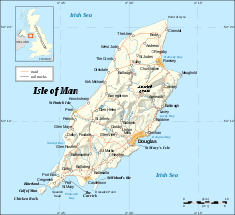

The Isle of Man is in the Irish Sea, nearly equal distance from the UK and Ireland. While the Isle of Man is not part of the United Kingdom, it is self-governing while under the British Crown with Her Majesty the Queen, as the Head of State. For the past 1,000 years, the Tynwald is the name of the island’s democratic Parliament.

While the British government overseas the Isle of Man, it does not interfere with the island’s laws or internal matters like social policies and fiscal administration without the specific consent of the Isle of Man’s government. The UK is only involved with military defense and foreign representation. The Isle of Man is only a part member of the European Union (EU), with involvement mostly relating to the customs laws and duties.

The Trusts Act 1995 governs all Isle of Man Trusts. All matters and questions related to an Isle of Man Trust are determined by local laws and not other jurisdictions. There are a few laws in the Isle of Man that effect the formation of a trust in the region. These laws and acts include:

- Settled Land Act 1891

- Trustee Act 1961

- Variation of Trust Act 1961

- Perpetuities and Accumulations Act 1968

- Recognition of Trusts Act 1988

- Trusts Act 1995

- Purpose Trusts Act 1996

- Trustee Act 2001

Benefits

Isle of Man Trusts receive many benefits including:

• No Income Tax for Non-Residents: There are no income taxes for either distributed or undistributed income for non-resident beneficiaries. However, U.S. citizens and others whose countries tax worldwide income must declare all income to their tax authorities.

• No Capital Gains, Inheritance, Gift, or Estate Taxes: Isle of Man Trusts do not pay capital gains tax, inheritance, gift or estate taxes.

• Privacy: Isle of Man Trusts offer privacy and confidentiality, and do not release information on public records, protecting trust owners.

• English: The Isle of Man’s official language is English.

• Fast Set Up: An Isle of Man Trust can be established quickly and efficiently, usually in one to three days.

• Less Bureaucracy: The Isle of Man’s laws provide less bureaucratic legal system than British or Irish equivalents.

• Educated and Skilled Workforce: The workforce in the Isle of Man is both well-educated and skilled.

Trust Name

All Isle of Man Trusts must select a unique name that is not similar to already existing trust names. In addition, the name of the Trust must end with the word “Trust.”

Office Address and Local Agent

All Trusts must have a registered local agent and a local office address for process service requests and official notices.

Beneficiaries and Grantors/Settlors

Beneficiaries

In the Isle of Man, the trust is established for the beneficiaries. These beneficiaries can be named or described by reference to a class of persons in the trust agreement. Beneficiaries can enforce the trust against the trustees, or their ownership against others.

Settlors (sometimes called grantors) usually form the trust and put the trust property into the hands of the trustees. Sometimes the settlor is a beneficiary, or a protector.

Trustees and Protectors

Trusts do not have directors, but they have trustees, protectors, and grantors/settlors that manage the trust, much like a director operates the management of a corporation.

Trustees

Trustees are expected to manage the assets placed within their trust within the terms of the trust’s original agreement. Trustees can be either private persons or corporate entities. In the Isle of Man, three categories of people or entities can be selected as trustees including:

- Fiduciary service providers licensed by the Financial Supervision Commission of the Isle of Man to conduct trust services;

- Manx (Isle of Man resident) Advocates (usually attorneys/solicitors); and

- Manx Accountants.

Trustees must manage the trust with the best interests in the beneficiaries in mind. Therefore, trustees are required to be both fair and impartial when dealing with beneficiaries. These requirements are outlined in the Trustee Act of 2001.

Protectors

In Isle of Man Trusts, protectors are optional, but often utilized. A protector should help trustees with guidance, and also check in with the beneficiaries and the settlor to let them know the trust is being administered for them with the best intentions in mind.

Protectors should be qualified professionals or at least have a general understanding of the trust itself, like the settlor him/herself or a relative.

Authorized Capital

Isle of Man Trusts do not have an authorized capital requirement.

Taxes

An Isle of Man Trust does not pay capital gains tax, inheritance tax, gift tax, or estate taxes.

Trustees, on the other hand, can be income tax payers that must file tax returns if they are Isle of Man residents. Isle of Man Trusts that have Manx resident beneficiaries must pay income tax at a rate of 20% on undistributed income. Non-residents are exempt.

Furthermore, beneficiaries that get income from the Trust may also be taxed if they are Isle of Man residents, or if the income stems from the Isle of Man.

If the beneficiaries of an Isle of Man Trust reside outside of the jurisdiction, and the income in the Trust stems from offshore transactions or bank interest, then there will be no Manx taxation applied to the Trust.

Annual Fees

Annual corporate or company fees do not apply to Isle of Man Trusts. In essence, there are no government registration or renewal fees.

Public Records

Ownership of and the beneficiaries of an Isle of Man Trust remain confidential.

Accounting and Audit Requirements

The beneficiaries must receive records explaining the activities of the trust. However, no format exists for maintaining trust accounts in the Isle of Man. Also, trust accounts are not required to be audited. However, if an audit is deemed appropriate the trustees can arrange for an audit which will be paid for out of the trust assets.

Annual General Meeting

Trusts are not required to hold an annual general meeting.

Time Required for Incorporation

An Isle of Man Trust can typically be set up in one to three days. This completion time depends on the turnaround with the trust name registration, as well as how accurately the applicant completes its trust registration documents.

Shelf Companies

Shelf companies cannot be created for Isle of Man Trusts.

Conclusion

Isle of Man Trusts receive many benefits including: no income taxes for non-resident beneficiaries, no capital gains tax, inheritance tax, gift tax, or estate taxes; they are fast to set up, offer complete privacy, less bureaucracy, no authorized capital, and little or no government fees.