under force from the courts. So, the trustee, who resides outside of your local court’s reach, refuses to comply. You are not in trouble because you are willingly obeying the judge’s orders and asking the trustee to bring back the funds. You’re in an “impossibility to act,” position which is certainly valid for a legal defense.

How to Structure a Cook Islands Trust

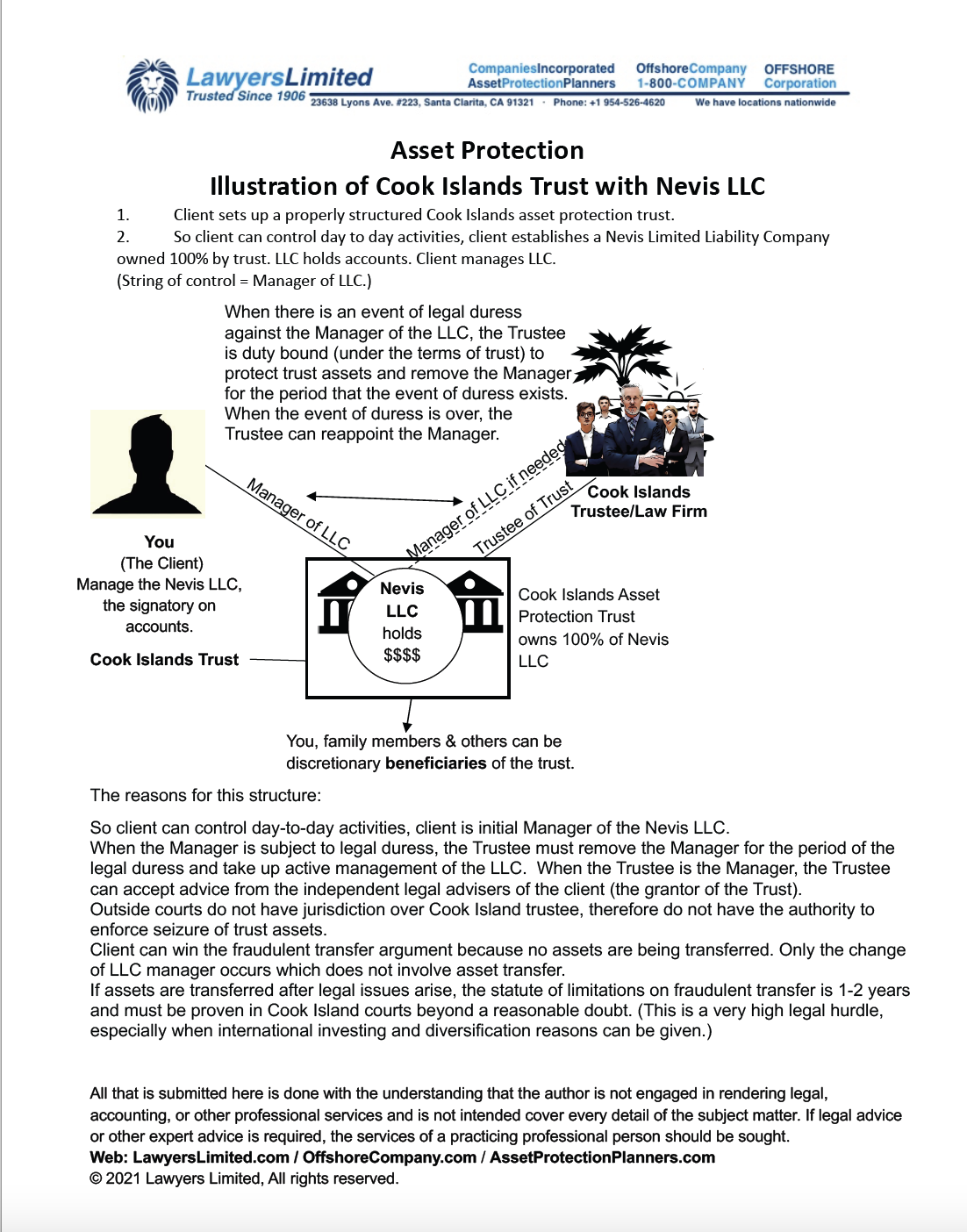

Prior to the “bad thing” taking place, you (who are the beneficiary of the trust) are in full control. Thus, you manage the daily financial affairs. The way this is accomplished is that we form an offshore limited liability company (LLC). The trust owns 100% of the LLC. You are the Manager of the offshore LLC. Thus, you control the assets of the LLC. You are the signer on all bank accounts. Moreover, you do not need to house the account in the Cook Islands, but can do so in any country in the world that offers a financial safe haven.

Then, when the “bad thing” crops up, the trustee can step in to protect you. That is, the trustee company, which is a law firm in the Cook Islands, simply takes your place as LLC manager.

Can I Trust the Trustee?

What about the safety of this offshore asset protection tool? Two important safety features are that the trustee of the Cook Islands trust is a licensed and bonded law firm. To obtain a license the trustee must have undergone grueling background checks. The bond means your funds are insured from trustee action. Moreover, we utilize a trust company that we have had a relationship with for over 20 years.

For safety and security of the client, there is only one instance in which the trustee can generally step in. That is, they can only step in when the courts would confiscate the money. So, the important question to pose is as follows. Would you prefer a 100% chance of the money being seized by the courts? Or would you prefer to have a fully licensed, bonded trustee company, that has never taken money from a client, perform the act you have paid them to perform. That being, to keep your opponents from taking your money?

Once the “bad thing” fades away, the controlling position, the management of the LLC, is returned to you and you are back in the pilot’s seat with all of your money safe and secure.

Meanwhile, during times of legal threat, if you have items that need paid, the trustee can take care of them for you. You can ask the trustee to forward some of your funds to an individual who you trust. They can, in turn, provide money for your needs. Thus, you still retain the ability to receive your money, but your legal enemies do not.

The end result is that the money for which you have worked so diligently for is safe and out of harm’s way.

What Can I Protect?

The strongest asset protection the Cook Islands trust provides for is cash held in a safe foreign bank account. US courts have jurisdiction over US accounts, so hold funds beyond their reach. Your trust can also hold a stock market portfolio, if you wish. You can either have a professional manage your funds or you or can conduct online trading that you do yourself. Keep in mind, again, the bank account does not need to be in the Cook Islands. You can establish it anywhere that does not recognize foreign civil court orders against you or your trust. Examples are Switzerland, Luxembourg, Panama, Hong Kong and Singapore, for example.

The courts where you live have the ability to seize local real estate. Therefore, it is fine to place real estate inside of the LLC that is owned by the trust. Alternatively, you can record a lien against property where the lien is payable to the LLC inside of the trust. In the event the bad thing happens, it is preferential to sell the real property that you do not care to sell than it is to lose the property outright by court seizure.

Who Can Set One Up?

We establish a great many Cook Islands trusts for attorneys who re-sell them to their clients. We also establish many trusts for our clients directly, who have need for strong offshore asset protection. Additionally, we can add estate planning verbiage in your trust. When you die, your interest in the trust can be forwarded to your children or others of your choosing.

Is It Revocable or Irrevocable?

It is semi-revocable. That is, the settlor can change the beneficiaries with the trustee’s cooperation. If the settlor could make changes directly, then the judge could force the settlor use that control. He or she would force the settlor to make the settlor’s enemies-at-law the new beneficiaries. In that event the only one in charge would be the judge. So, for asset protection purposes, the trustee is the safety valve for changes in order to maintain the trust’s asset protection.

Statute of Limitations on Fraudulent Conveyance

A statute of limitations is a prescribed time limit for bringing legal action. Fraudulent conveyance, also known as fraudulent transfer is an attempt to avoid paying a debt by transferring assets to another person or legal entity. Even though it has the “f” word, it is a civil action and not a criminal one. So a statute of limitations on fraudulent transfer refers to a period of time after which one has transferred assets to another that cuts off the ability for another party to undertake legal proceedings to seize the assets.

For a Cook Islands Trust, once you put assets inside two clocks start ticking simultaneously. The time limit for filing documents in the Cook Islands in an attempt to get assets out of a Cook Island is one year from the time the trust is funded or two years from the cause of action. Cause of action means the facts that allow a person to bring an action against another. A car crash is one example of a cause of action. Another is breach of contract, for instance.

So, let’s say you rear end someone in your car and immediately set up a Cook Islands trust. Six months later you get sued. The lawsuit will probably take about a year. You appeal and that may take another six months. By the time it is all over, your opponent could not even bring the lawsuit to the Cook Islands if he or she wanted to.

Offshore Asset Protection After a Lawsuit

Even if they did beat the clock in the Cook Islands there are other nearly insurmountable barriers. First, they would have to fight an extremely expensive legal battle an ocean away. Second, they would have to prove beyond a shadow of a reasonable doubt that you put the money into the trust to defraud that particular creditor. Not any old creditor, mind you, but that particular one. There are many reasons that you can give for setting up international trusts. Asset diversification is one. Taking advantage of international investments with fewer stifling regulations is another.

We have never seen any of our settlors or beneficiaries of the Cook Islands trust we have established lose a cent in this manner. That is whether or not the legal action was brought before or after the time limit. What usually happens is that the plaintiff sees that the cost of litigation is so insurmountable that the prospect of losing outweighs the infinitesimally small chance of victory.

Case Law

Does it work? We have been establishing Cook Islands trusts since the mid nineties. In that time, with several thousand trusts created, we have no record of a client losing money who has placed funds into a Cook Islands trust in an international bank account. The case law, where the trust has been challenged, shows that it works. By far, however, the plaintiff or judgment creditor goes away one they see that the trust in place.

There have been a few instances where clients have asked us about The Anderson Case wherein the individuals for whom the trust was established had a brief jail stay for contempt of court. This is the reason why: The attorney who set up the trust for the Andersons set it up incorrectly. The attorney wrote up the trust making the Andersons both the beneficiaries (who basically own the trust) as well as the protectors (who can instruct the trustee). This was very poor judgment on their attorney’s part.

The US judge said that because the Anderson’s were also the protectors they actually created their own “impossibility to act.” The very good news is that, although the trust was poorly drafted, it still protected the Anderson’s assets. The case was then moved to a Cook Islands where the judge in the Cook Islands and New Zealand upheld the trust’s asset protection. The Anderson’s money was safe and secure. This is very strong evidence as to the powerful asset protection inherent in the Cook Islands trust. Even when the trust deed was written improperly, the asset protection held strong.

Self-Serving Professionals

Be very wary of a particular service provider out there who has his own trust structure that he establishes but he downplays all other options, including the trust we are discussing. He has a weak local trust setup and, thus, downplays all other alternatives. He ignores the fact that there is proven case law history showing the trust in the Cook Islands has shown itself strong repeatedly. The weakness inherent in local trusts is that it is under the nose of the local judge. Thus, with the unparalleled asset protection strength demonstrated in the Cook Islands, most of us in the field, who do not have a secret motive, agree. The type of trust described here offers the world’s strongest asset protection.

Alternatives

There are other offshore trust jurisdictions such as Nevis, Anguilla, Barbados and others. In-depth research of the case law history shows that the Cook Islands tends to offer the most effective protection.