A Nauru Trust can be set up by foreigners where all the income derived from the trust’s assets outside of the country will be free from all taxes. Typical trusts with beneficiaries along with purpose trust with no beneficiaries can be formed in Nauru.

Foreigners find the asset protection benefits and lack of a fraudulent conveyance law along with the Nauru courts history of never allowing the seizure of trust assets by a foreign country’s court order or judgments appealing.

While there is no specific law establishing trusts in Nauru there is a law creating trust corporations to provide trustee services called the Nauru Trustee Corporation Act of 1972 (amended in 2011). This law provides the structures for creating trusts and how trustees must act in relation to their trustee services.

Background

Nauru was an Australian Trust Territory for many years until it gained independence in 1968. Nauru follows English Common Laws and English is its second official language.

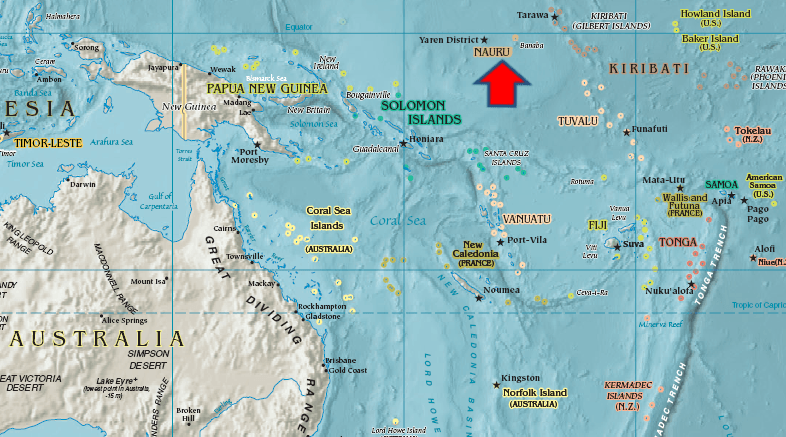

Located in the Pacific Ocean near Australia and Papua New Guinea, Nauru is the smallest island country in the world.

Offshore Trust Benefits

A Nauru Trust offers the following benefits:

• Total Foreign Owners: The settlor and the beneficiaries can be foreigners.

• Tax Exempt: Trusts are exempt from all taxes. However, U.S. taxpayers and others residing in countries taxing global income must disclose all income to their governments.

• Privacy: No public records exist concerning the settlor or beneficiaries.

• Asset Protection: Nauru courts have never upheld other countries’ fraudulent conveyance laws or allowed seizures of assets by foreign court orders.

• Estate Planning: No law exists limiting the duration of a trust making them perpetual. Other countries’ forced heirship laws have never been recognized by the Nauru courts.

• Business Activities: Trusts are not prohibited from engaging in business activities.

• Fast Formation: a trust deed can be written in one day.

• English: As a former Australian Trust Territory, their official second language is English.

Nauru Trust Name

Every trust must identify itself as a trust in its name to avoid confusion with other legal entities. The trust’s name must not conflict with the names of other legal entities in Nauru.

Purpose Trusts

Trusts established with no beneficiaries but based on specific purposes or objectives are permitted. However, they are required to appoint at least one of its trustees who is a Nauru corporation licensed as a trustee services provider.

Bare Trust

A “bare trust” is defined as a trust where the beneficiaries have the right to both the income and capital and may demand that both be transferred into his or her name. These types of trusts are sometimes referred to as a “mandatory trust” or a “simple trust”.

A bare trust is permitted and completely valid in Nauru.

Fraudulent Conveyance

Nauru does not recognize any laws against fraudulent conveyances. However, Nauru does follow the English law of 1968 which allows a court to interpret foreign laws regarding the circumstances upon which the trust’s settlor established the trust to see if a fraudulent intent existed. So far, no court in Nauru has interpreted other jurisdiction’s fraudulent conveyance laws in order to apply them to a Nauru trust.

Asset Protection

Nauru will not allow a trust’s assets to be seized by another country unless the trust violated Nauru laws which would cause the seizure of its assets. So far, Nauru courts have not applied this legal concept in order to approve another country’s courts to order the seizure of a Nauru trust’s assets.

Forced Heirship

Following English law, the Nauru courts will not look behind the terms of a trust deed in order to allow a forced heirship from an heir in another country challenging the validity of a Nauru trust or its named beneficiaries.

Settlor

The creator of a trust is called the “settlor” who can live anywhere in the world and be a citizen of any country. The settlor transfers his or her assets to a third party “trustee” to hold and to use for the benefit of named persons “beneficiaries” under the terms and conditions set forth in a written trust deed.

Trust Deed

A trust deed is a written document describing assets (properties, funds, etc.) whose titles are transferred to the trustee under certain conditions. Like the Articles of Incorporation are to a corporation, the trust deed defines the roles of the trustee and beneficiaries (if any are named) along with their powers, rights, compensation, appointment, and removal. A protector may be appointed to protect the rights of the beneficiaries.

In addition, the trust deed establishes when and how the beneficiaries may receive income generated by the assets and the capital itself. Some beneficiaries may have greater rights to the income and assets than the others. Termination of the trust may be set by an event occurring or a definite date.

The trust’s assets may be invested by the trustee with full discretion as an owner or the trust deed may restrict and limit the types of investments the trustee may make.

Beneficiaries

Beneficiaries are the ones benefitting from the trust. They can be citizens of any country and can live anywhere. Their rights are determined by the trust deed.

Trustee

Trusts must appoint a local licensed Trust Corporation as one of its trustees. The other trustees can reside anywhere and be citizens of any country.

The trust deed determines how many trustees may be appointed, how they are compensated, removed, and what powers they have. The trust deed may limit the discretion and powers of the trustee(s) regarding investments.

Protector

No specific law exists providing for the appointment of a protector to protect the interests of the beneficiaries. However, Nauru will allow the appointment of a special person with the powers to oversee and/or overrule the actions of the trustees if the trust deed provides for such powers.

Business Activities

Following English laws, a trustee may engage in trading and other business activities if the trust deed allows. However, best practices dictate that the trust and/or the trustees do so by using a corporation whose shares are owned by the trust or trustee.

Taxes

The income from trusts whose assets and beneficiaries are located outside of Nauru are totally tax free. Trusts are not subject to a corporate tax, income tax, gift tax, capital gains tax, inheritance tax, or estate tax.

Note: U.S. taxpayers must still declare all income to their tax authorities along with all others subject to worldwide income taxation.

Public Records

No public records exist regarding the settlor, beneficiaries, or the assets since trust do not register with the government.

Time for Formation

Depending upon the speed of the preparer, a trust deed may be written in one day.

Conclusion

A Nauru Trust has these benefits: total foreign participation, no taxes, privacy, estate planning, asset protection, business activities allowed, fast formation, and English as a second language.